Is 340B benefiting the vulnerable, uninsured patients it was designed to help? That’s the most important question policymakers should be asking in any discussion about the 340B program. Unfortunately, this program is essentially a black box with lax reporting requirements and weak oversight – which means there is little to no clear evidence that patients consistently benefit from the massive discounts on medicines provided to 340B covered entities.

While that one crucial question continues to go unanswered, skyrocketing 340B growth continues as 340B hospitals and their contract pharmacies work to siphon more and more money out of the program and away from patients. A recent analysis adds to a mounting body of evidence indicating the program has veered off course while ballooning in size. The report found:

- By 2018, purchases through the 340B program had grown to account for 14% of the total branded outpatient drug market.

- The program is now the second largest federal prescription drug program, behind only Medicare Part D, exceeding Medicare Part B, Medicaid and VA / Tricare / DOD.

Though there are a number of methodologies for comparing the relative size of the program, this analysis more accurately puts the 340B program into perspective by comparing undiscounted 340B branded drug sales to total undiscounted drug sales while also excluding inpatient and generic drug sales from the comparison.

Oddly, the Health Resources and Services Administration (HRSA), the agency that oversees 340B, does not do any sort of program growth analysis of its own – another example of weak government oversight. Instead, HRSA has delegated its responsibility to monitor program sales to an outside expert whose data also confirm concerning growth patterns, showing that discounted 340B purchases in 2019 were 23% higher than in 2018, amounting to $29.9 billion. Since 2014 alone, the program has tripled in size.

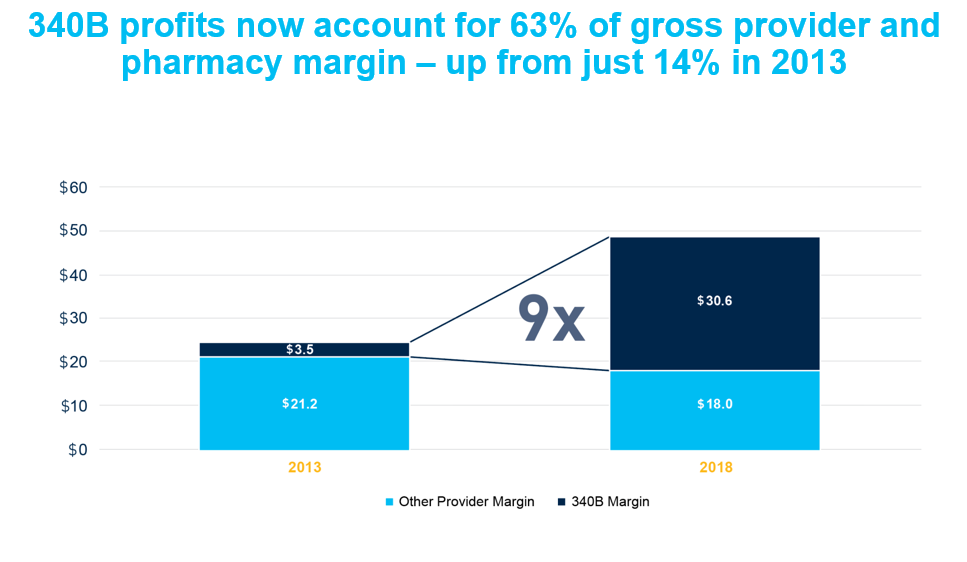

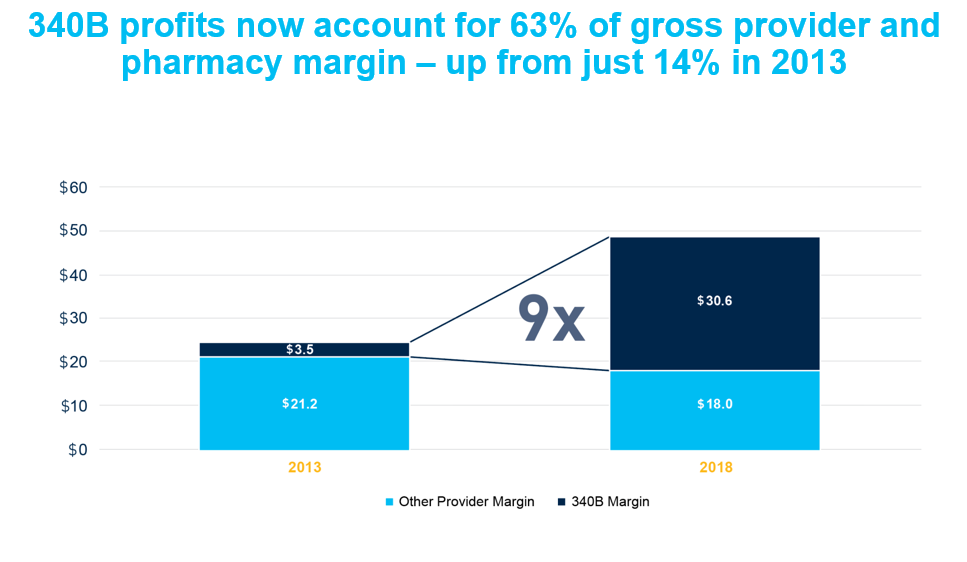

A separate analysis that took a broader look at the supply chain found that the amount hospitals, pharmacies and other health care providers retained on the sale of brand medicines nearly doubled between 2013 and 2018, increasing from $24.7 billion to $48.6 billion. Much of this growth was attributed to expansion of the 340B drug pricing program. According to the analysis, the amount hospitals and other 340B entities retained from the sale of brand medicines purchased through the 340B program was 9 times larger in 2018 than in 2013.

Increasing accountability and oversight in 340B should always be a priority, but the COVID-19 pandemic makes these efforts even more urgent. It is critical to ensure that hospitals use 340B discounts to benefit vulnerable patients who now face increased health risks and challenges.

Policymakers must push for meaningful reform to increase transparency and accountability in the 340B program and ensure it benefits patients as it was intended. Learn more about the importance of 340B reform here.