How standardized plans can improve patients’ access to medicines

Patients like Melissa and Hernando deserve commonsense solutions to help improve medicine access and affordability.

How standardized plans can improve patients’ access to medicines.

Patients like Melissa and Hernando deserve commonsense solutions to help improve medicine access and affordability.

How standardized plans can improve patients’ access to medicines.

While insurers negotiate steep discounts on medicines, they don’t always share these savings directly with patients. In recent years, insurers have shifted costs for brand medicines to patients by subjecting them to higher deductibles and using coinsurance rather than fixed copays. This ties the amount that patients are required to pay out-of-pocket for their medicines to the undiscounted price rather than the negotiated price their insurer gets.

The Department of Health and Human Services (HHS) recently proposed a rule which could help lower patients’ costs at the pharmacy counter for patients with health insurance coverage from HealthCare.gov. The proposed 2023 Notice of Benefit and Payment Parameters (NBPP) would require qualified health plans to offer standardized benefit designs. These standardized plans can increase patient access and improve affordability by:

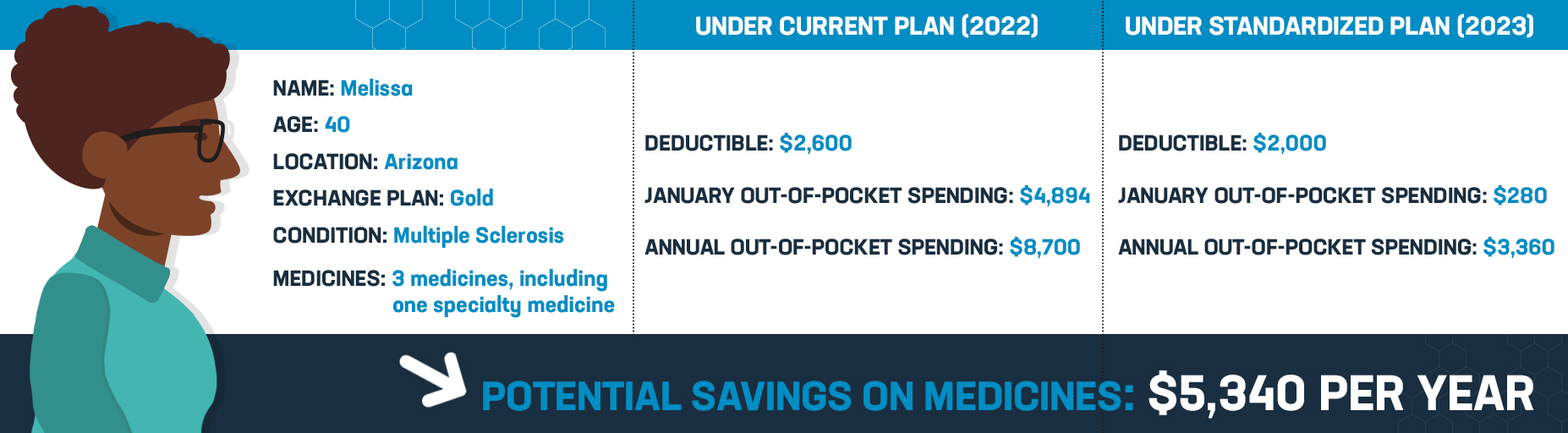

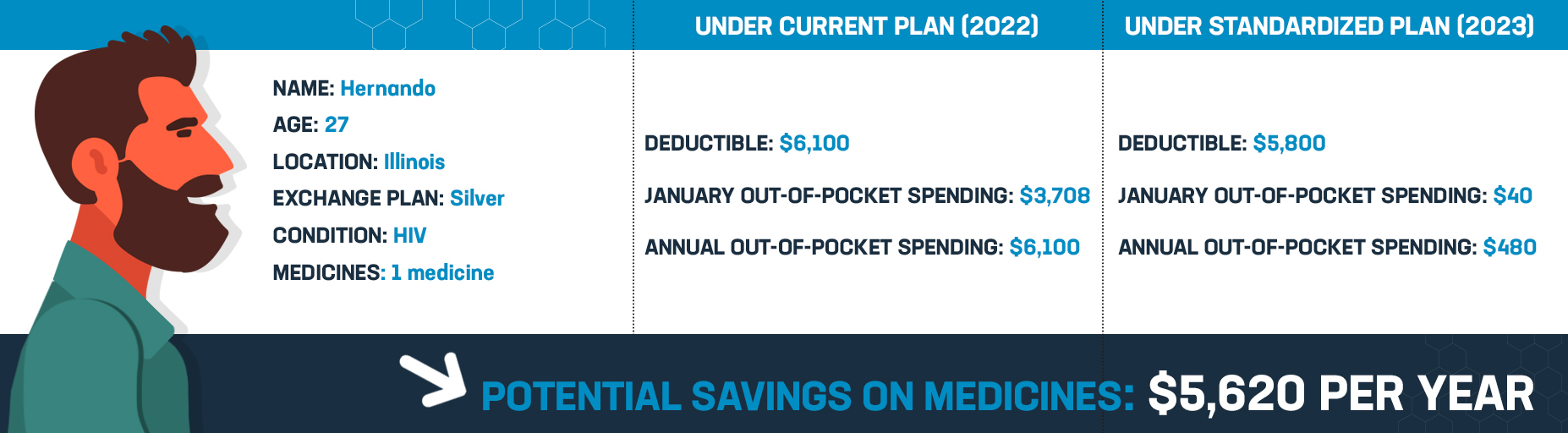

This rule could lower patients’ out-of-pocket costs for medicines. Here are some hypothetical examples:

Melissa is a 40-year-old from Arizona who takes three medicines to manage her multiple sclerosis. She has to spend $8,700 on her medicines this year due to the cost sharing set by her insurer. But if Melissa’s gold plan – which she purchases through HealthCare.gov – was the proposed standardized plan, Melissa could save $5,340 annually.

Hernando is a 27-year-old from Illinois who takes one medicine to manage his HIV. Like Melissa, Hernando’s health plan subjects him to high out-of-pocket costs for his medicines, which are projected to total $6,100 by the end of the year. But if Hernando’s silver plan – which he purchases through HealthCare.gov – was the proposed standardized plan, Hernando’s out-of-pocket spending could decrease to just $480 per year, contributing to over 92% in savings.

Patients like Melissa and Hernando deserve commonsense solutions to help improve medicine access and affordability. It’s time for policymakers to advance policies like standardized plans that make insurance work like insurance. HHS should finalize the proposed approach to standardized plans in the 2023 NBPP without modifications that would weaken the policy for patients.

Read more patient examples here and learn about how we can build a better health care system by visiting PhRMA.org/BetterWay.