New data show changes in how insurers structure health insurance benefits have made out-of-pocket costs harder for patients to budget for or predict. A Kaiser Family Foundation analysis released this week finds patients are paying more out-of-pocket through deductibles and coinsurance, while copayments are going down.

Shifting patient cost sharing to deductibles and coinsurance – along with rising overall out-of-pocket costs – further adds to the burden on patients. Deductibles require patients to pay the full cost of many types of health care before insurance contributes to the costs. Even for those without the benefit of a health savings account, workers often faced deductibles of more than $1,000 a month in 2015 and average deductibles were more than twice as high as they were in 2006 for those in health plans with a deductible.[1]

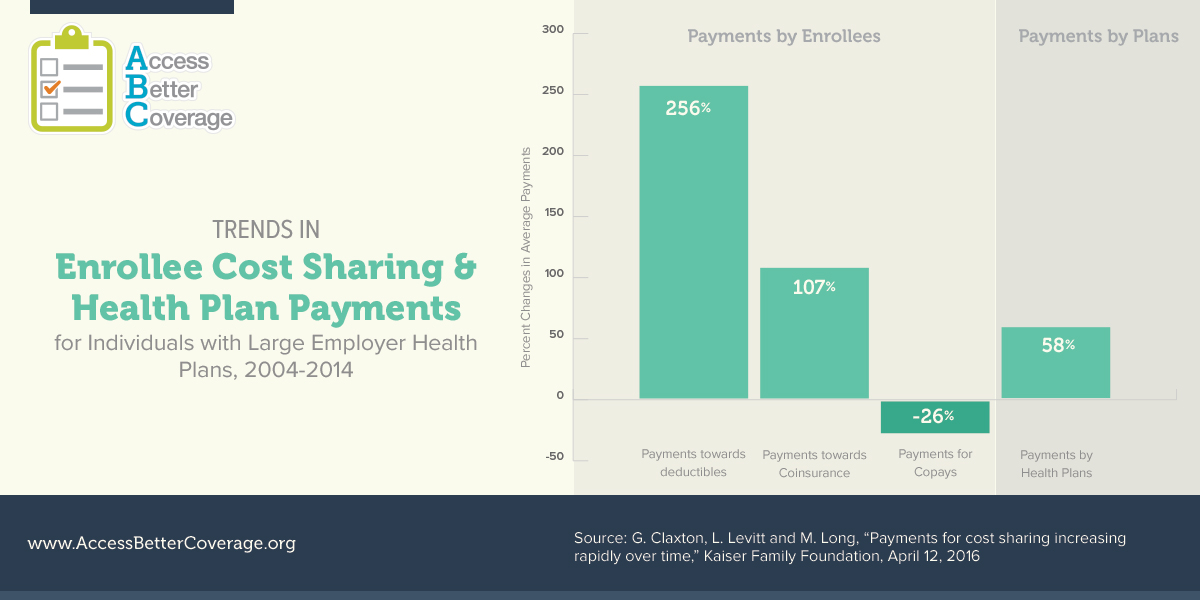

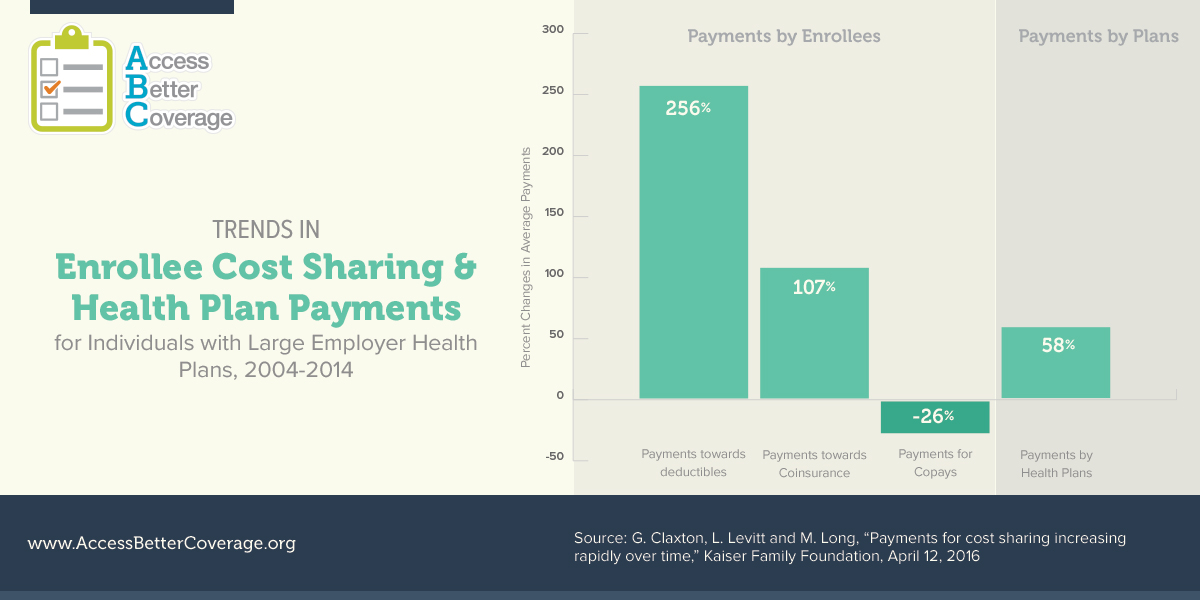

The data highlight the trend in diminished insurance coverage was occurring from 2004 to 2014. Payments for deductibles and coinsurance have outpaced increases in costs paid by the health plans themselves. As the infographic shows, average payments toward deductibles more than tripled, rising 256 percent, and average payments toward coinsurance more than doubled, rising 107 percent. This is while average payments by health plans themselves only increased 58 percent. Increased use of coinsurance has even impacted patients using preferred brand medicines. Kaiser’s Employer Health Benefits Survey data show the percent of workers facing coinsurance for preferred brand medicines has increased from 8 percent in 2007 to 24 percent in 2015.[2] While copays require patients to pay a fixed amount, coinsurance requires patients to pay a percentage of the cost of their health care and is therefore harder for patients to predict.

Read more about PhRMA’s policy solutions to deliver innovative treatments to patients through engaging and empowering consumers here. And visit AccessBetterCoverage.org for more on how insurance covers your medicines.

[1] Kaiser/HRET data, “Among Covered Workers with a General Annual Health Plan Deductible for Single Coverage, Average Deductible, by Plan Type, 2006-2015,” available at http://kff.org/health-costs/report/2015-employer-health-benefits-survey/view/exhibits/

[2] Kaiser/HRET data for 2007 and 2015. Percentages are among workers with three or more cost sharing tiers.