Nearly 50% of total spending on brand medicines – the sum of all payments made at the pharmacy or paid on a claim to a health care provider – went to the supply chain and other entities in 2018, according to a new analysis from the Berkeley Research Group (BRG). Here are four things from the analysis that you should know:

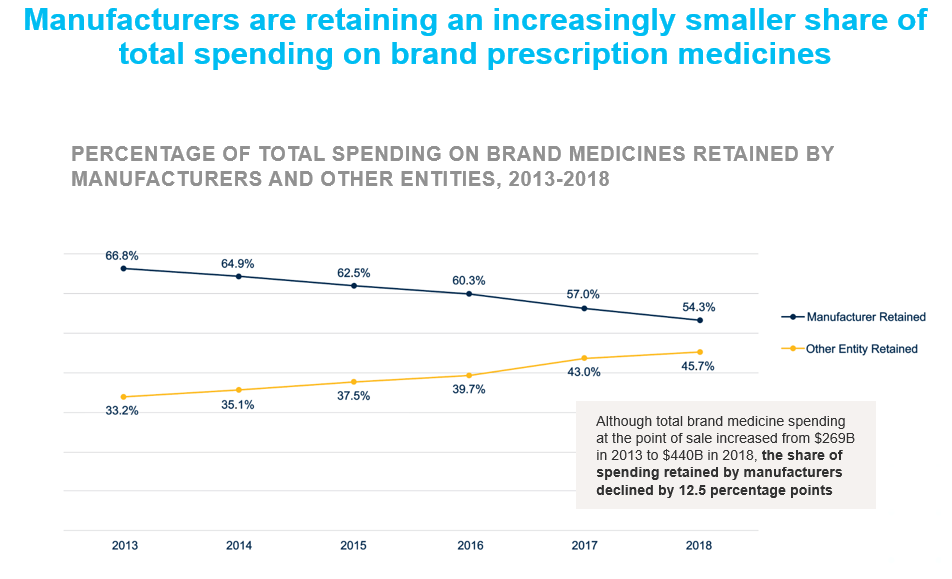

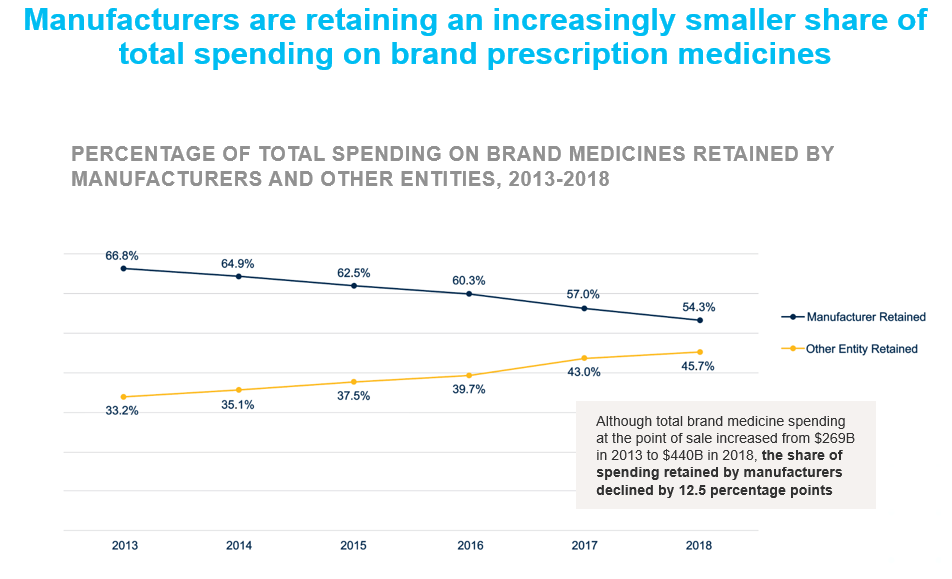

- Hospitals, health insurers, pharmacy benefit managers, the government and others got nearly 50% of what was spent on brand medicines in 2018, up from 33% five years prior. By contrast, innovative biopharmaceutical companies that research, develop and manufacture medicines retained just 54% of total point-of-sale spending on brand medicines.

