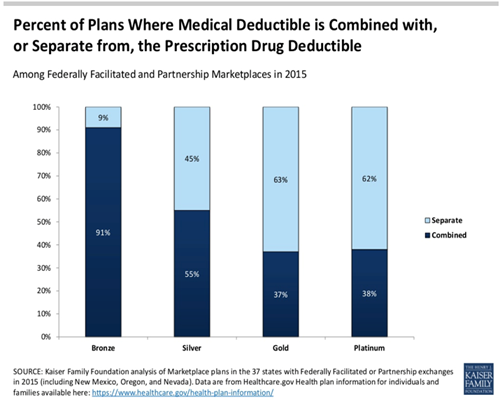

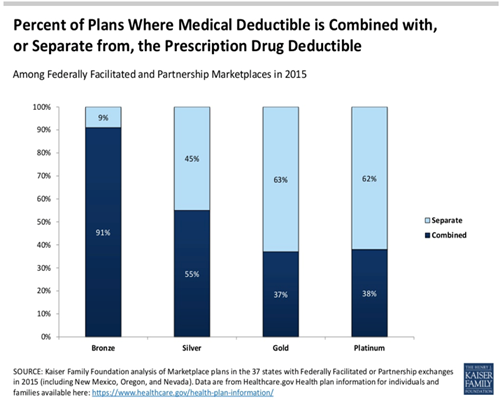

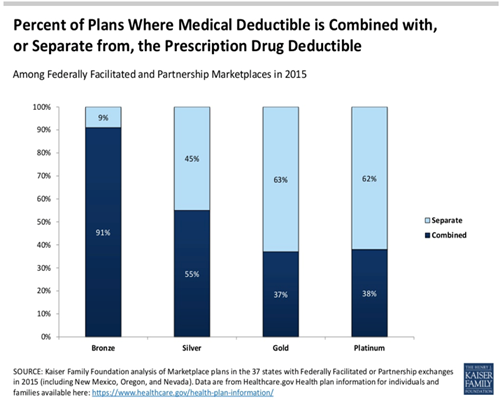

Earlier this week, the Kaiser Family Foundation released new research about the deductibles in different health insurance exchange plans. The study found for bronze or silver plans patients often have to pay thousands of dollars out of pocket due to high combined deductibles.

It’s important for patients to be aware of how their plan deductible is structured. Plans that apply a large deductible to prescriptions can leave patients with high out-of-pocket costs for accessing needed medicines, like those to treat chronic conditions. For example, the average silver plan combined deductible is $2,563. This could mean that a patient would have to pay $200 each month for prescriptions without ever having any of their medicines covered by insurance.

Patients need clarity about how plans treat deductibles to know of prescription drugs are subject to the out-of-pocket cost. For more information about insurance coverage, including videos explaining basic concepts visit AccessBetterCoverage.org.