Conversations and healthy debate about issues facing our industry and the health care system are critical to addressing some of today’s challenges and opportunities. The Catalyst welcomes guest contributors, including patients, stakeholders, innovators and others, to share their perspectives and point of view. Views represented here may not be those of PhRMA, though they are no less key to a healthy dialogue on issues in health care today.

Conversations and healthy debate about issues facing our industry and the health care system are critical to addressing some of today’s challenges and opportunities. The Catalyst welcomes guest contributors, including patients, stakeholders, innovators and others, to share their perspectives and point of view. Views represented here may not be those of PhRMA, though they are no less key to a healthy dialogue on issues in health care today.

We’re pleased to host a guest blog from Professor MP Pugatch, the IPKM Professor of Valorisation, Entrepreneurship and Management at the University of Maastricht and Managing Director of Pugatch Consilium, a boutique research consultancy.

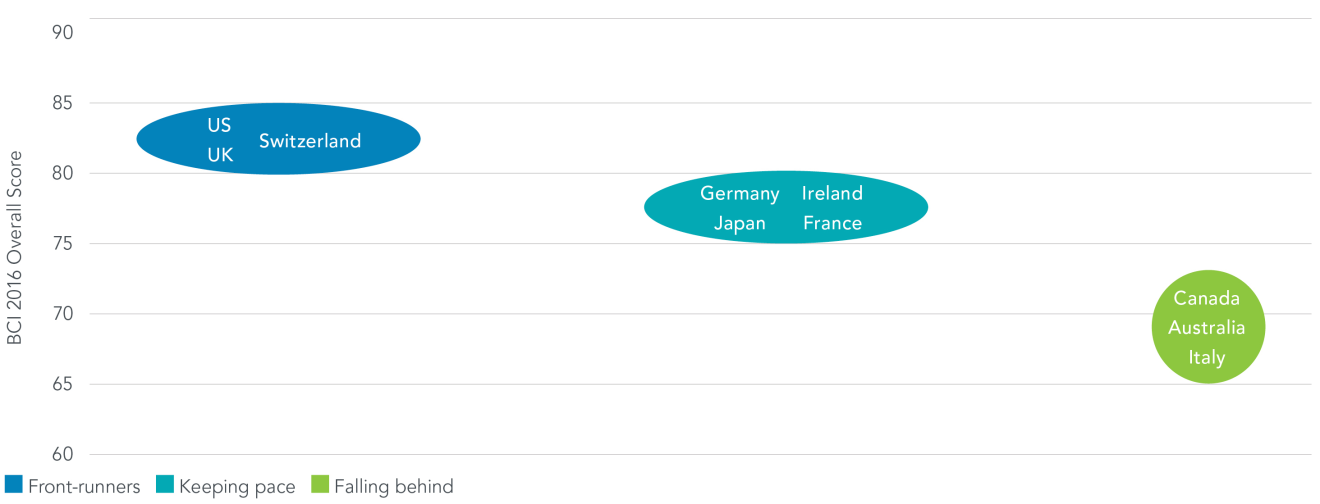

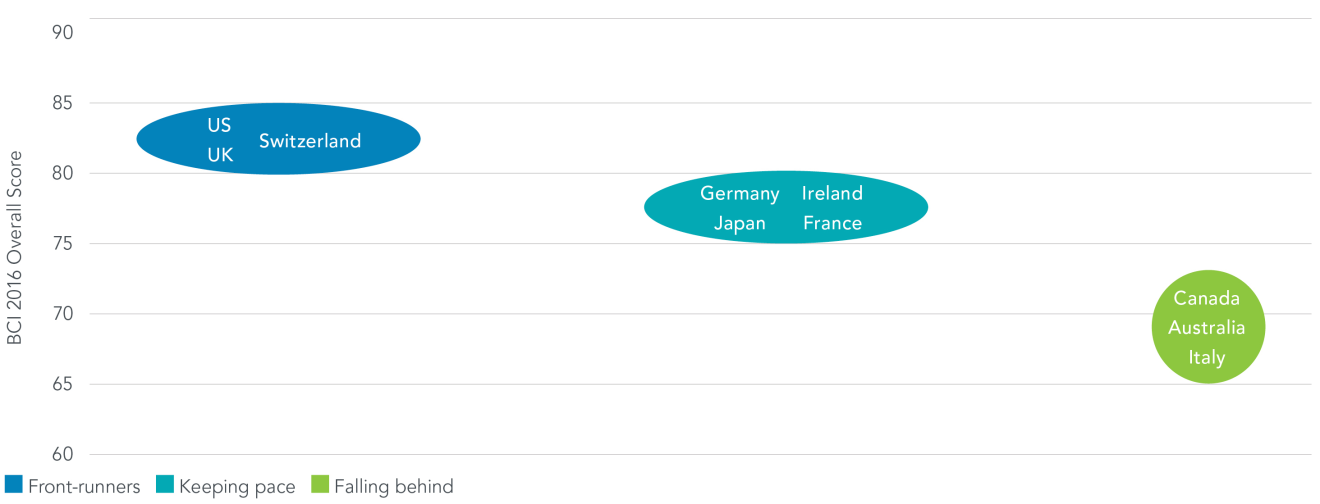

In the race for biopharmaceutical investment economies with pro-innovation policies – many of them relatively small economies – are quickening their stride, while those employing weak policies remain behind. The results of the 2016 Biopharmaceutical Competitiveness & Investment (BCI) Survey, released today, reveal that though still presenting certain policy obstacles the “Asian Tigers” – Singapore, South Korea and Taiwan – and Israel are rated as most competitive for investment compared to other “newcomer” markets. Switzerland and the US are among those leading mature markets. Meanwhile, the BRIC economies and remaining APAC place at the rear of newcomer markets, and Canada and Australia are viewed as falling behind among mature markets.

BCI Overall Results

Newcomer Markets

Mature Markets

Source: Pugatch Consilium (2016)

In its third edition, the BCI Survey is a global executive opinion survey and index of economies’ biomedical investment-attractiveness created by Pugatch Consilium and commissioned by PhRMA. Incorporating the views of biopharmaceutical country managers and their teams – who often have a candid and accurate understanding of how the local policy environment factors into investment decisions – the BCI enables a unique and highly relevant snapshot of economies’ biomedical competitiveness.