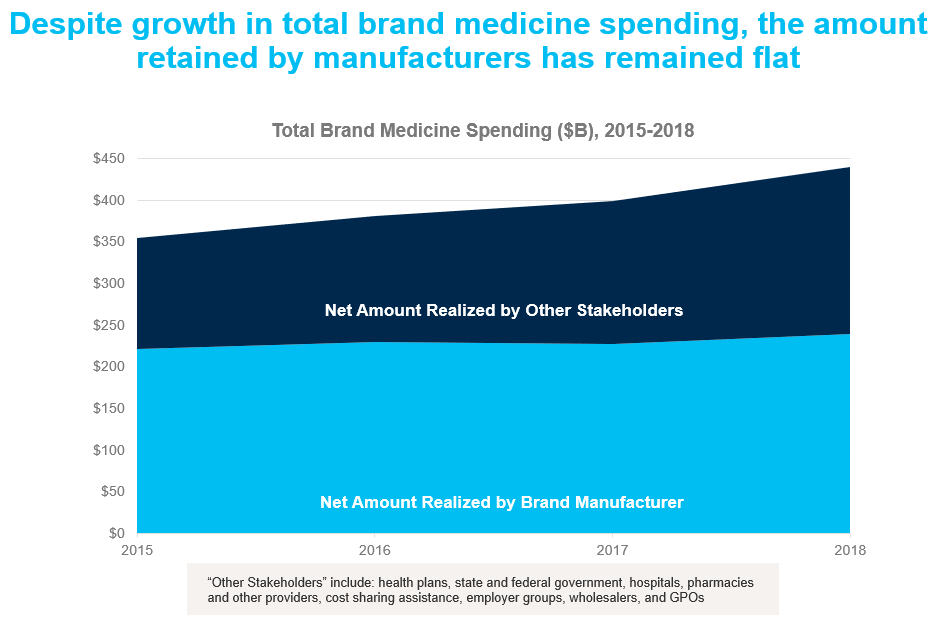

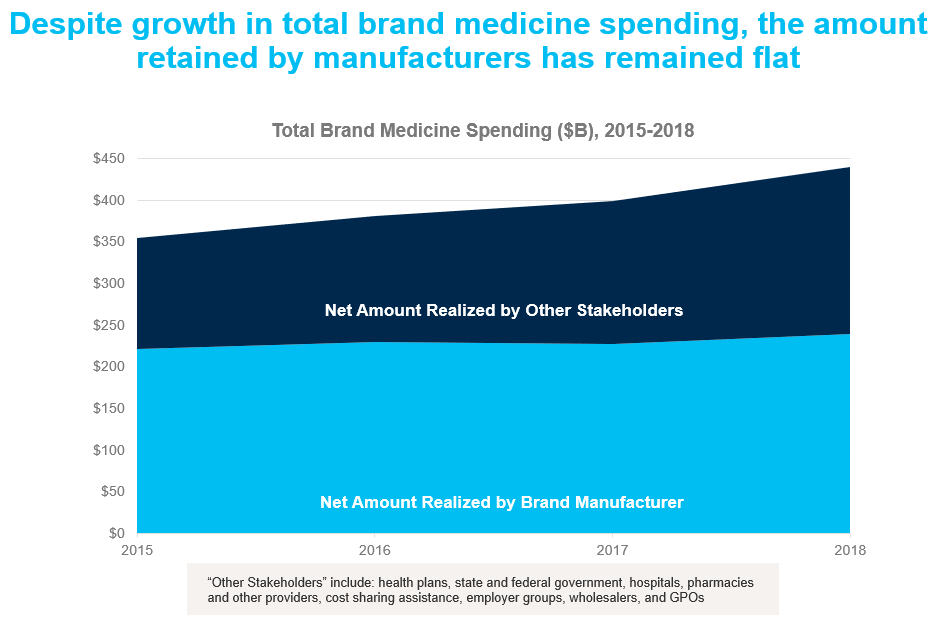

- The share of total spending on brand medicines that biopharmaceutical companies retain has been steadily declining as rebates and discounts have increased. Between 2015 and 2018, the amount innovative biopharmaceutical companies retained from the sale of brand medicines increased, on average, 2.6% annually, in line with inflation. In this same timeframe, companies brought nearly 200 new innovative treatments and cures to patients.

