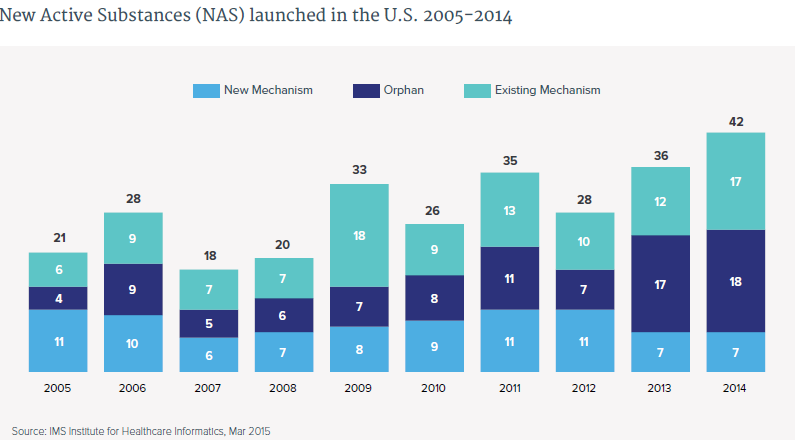

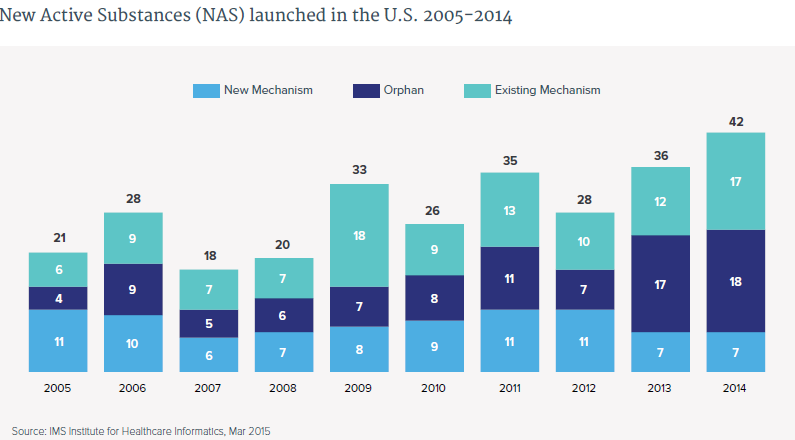

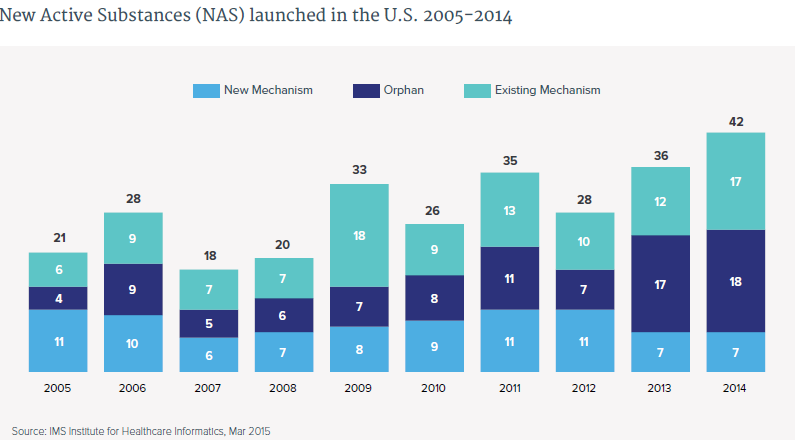

Last year was unique for our nation’s health care system. Nearly 10 million uninsured patients gained health insurance coverage – the largest gain in four decades -- and the FDA’s Center for Drug Evaluation and Research (CDER) approved a record of more than 40 new medicines. Given these historical milestones, an increase in the growth in spending on medicines last year was to be expected. Even so, that rise should not overshadow the fact that spending on retail prescription medicines have consistently accounted for just 10 percent of U.S. health care spending – a figure that is projected by government actuaries to remain stable through the next decade.

A new report released today titled, “Medicines Use and Spending Shifts: A Review of the Use of Medicines in the U.S. in 2014,” from IMS Institute for Healthcare Informatics found that spending on medicines increased 13.1 percent in 2014. IMS Health attributes last year’s uptick in growth in part to the remarkable number of new medicines brought to patients. In fact, according to IMS Health, we haven’t seen this many new approvals since 2001, which is the last year that spending on medicines grew at a similar rate. Importantly, last fall, IMS Health projected that –despite a temporary increase in U.S. spending growth in 2014 – spending on medicines will moderate to 5-8 percent, in line with overall U.S. health care growth over the next decade.

Of the approved medicines in 2014, more than one-third were considered “specialty.” These medicines are used to treat complex or rare health conditions such as rheumatoid arthritis, multiple sclerosis and cancer and are used by less than five percent of U.S. patients. Like spending on hospital and medical care, spending on medicines is typically concentrated among the sickest patients, and IMS Health reported that “specialty” medicines now account for one-third of total spending on medicines. This is not surprising when you consider that nearly 90 percent of all medicines prescribed to U.S. patients are lower-cost generics. That is the way our system works: innovator companies invest in pioneering research to bring new treatments to patients, and over time those medicines become available as generic copies which consumers can use for many years at low cost.

Of the approved medicines in 2014, more than one-third were considered “specialty.” These medicines are used to treat complex or rare health conditions such as rheumatoid arthritis, multiple sclerosis and cancer and are used by less than five percent of U.S. patients. Like spending on hospital and medical care, spending on medicines is typically concentrated among the sickest patients, and IMS Health reported that “specialty” medicines now account for one-third of total spending on medicines. This is not surprising when you consider that nearly 90 percent of all medicines prescribed to U.S. patients are lower-cost generics. That is the way our system works: innovator companies invest in pioneering research to bring new treatments to patients, and over time those medicines become available as generic copies which consumers can use for many years at low cost.

IMS Health also found that new medicines have transformed disease treatment for millions of patients. New medicines brought major treatment advances in hepatitis C, multiple sclerosis, and cancer. At the same time, improvements to existing medicines provided patients with easier dosing and increased efficacy, including the first non-biologic single injection for osteoarthritis, once-daily formulations of diabetes medicines, and three new immunotheraptic allergy products which can be taken at home rather than in a doctor’s office.

Today’s innovative new medicines are helping patients live longer, healthier, more productive lives and transforming the way we treat diseases. We cannot allow the costs of bringing a record number of new medicines to patients overshadow these critical advances and ignore the bigger picture on spending on medicines.

Read more about spending on medicines here.

Of the approved medicines

Of the approved medicines