One primary reason people buy health insurance is to protect themselves from unpredictable and unaffordable health care costs. But when patients face high coinsurance—meaning they have to pay a percentage of the total cost of an item or service—they may be left with the very high and difficult to predict costs they were trying to avoid. Newly released data from Avalere Health shows more and more patients likely are seeing this type of cost sharing when they go to fill a prescription as health plans are increasingly requiring high coinsurance for medicines placed on specialty tiers.

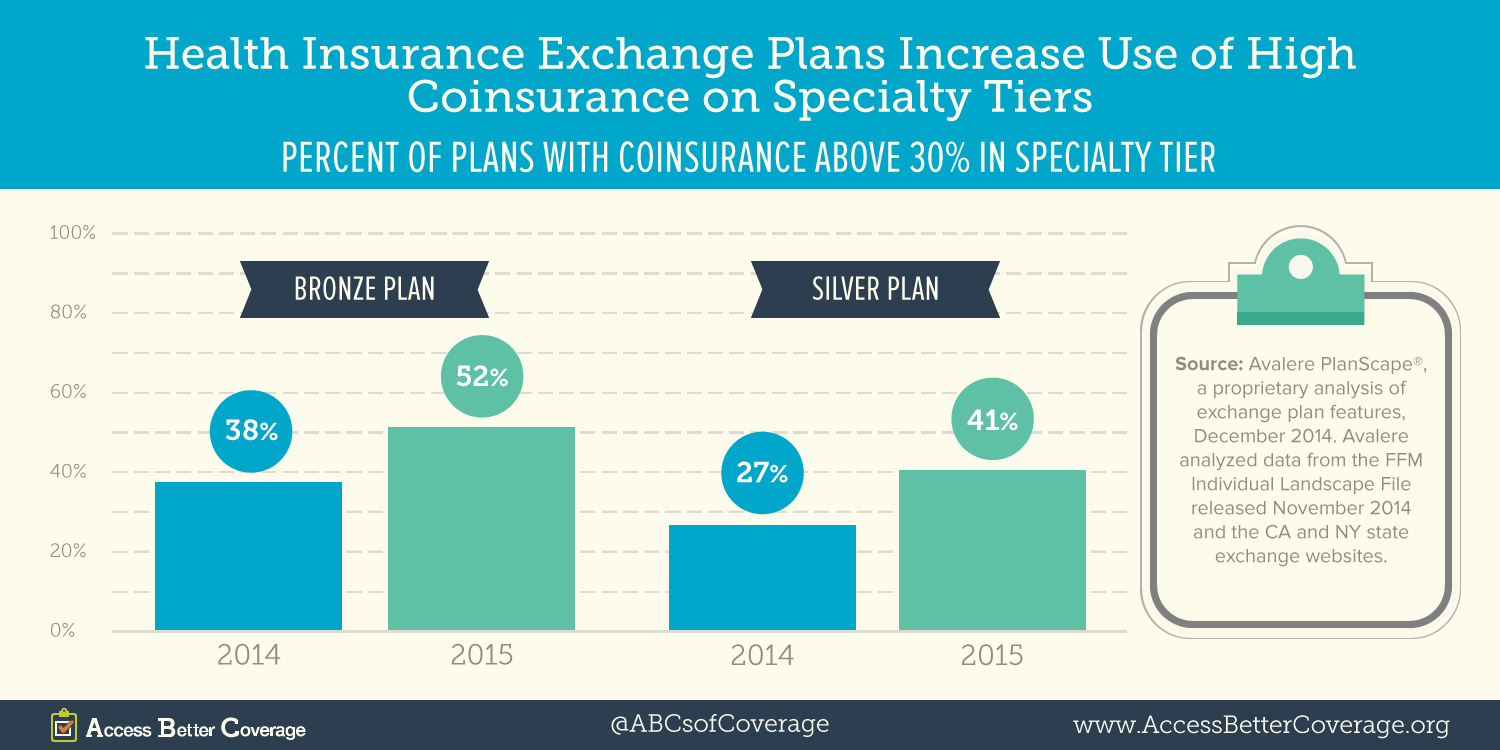

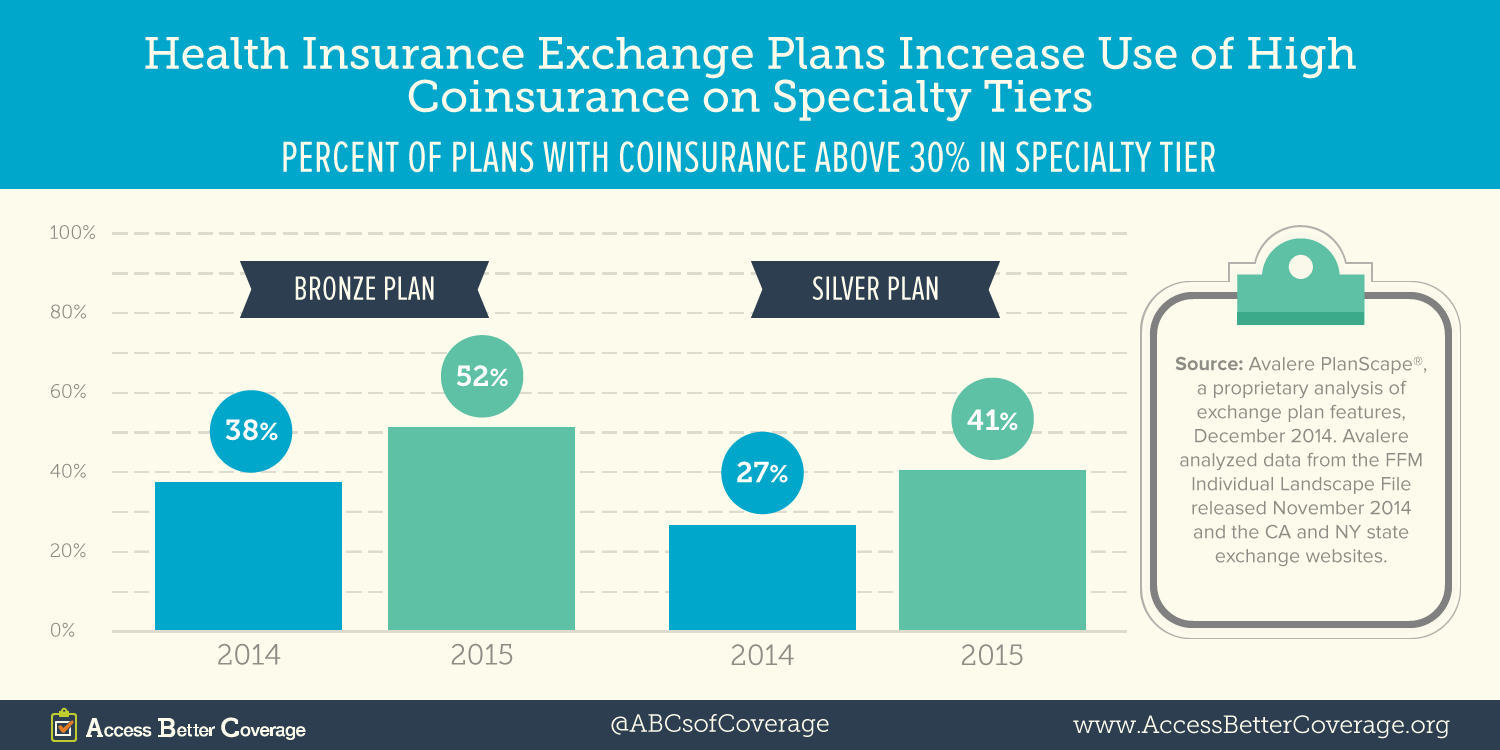

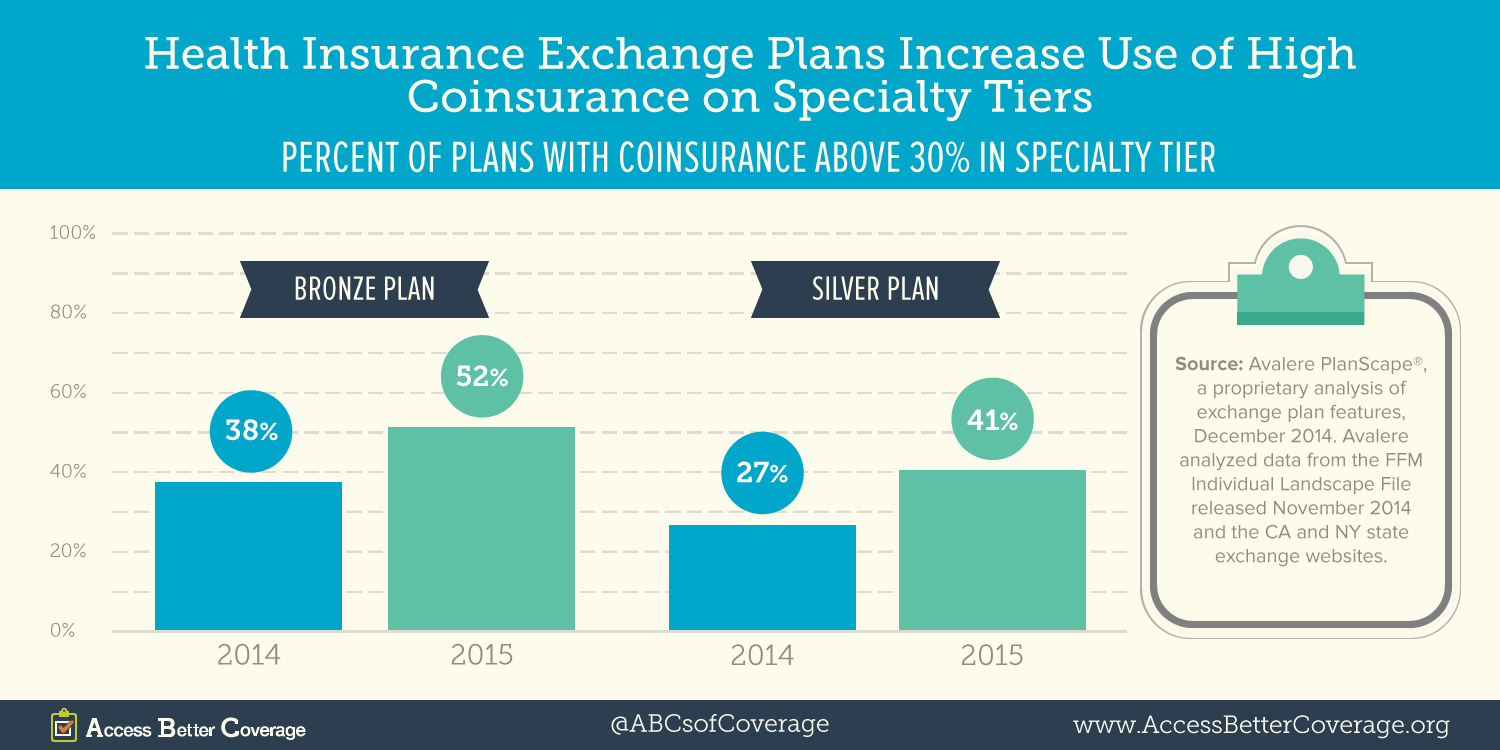

Avalere conducted an analysis using data from 36 states (all the states using Healthcare.gov as well as California and New York). Avalere found the percent of these plans requiring high coinsurance (defined as more than 30 percent) for specialty tier medicines increased dramatically between 2014 and 2015. Specifically, the proportion of bronze and silver plans using specialty tier coinsurance of more than 30 percent increased by 14 percentage points from 2014 to 2015. In 2015, more than half of bronze plans and more than 4 of 10 silver plans require patients to pay coinsurance of more than 30 percent for medications on the specialty tier.

