The journey to better health care requires a holistic view

The journey to better health care requires a holistic view.

The journey to better health care requires a holistic view.

The journey to better health care requires a holistic view.

The journey to better health care requires a holistic view.

Venture capital is increasingly becoming the growing force for financing biotech and other startups, fueling medical advances in the U.S. A new report released today from TEConomy, examines the role and impact of one specific player in that ecosystem: biopharmaceutical corporate venture capital (CVC) funds, which often support early stage medical innovation.

A growing number of biopharmaceutical companies have affiliated CVC funds which provide direct investments in young, innovative and highly risky companies. These biopharma CVC funds not only provide direct investments to promising startups but also mentoring, strategic guidance and other support.

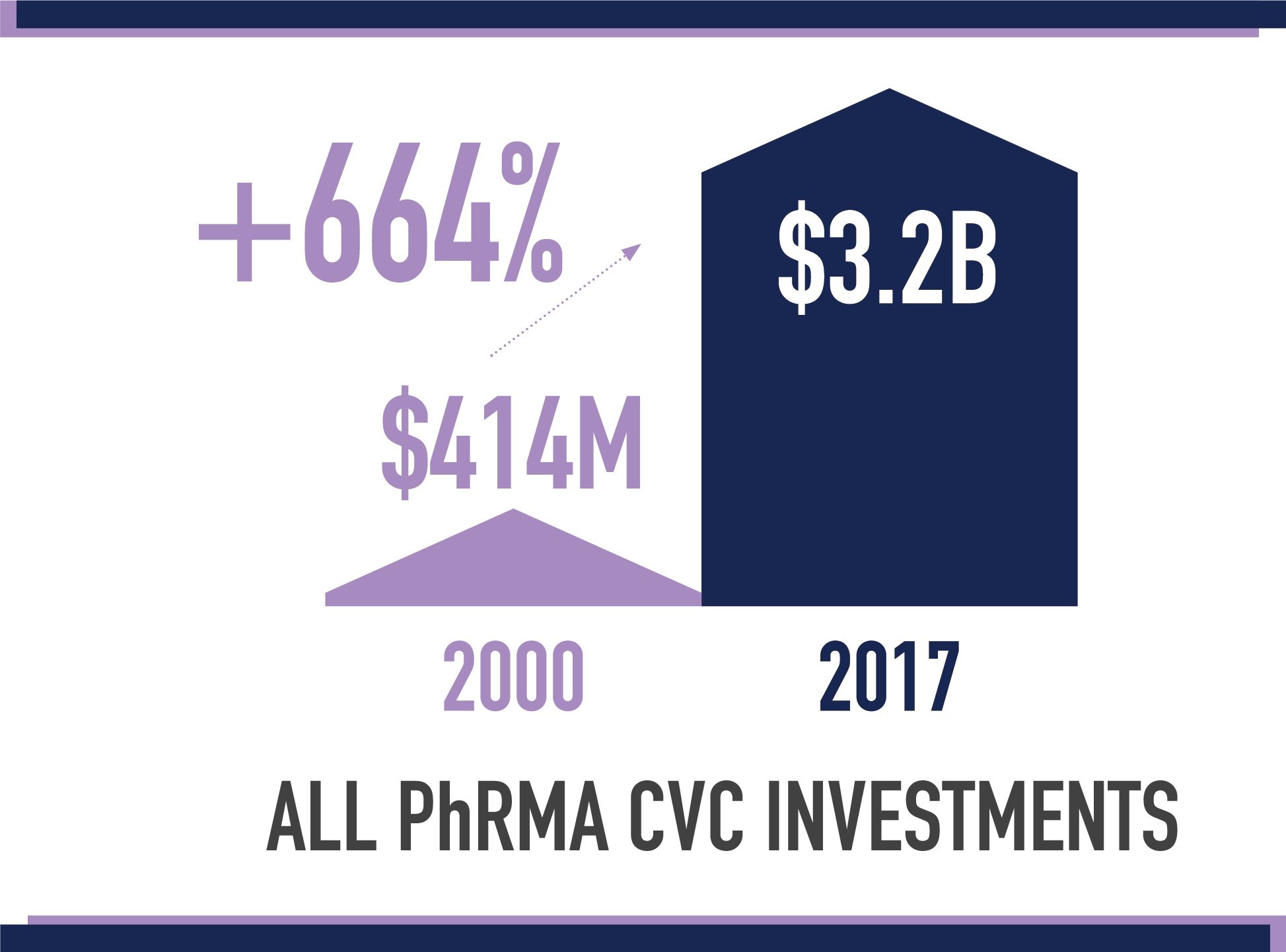

The report identified and reviewed trends related to CVC funds affiliated with PhRMA member companies —generally quasi- or fully independent venture capital groups. TEConomy found that deals involving PhRMA member CVC investments grew from just $414 million in 2000 to $3.2 billion in 2017. These CVC funds offer funding at critical points in an emerging company’s evolution, while also offering non-financial support that can help give startups a competitive edge.

The report also shows that biopharmaceutical CVC funds are active in early stage investments, even when traditional VC partners have shied away from such deals. For example, in 2011, 73 percent of PhRMA member CVC investments were in early stage deals while just 48 percent of deals made by traditional VC firms were to support early stage research.

The report further found that CVC investments are helping sustain the health of the early stage biomedical ecosystem when it can be most risky. The areas of investment are broad and characterized by a high degree of innovation and uncertainty. A key area of investment is new digital health technologies that can improve health care delivery. These can include mobile health applications to provide patients with reminders and other information to manage their health care condition, and the use of health information technologies to integrate lab, clinical and other data to support medical decision making.

Other research has found that CVC backed companies have a higher rate of overall success than those without their involvement. PhRMA member CVC funds do not just provide financial support but also access to highly skilled R&D experts, strategic guidance through board participation or informal consultations on manufacturing, regulatory and other critical aspects of biomedical innovation. In addition, PhRMA member CVC funds can offer access to lab space and other key infrastructure. This additional support has helped generate a higher share of initial public offerings by biotech startups backed by PhRMA member CVC funds than those without such support.

Biopharma CVC funds are just one more way in which PhRMA member companies are seeking to sustain and grow the vibrant U.S. R&D biopharmaceutical ecosystem that continues to lead the world in medical innovation, bringing new medical advances to patients.

To learn more about the role corporate venture capital has in the biopharmaceutical research and development process, click here.