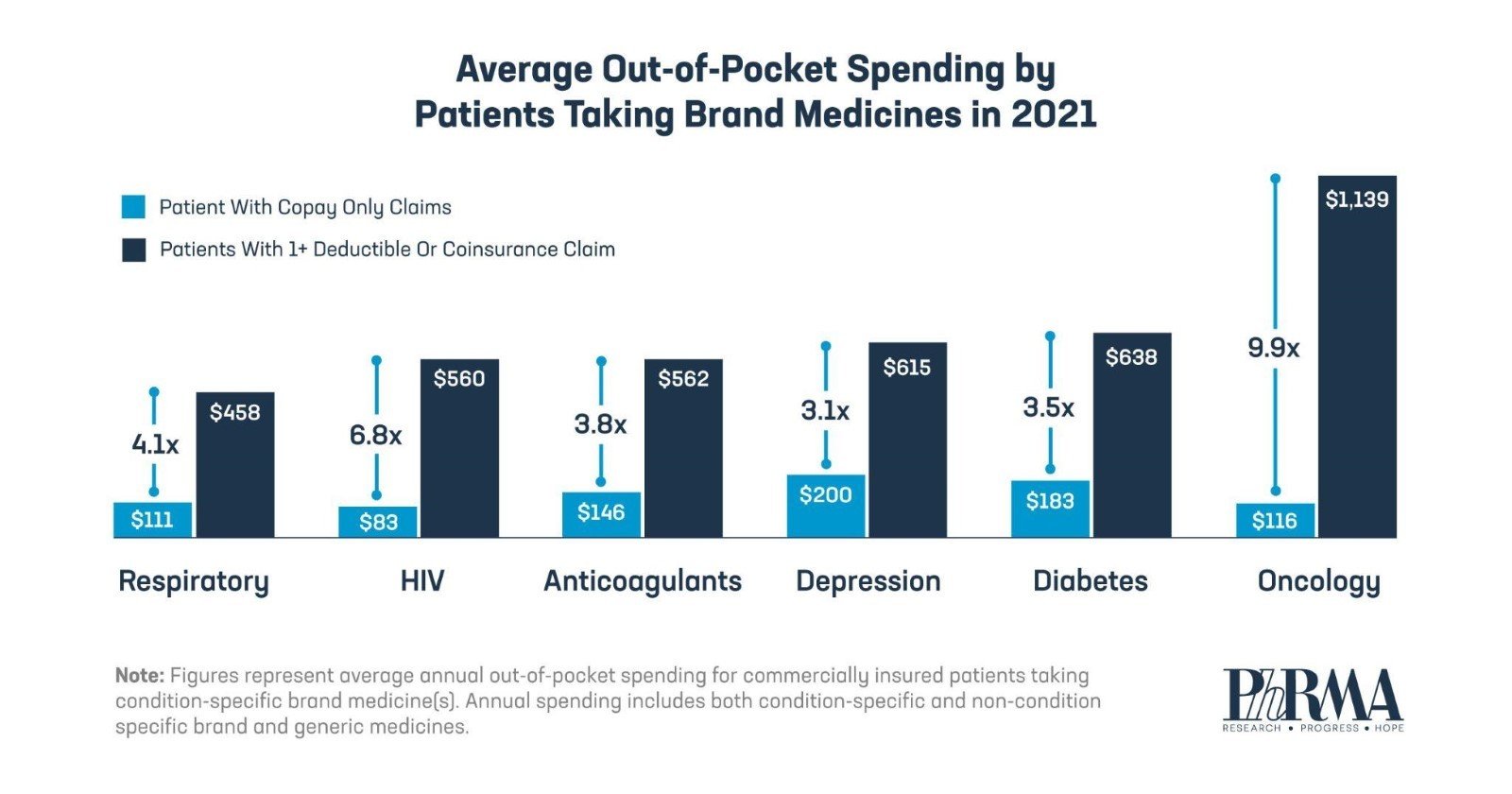

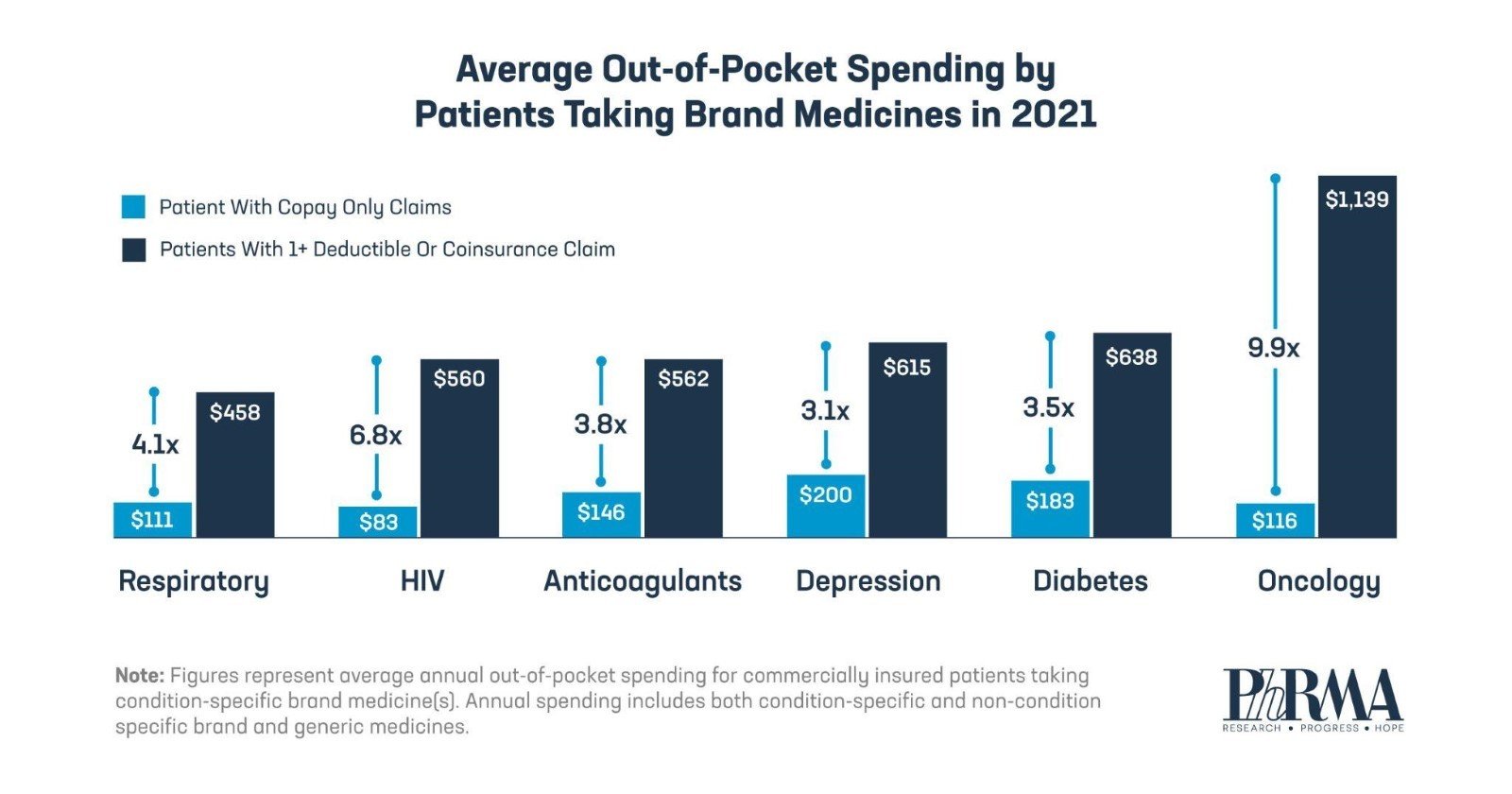

Health plans are increasingly using deductibles and coinsurance to shift more of the cost of care to chronically ill patients taking brand medicines. As data from IQVIA show, this alarming trend is especially burdensome for patients with cancer, who pay nearly 10X more on average per year for their medicines when they face deductibles and coinsurance versus patients with only fixed copays.

Out-of-pocket costs for patients with deductibles and coinsurance are often based on the list price, not the lower price their health plans and PBMs usually pay.