Previous research found an increasing share of health insurance exchange plans putting all medicines used to treat certain conditions on the specialty tier. This is particularly concerning given the number of exchange plans requiring coinsurance of more than 30 percent for medications on the specialty tier.

Previous research found an increasing share of health insurance exchange plans putting all medicines used to treat certain conditions on the specialty tier. This is particularly concerning given the number of exchange plans requiring coinsurance of more than 30 percent for medications on the specialty tier.

While the out-of-pocket maximum provides a key protection for consumers by capping out-of-pocket costs at no more than $6,600 for an individual or $13,200 for a family, patients may face challenges meeting cost-sharing obligations until they reach that out-of-pocket maximum. This is particularly true when patients have to pay thousands of dollars in the beginning of the year for treatments – sometimes in a single month – rather than spreading costs out over the year. High out-of-pocket costs like coinsurance for medicines can be particularly challenging for patients. Unlike high out-of-pocket costs at a hospital, which patients may be able to pay over time, patients may be turned away at the pharmacy if they cannot afford to pay their cost sharing at the time they need prescriptions. This barrier to access may mean patients go without their medicine.

CMS recently raised concerns about plan designs that place all or most medicines for a certain condition in the highest cost sharing tier as being potentially discriminatory against certain types of patients, most recently in the final Notice of Benefit and Payment Parameters for 2016 and the 2016 Letter to Issuers. This CMS guidance suggests patients would benefit from additional CMS or state oversight to ensure all or most medicines to treat a condition are not being placed on the specialty tier—leaving some patients unable to access necessary treatments.

Learn more about access to health coverage and potential hurdles patients face at AccessBetterCoverage.org.

Get instant updates on issues you care about - here. {{cta('4fe14269-44de-493b-a19c-946e0454614a')}}

Previous research

Previous research