In case you missed it, a front-page story in The New York Times this weekend told the story of Patricia Wanderlich and several other patients who, despite purchasing coverage through the health insurance exchange, or marketplace, have found high, and often combined, deductibles are a major hurdle to accessing needed care.

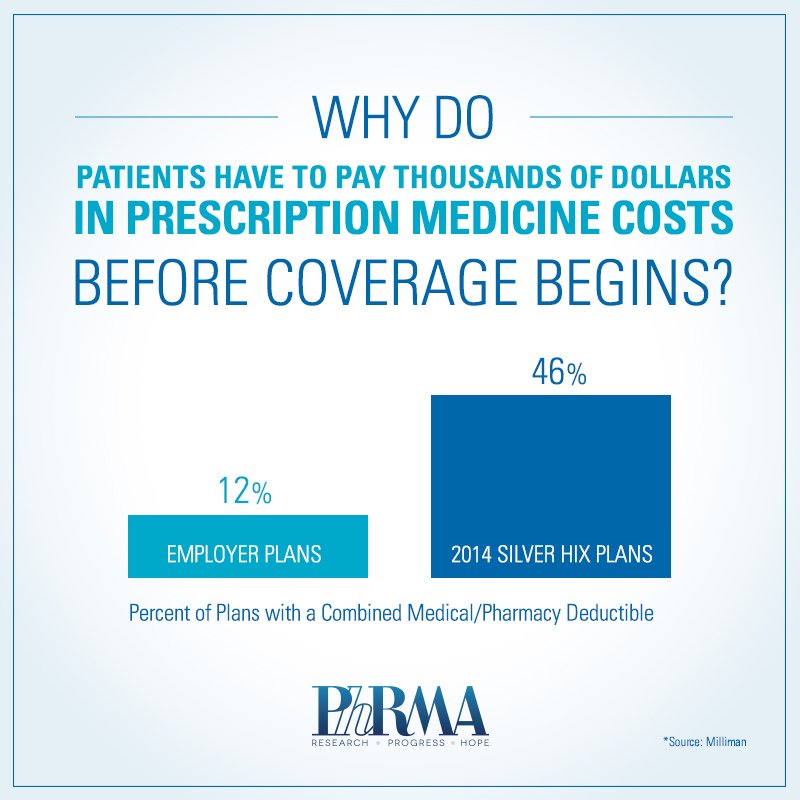

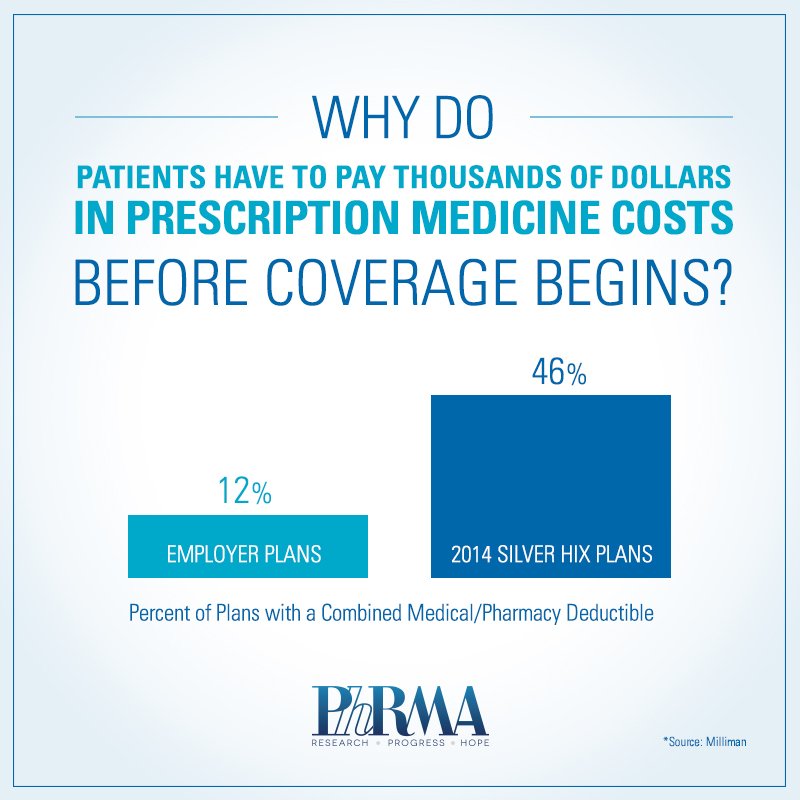

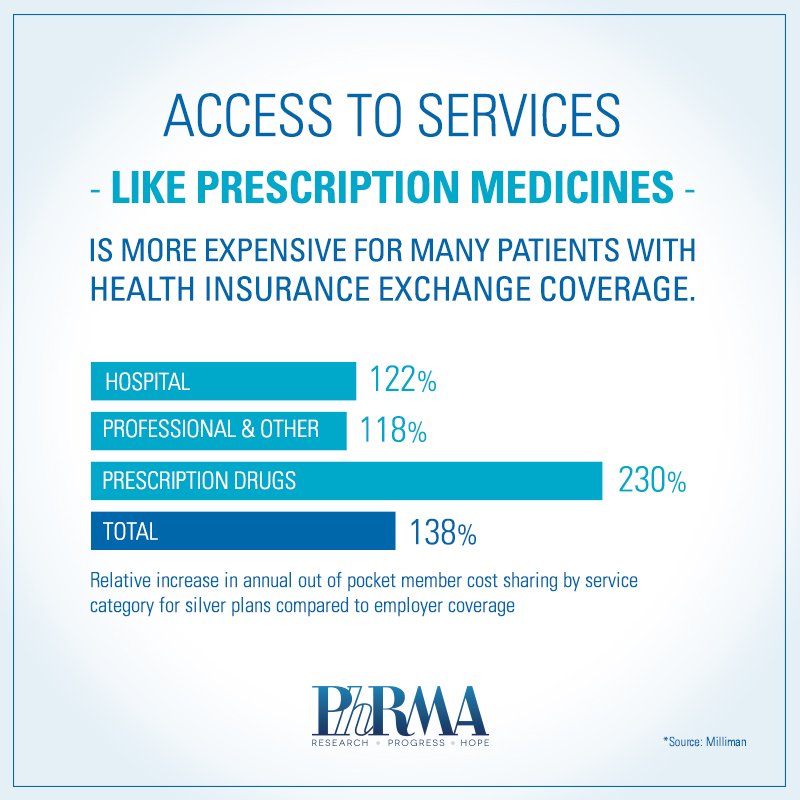

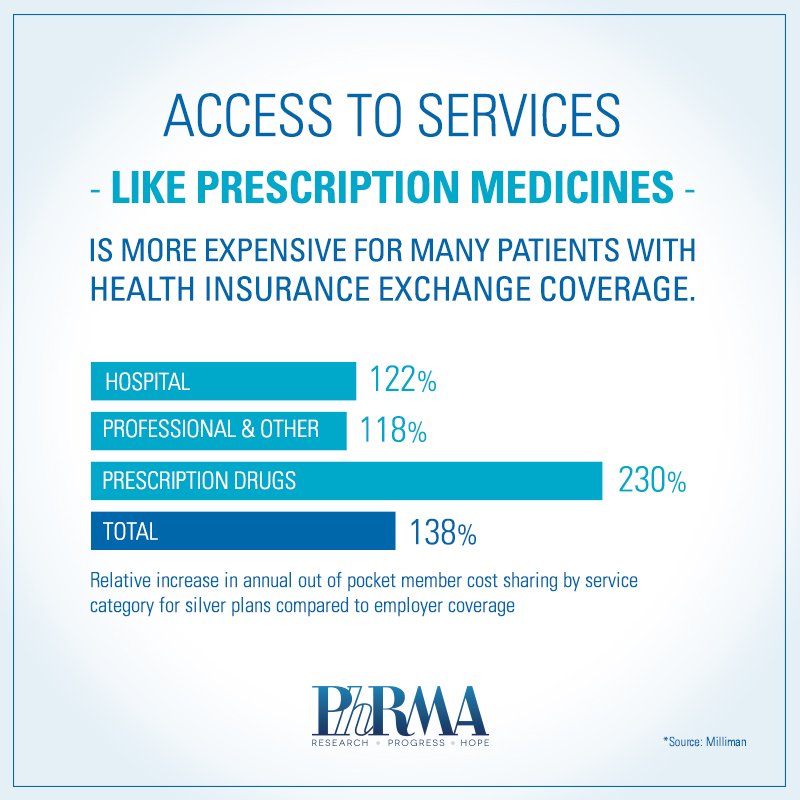

The patients featured in the article are not alone. High combined deductibles may put needed services and treatments out of reach for many Americans, particularly those who purchased Affordable Care Act health insurance exchange plans. For example, a recent report from Milliman round that Silver plans are nearly four times more likely to have a single combined deductible for medical and pharmacy benefits compared to typical employer-sponsored plan. Despite having health coverage, access to care isn’t guaranteed.

A few highlights:

- “About 7.3 million Americans are enrolled in private coverage through the Affordable Care Act marketplaces, and more than 80 percent qualified for federal subsidies to help with the cost of their monthly premiums. But many are still on the hook for deductibles that can top $5,000 for individuals and $10,000 for families — the trade-off, insurers say, for keeping premiums for the marketplace plans relatively low. The result is that some people — no firm data exists on how many — say they hesitate to use their new insurance because of the high out-of-pocket costs.”