Two major factors enhance the BCI Survey in 2016. First, the economies covered have nearly doubled compared to 2015 to 28 markets, capturing many of the largest and most active biopharmaceutical markets worldwide. Second, in 2016 the BCI Survey has been developed into two separate surveys, one targeting newcomer markets and the other, mature markets. Economies are gauged in relation to other markets with similar levels of development, allowing for an even more fine-tuned snapshot of each market’s attractiveness for biopharmaceutical investment.

According to executives, newcomer markets are still divided when it comes to protecting intellectual property and localizing innovation. Though some important gaps exist around market access policies and patent enforcement, in most respects top scoring economies are viewed as having IP environments in line with international standards and supporting biopharmaceutical innovation and technology transfer through positive incentives and dedicated funding. In contrast, economies at the rear still face fundamental challenges in these areas. A steady rise in patenting criteria that discriminate against biopharmaceutical inventions is one commonly cited barrier, with India’s enhanced efficacy requirements having inspired look-alike bills in other countries including Brazil, Indonesia and South Africa. Localization policies that require investment in the local biopharmaceutical sector or establish punitive incentives to invest are likewise deterring investment from biopharmaceutical innovators in a number of the BCI markets.

Mature markets are not immune to policy challenges either. In the area of IP, Canada’s heightened patent utility requirement and legislation allowing for release of confidential business information, and Australia’s practice of requiring damages from originator companies and other methods sought to address “evergreening” are seen as introducing significant uncertainty and risks to R&D investment.

Economies that seek to avoid these types of barriers and prioritize innovation across the research, regulatory, market access and IP systems are those that maintain a competitive advantage compared to other mature markets.

The study, The Race for Biopharmaceutical Innovation: BCI Survey 2016, is available for download.

Conversations and

Conversations and