The biopharmaceutical ecosystem has helped make the U.S. the global leader in biomedical innovation today. An important part of this ecosystem is the thousands of small startup biopharmaceutical firms that explore new avenues of medical research. Venture capital is the financial lifeblood of these startups, and America’s biopharmaceutical companies play an important role in startup financing through investments made by their corporate venture capital (CVC) arms.

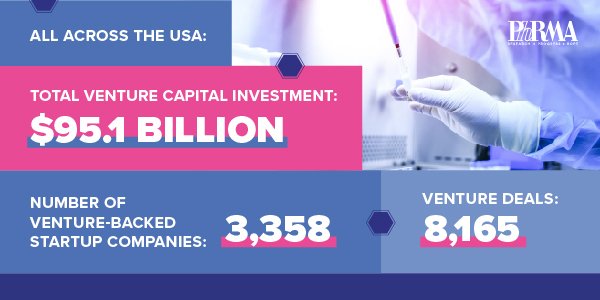

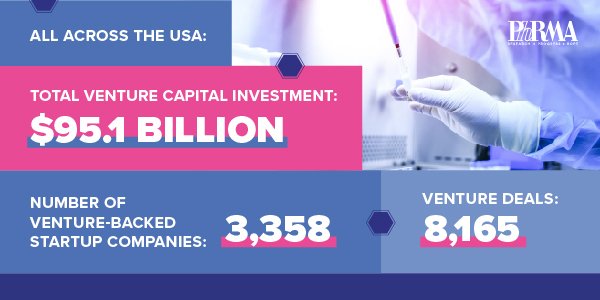

To spotlight the importance of venture investment in the biopharmaceutical ecosystem, PhRMA today released new data examining the impact of venture capital and small startup companies in the U.S. from 2000-2017.

The vast majority of biopharmaceutical companies are small startups, which provide jobs and economic growth in almost every state in the U.S. Between 2000 and 2017, more than $95 billion of venture capital investments were made in over 3,300 startup biopharmaceutical companies.

Venture capital is the most important source of startup financing, and these types of investments in biopharmaceutical companies have increased by more than 160 percent since 2010. A large share of this investment comes from affiliated PhRMA member company CVCs, which make such equity investments in part to support their own innovative research.

Biopharmaceutical research is inherently risky, due in part to the increasing complexity of the cutting-edge treatments being developed, including cell and gene therapies, precision medicine, and digital health technologies. Much of the research and development conducted by small biopharmaceutical startups is in early-stage research, generally regarded by investors as being of the highest risk. Venture capital is allowing biopharmaceutical startups to take those risks, which may result in a new, life-saving treatment.

New medicines developed by startups not only advance science and human health, but also bring jobs and economic growth to their communities. While relatively small in numbers compared to large firms, jobs in startup biopharma companies are knowledge-intensive and high-impact, generating a positive ripple effect throughout the regional economy. In this way, venture-backed enterprises deliver the dual benefits of scientific advancement and economic growth beyond the traditional biopharmaceutical hubs into smaller communities across the nation.

To learn more and download state-specific fact sheets, click here.