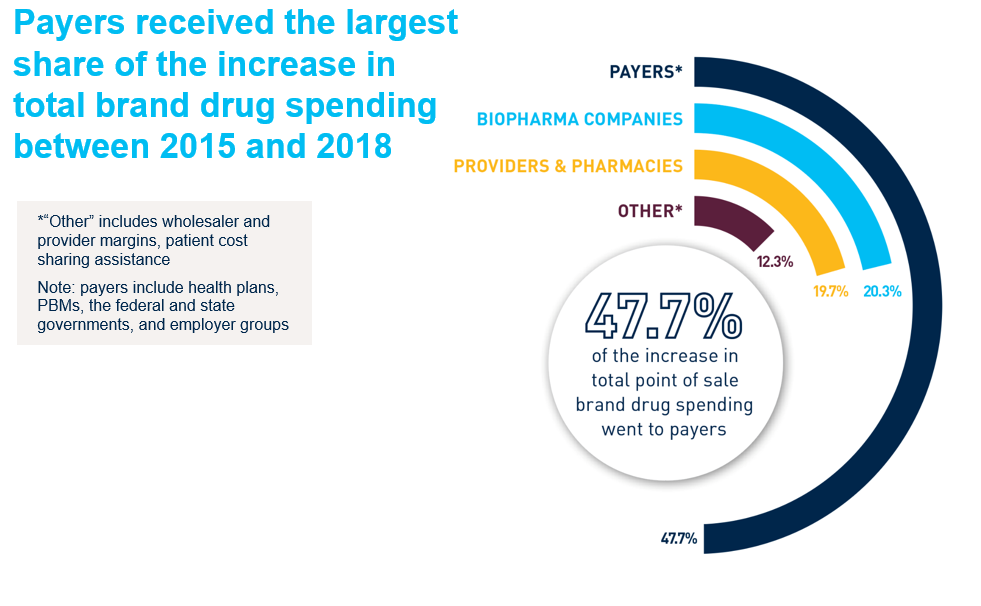

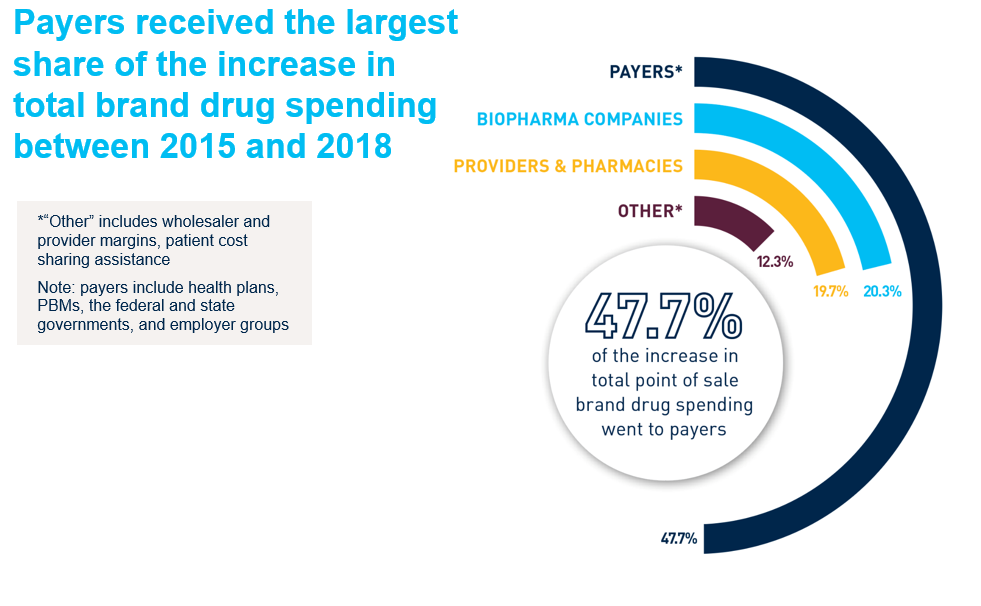

- Nearly half of the increase in the total amount spent on brand medicines went to payers between 2015 and 2018. Twenty percent went to hospitals, pharmacies and other health care providers, which is the same amount that went to biopharmaceutical companies that research, develop and manufacture medicines.

