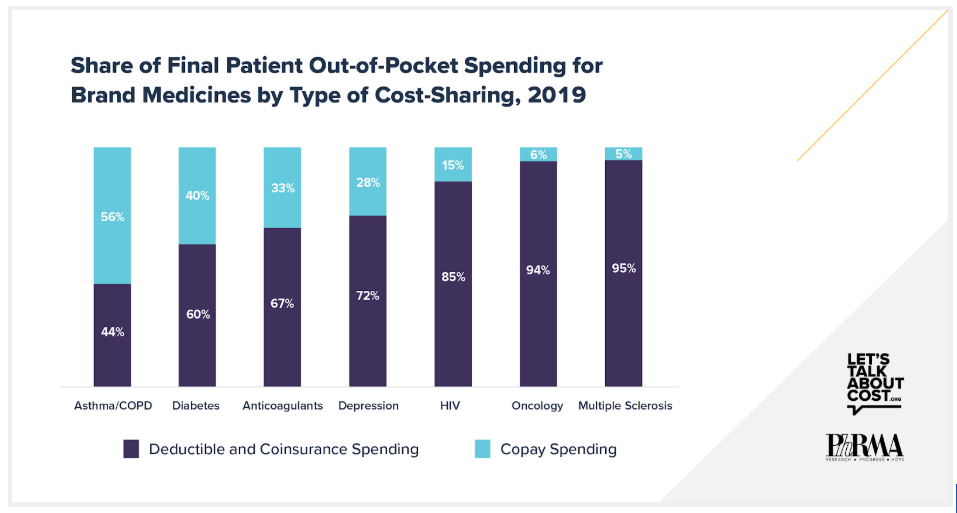

New data show deductibles and coinsurance result in high out-of-pocket spending for commercially insured patients taking brand medicines. IQVIA analyzed trends in cost sharing across seven therapy areas and found that anywhere from 44% to 95% of patients’ total out-of-pocket spending for brand medicines in 2019 was due to deductibles and coinsurance. Compared to patients who only paid copays for brand medicines, patients with deductibles or coinsurance had significantly higher annual out-of-pocket spending across all seven therapeutic areas. In fact, for patients with complex conditions, like cancer and HIV, spending was as much as 25 to 30 times higher.

These findings point to an alarming trend. Health plans’ increasing use of deductibles and coinsurance is shifting more of the cost of care to chronically ill patients taking brand medicines. Even though health plans and pharmacy benefit managers (PBMs) often negotiate rebates from biopharmaceutical companies that significantly reduce brand medicine prices, most patients with deductibles and coinsurance do not benefit directly from these savings and are instead charged cost sharing based on the full undiscounted prices.

