ICYMI – 3 new reports show dramatic slowdown in medicine spending growth

Newly released data confirm previous projections of significant decline in medicine spending growth.

ICYMI – 3 new reports show dramatic slowdown in medicine spending growth.

Newly released data confirm previous projections of significant decline in medicine spending growth.

ICYMI – 3 new reports show dramatic slowdown in medicine spending growth.

Newly released government actuary and pharmacy benefit manager data confirm previous projections of a significant decline in medicine spending growth. After accounting for discounts and rebates, medicine spending growth in 2016 dipped into the low single digits, with growth rates between 2 and 5 percent.

But where do the discounts go?

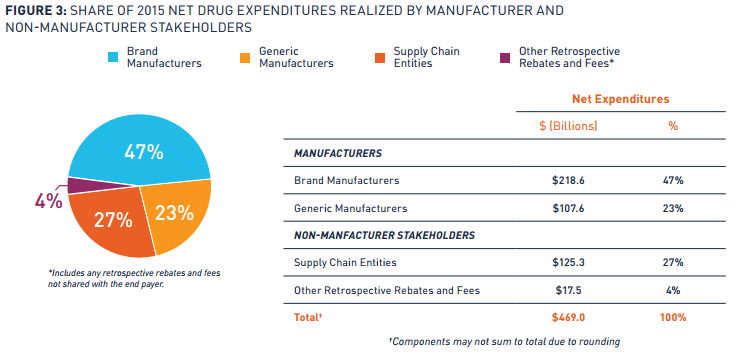

These trend reports follow a recent analysis by the Berkeley Research Group which found brand biopharmaceutical companies retained just 63 percent of total gross (based on list price) spending on brand medicines. This suggests more than one-third of a brand prescription medicine’s list price is rebated back to insurance companies, PBMs and the government, or retained by other stakeholders in the supply chain.

This study begs an important question: Are we doing enough to ensure the growing amount of rebates and discounts flow to the patient? Unlike care received at an in-network hospital or physician’s office, a patient’s cost-sharing for medicines, including payments for care received prior to meeting a deductible or from a co-insurance, is typically based on the list price of a medicine, not the net prices after rebates and discounts are factored in.

Learn more about the cost and value of medicines at www.phrma.org/cost.