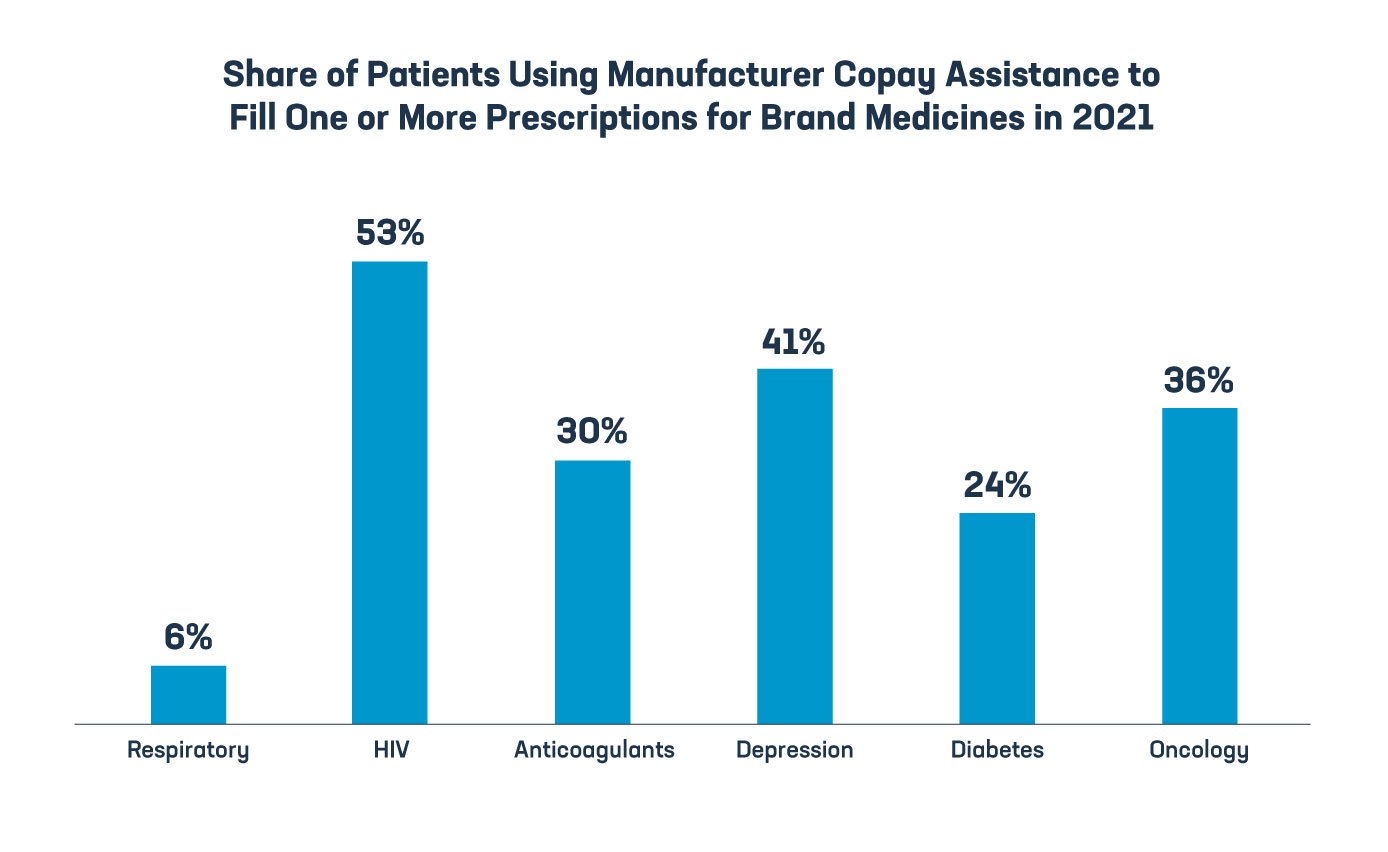

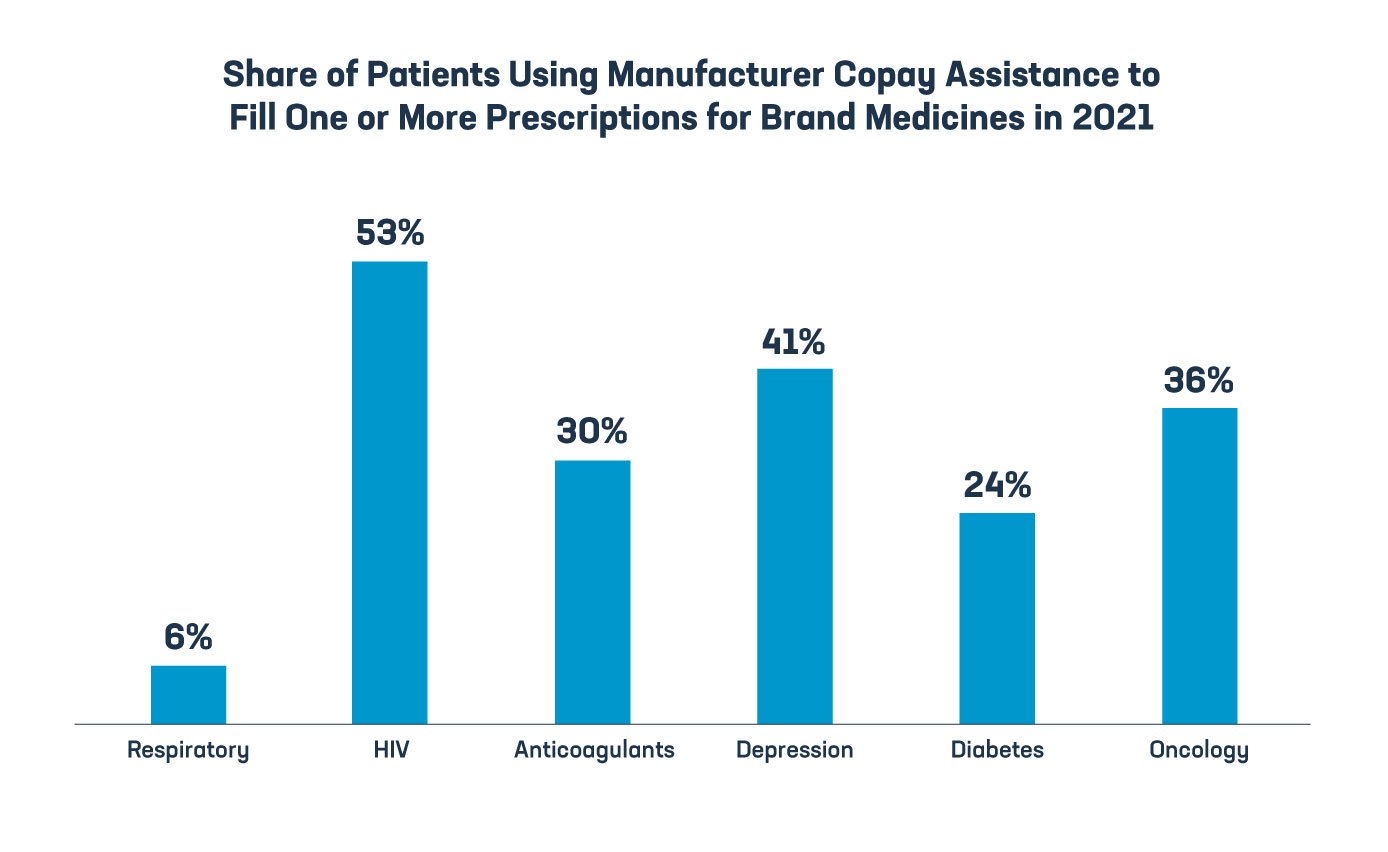

When insurers require them to pay more than they should, many patients have turned to manufacturer copay assistance for help. This assistance plays an important role in helping patients with chronic and complex illnesses afford and access the medicines they need.