- “Insurers must cover certain preventive services, like immunizations, cholesterol checks and screening for breast and colon cancer, at no cost to the consumer if the provider is in their network. But for other services and items, like prescription drugs, marketplace customers often have to meet their deductible before insurance starts to help.”

- “While high-deductible plans cover most of the costs of severe illnesses and lengthy hospital stays, protecting against catastrophic debt, those plans may compel people to forgo routine care that could prevent bigger, longer-term health issues, according to experts and research.”

- “I’m just doing what I can to keep myself healthy,” she [Carol Payne] added. “I mean, $6,000 — do they think I’ve just got that under my mattress?”

- “Consumers also benefit from a provision of the Affordable Care Act that limits out-of-pocket costs, which include deductibles. The limit this year is $6,350 for an individual and $12,700 for a family plan. But in general, the limits apply only to care provided by doctors and hospitals in a plan’s network and do not cap charges for out-of-network care.”

The Times’ story is part of a growing number of articles highlighting the challenges patients are having accessing needed medicines on the new health insurance exchanges:

- 333 patient groups recently sent a letter to HHS raising concerns about patients’ access to medicines.

- Some patient groups recently filed a lawsuit against some insurers alleging that they are intentionally discriminating against people with HIV.

PhRMA recently launched Access Better Coverage.org, a new website designed to educate consumers about the ABCs of health coverage and access to prescription medicines.