Much like Turing, Valeant Pharmaceutical’s strategy is more reflective of a hedge fund than an innovative biopharmaceutical company.

Valeant’s CEO has stated that the company’s “strategy is quite different from traditional pharmaceutical companies” in that it has “consistently pursued profitable growth through diversification, strong execution and financial discipline,” rather than a focus on R&D investment and innovation.

A recent article in Fortune cited one investor as saying that “Valeant isn’t merely a pharmaceutical company, but rather a ‘platform company’ that systematically makes acquisitions in order to increase its own value.” It went on to compare Valeant to “a special purpose acquisition company, or SPAC—a shell company created for the purpose of buying other companies.”

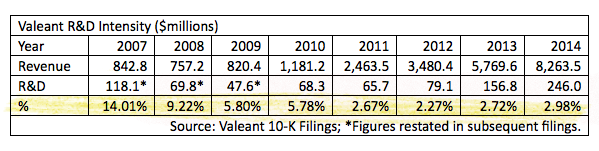

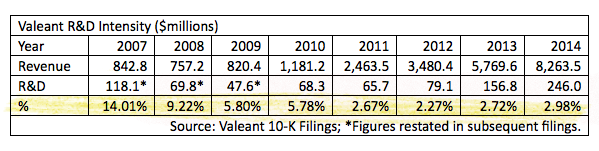

This strategy is much different than the vast majority of innovative biopharmaceutical companies that invest a significant share of their revenues into developing new treatments and cures for patients. Take a look at the data:

- Valeant invests on average less than 3% of its total revenue on R&D. PhRMA member companies invest on average 20% of total revenue on R&D.

This significant investment reflects our member companies’ long history of drug discovery and innovation resulting in increased longevity and improved lives for millions of patients.

This significant investment reflects our member companies’ long history of drug discovery and innovation resulting in increased longevity and improved lives for millions of patients.

- The nation’s innovative biopharmaceutical companies consistently spend tens of billions of dollars on R&D each year. In fact, PhRMA members invested more than $51 billion in R&D in 2014.

According to the National Science Foundation, the sector is the single largest funder of business R&D in the U.S., representing about one in every five dollars spent on domestic R&D by U.S. businesses.

According to the National Science Foundation, the sector is the single largest funder of business R&D in the U.S., representing about one in every five dollars spent on domestic R&D by U.S. businesses.

- A recent study by the Brookings Institution found that the biopharmaceutical industry is a leader among advanced industries with the highest R&D-intensity in the U.S. economy. Biopharmaceutical companies invest more in R&D relative to sales than any other manufacturing industry (more than 18 percent) – six times the average for the manufacturing sector.

Unlike Valeant and Turing, innovative biopharmaceutical companies have R&D at the core — and the numbers prove it.