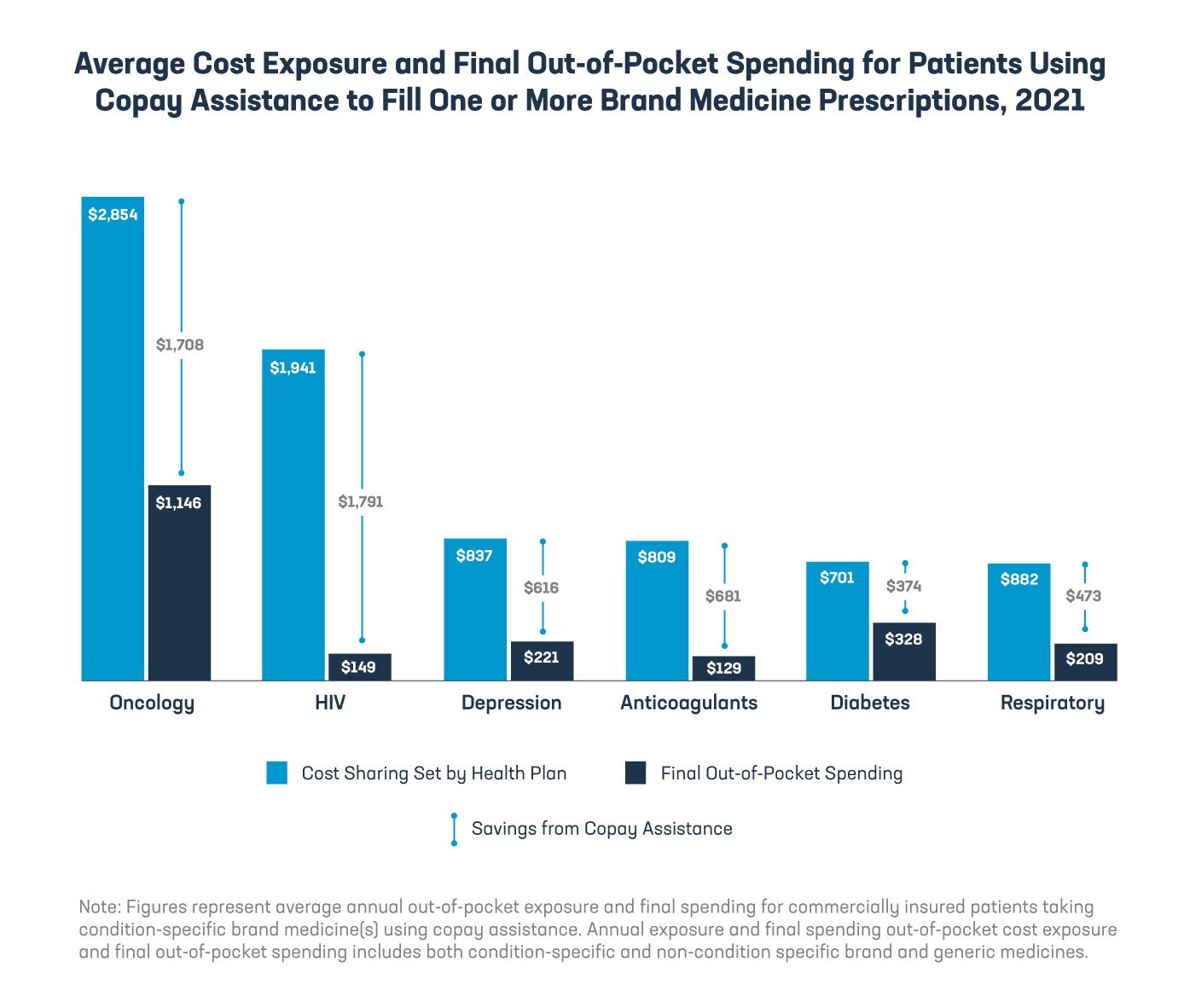

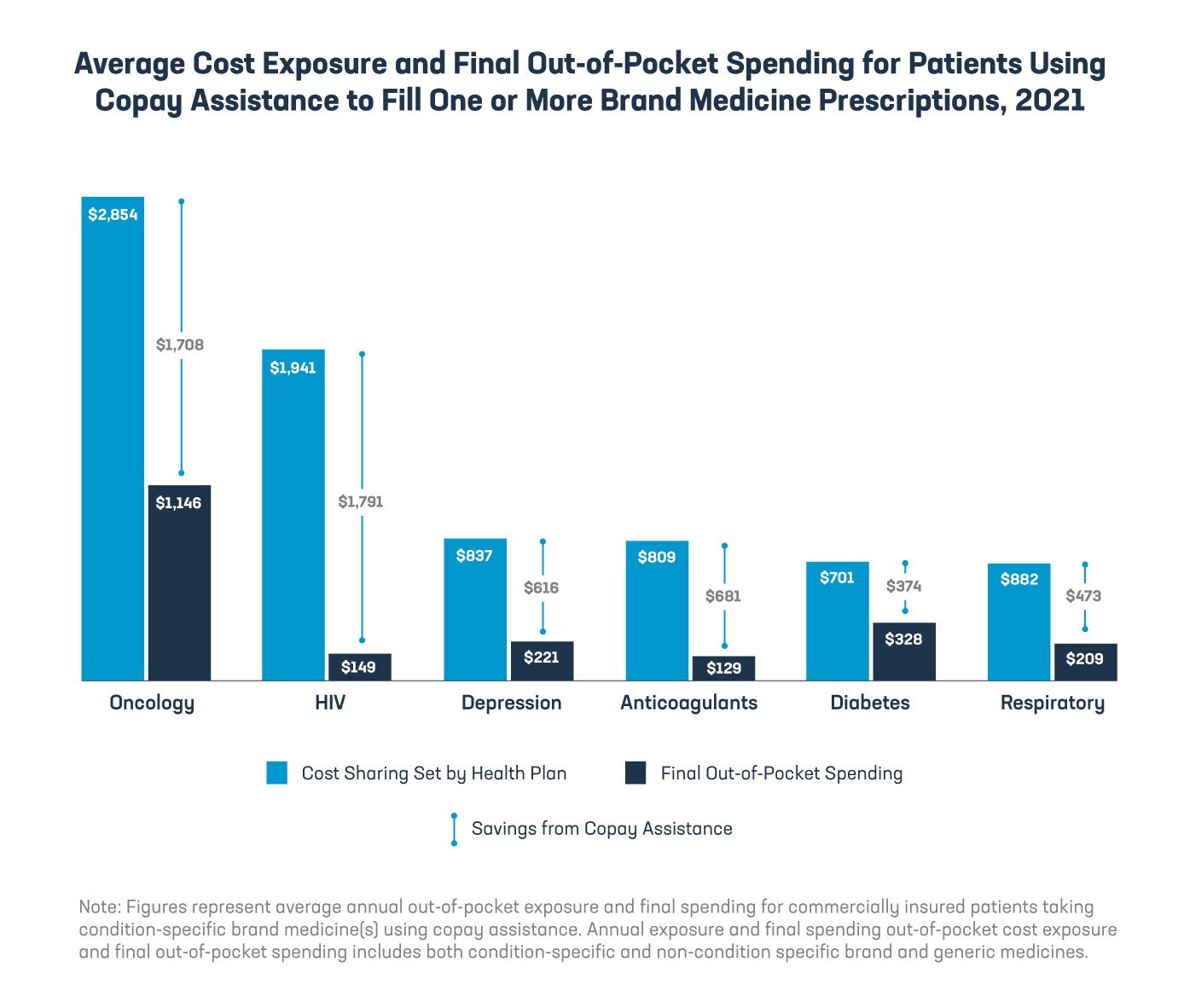

In 2021, patients who used copay assistance for brand:

- Diabetes medicines saved an average of $374. Their average annual out-of-pocket costs would have been more than 2x higher without this assistance.

- HIV medicines saved an average of $1,791. Without this assistance, their average annual out-of-pocket costs would have been nearly 13x higher.

- Cancer medicines saved an average of $1,708. Without this assistance, their average annual out-of-pocket costs would have been more than 2.5x higher.

Manufacturers have stepped up to help make medicines affordable by providing copay assistance, but many insurers and PBMs have adopted programs that deny patients the benefit of this assistance.

If health insurers and their PBMs don’t pay full price for medicines, patients shouldn’t either. Middlemen should base what patients pay on the lower price health plans and PBMs pay. And patients need policies that protect copay assistance so that health insurers and PBMs are no longer able to limit how much assistance can help patients at the pharmacy counter.

Access the report here and learn more at phrma.org/middlemen.