Many seniors are paying more for Part D medicines than their insurer

For seniors who rely on Medicare Part D, the out-of-pocket costs for medicines can sometimes be a barrier.

Many seniors are paying more for Part D medicines than their insurer.

For seniors who rely on Medicare Part D, the out-of-pocket costs for medicines can sometimes be a barrier.

Many seniors are paying more for Part D medicines than their insurer.

For seniors who rely on Medicare Part D, the out-of-pocket costs for medicines can sometimes be a barrier. Insurers and pharmacy benefit managers (PBMs) continue to shift more and more costs to patients. And a new analysis from the Medicare Payment Advisory Commission (MedPAC) shows why this is a problem that must be addressed.

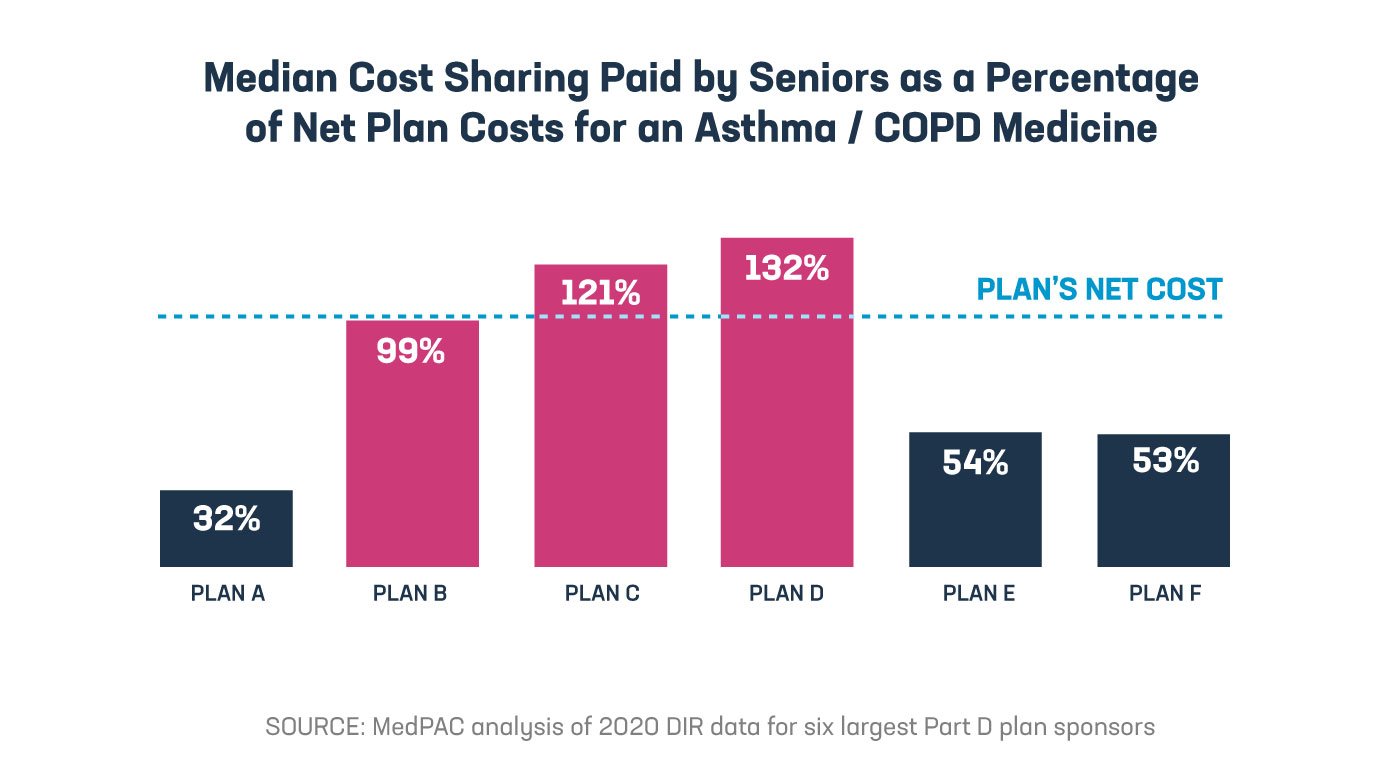

MedPAC’s analysis shows that rebates and other payments from manufacturers and pharmacies lowered Part D spending by 33% in 2020. And while insurers and PBMs who sponsor Part D plans are saving money, Part D beneficiaries are paying more. That’s because seniors’ cost sharing isn’t based on the discounted net price Part D plans pay. Looking at the six largest plan sponsors in Part D, which include companies like UnitedHealth, Humana and CVS Health, MedPAC found:

The Part D benefit is structured so that under the standard benefit design, beneficiaries who don’t participate in the low-income subsidy program are expected to pay an average of 25% of their medicine costs between the deductible and catastrophic phase. But this requirement is currently assessed before taking into account steadily increasing rebates and payments Part D plans receive from manufacturers. MedPAC’s analysis shows the effective rate of patient cost sharing is significantly higher than Congress intended, making the Part D benefit less valuable for many patients.

We can’t overlook that the Inflation Reduction Act did include changes that will make a difference for some seniors at the pharmacy, like capping the annual amount seniors pay out of pocket and making out-of-pocket costs more predictable month to month — policies the biopharmaceutical industry has long advocated. But the law didn’t do nearly enough to stop insurer and PBM abuses and instead prioritized government price setting that will do more harm than good.

The MedPAC analysis demonstrates why policymakers need to stop insurer and PBM abuses. To make changes that meaningfully lower patient out-of-pocket costs, policymakers should ensure that seniors’ cost sharing is based off the net price Part D plans pay, not the list price.