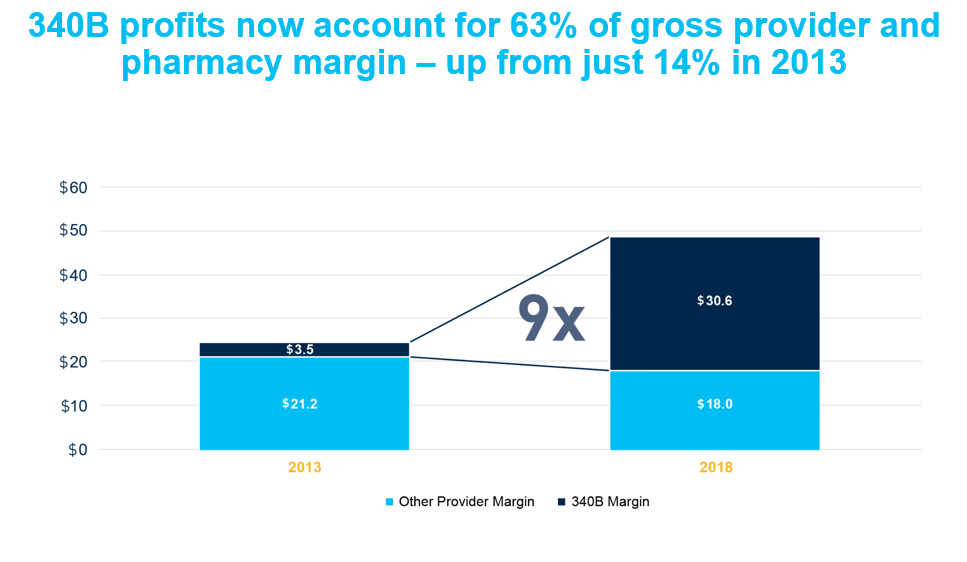

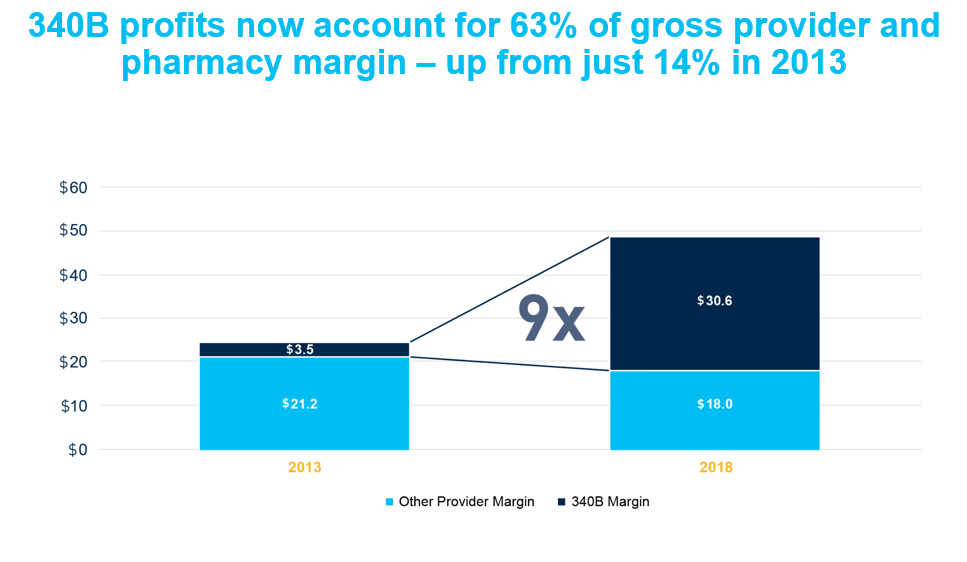

- The amount hospitals, pharmacies and other health care providers retained on the sale of brand medicines nearly doubled between 2013 and 2018, increasing from $24.7 billion to $48.6 billion. This trend was primarily driven by unprecedented expansion in the 340B drug pricing program. In fact, the amount hospitals and other 340B entities retained from the sale of brand medicines purchased through the 340B program was 9 times larger in 2018 than in 2013.

View the full analysis here and learn more at LetsTalkAboutCost.org.