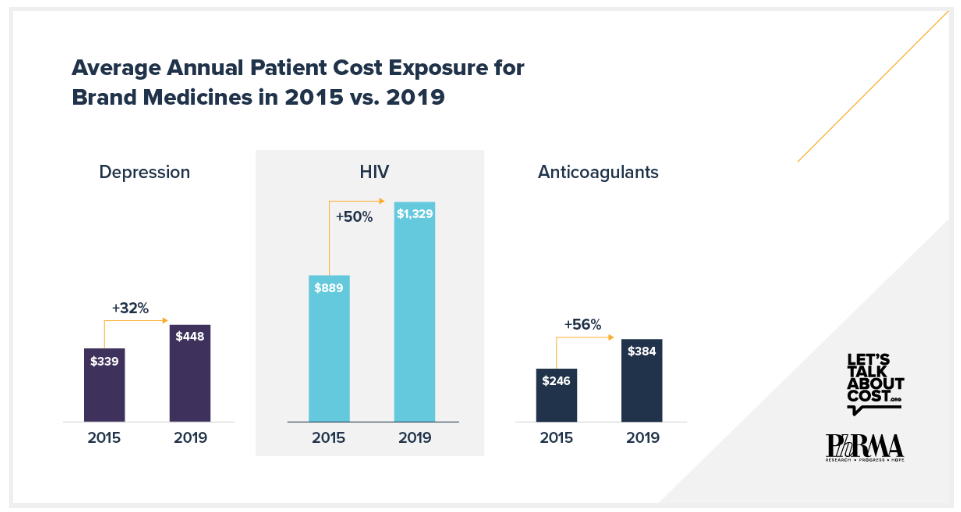

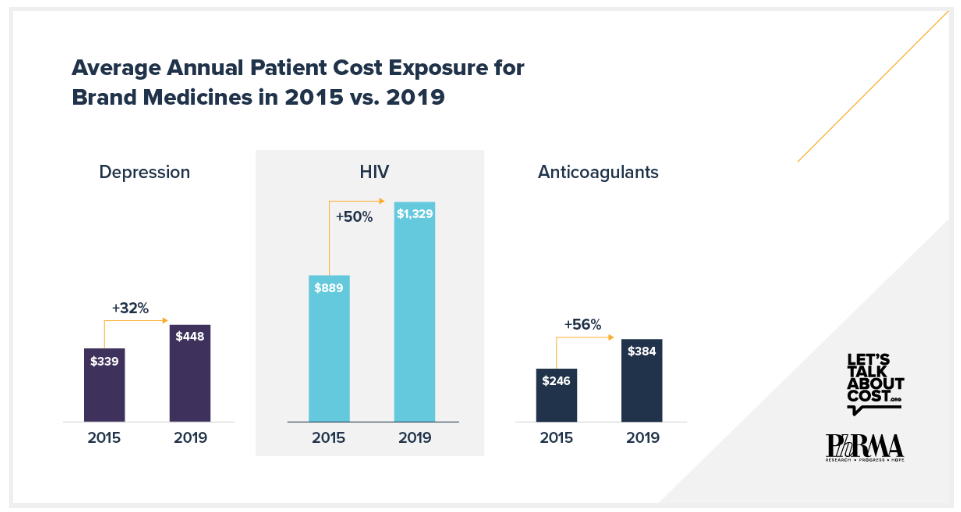

The IQVIA data also show that health plans have been exposing chronically ill patients to increasingly higher cost sharing for brand medicines. For example, between 2015 and 2019, the amount patients were required to pay at the pharmacy counter increased by 32% for brand depression medicines, 50% for brand HIV medicines and 56% for brand anticoagulants. In contrast, average net prices for brand medicines grew by less than 3% annually over that same time, in line with inflation.

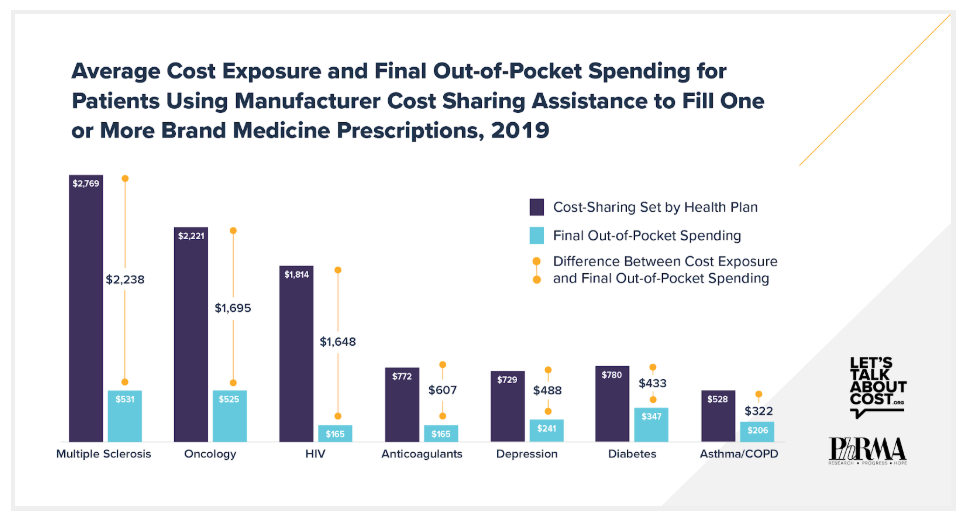

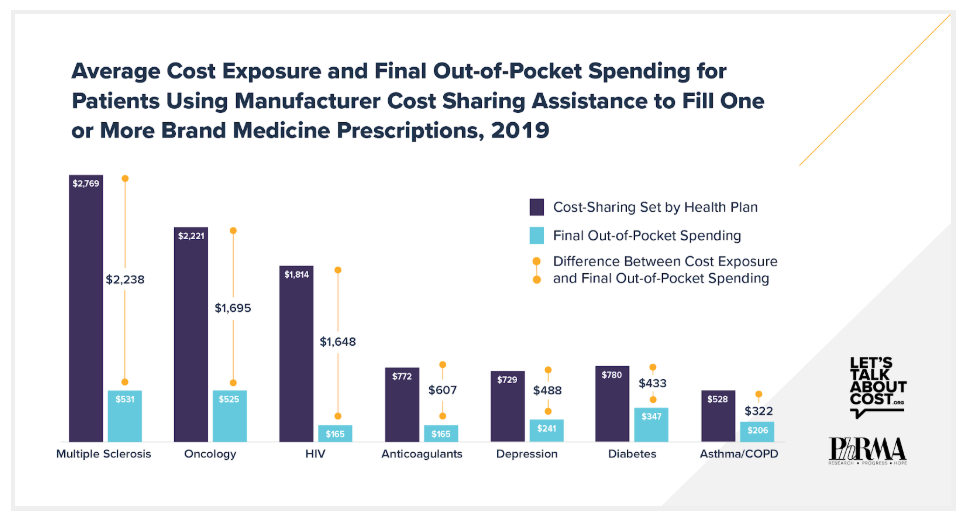

Often, biopharmaceutical companies offer cost-sharing assistance to help commercially insured patients afford these skyrocketing out-of-pocket costs. Across all seven therapeutic areas, manufacturer cost-sharing assistance helped an increasing share of patients pay their out-of-pocket costs. In 2019 alone, cost-sharing assistance helped patients with common, chronic conditions, like asthma/COPD, diabetes and depression, with up to nearly $500 toward their out-of-pocket costs. For more complex conditions like HIV, cancer and multiple sclerosis, manufacturer cost-sharing assistance saved patients between $1,600 and $2,200 on their out-of-pocket costs.

Importantly, data suggest that cost-sharing assistance is not encouraging patients to take brand medicines when generics are available. Prior research shows that just 0.4% of prescriptions filled using cost-sharing assistance are for brand medicines with a generic equivalent. By helping patients with their out-of-pocket costs, manufacturer cost-sharing assistance can help improve adherence to treatment and reduce the risk that patients will abandon their prescriptions at the pharmacy counter.

Unfortunately, a recent policy change from the Administration makes it harder for patients to have manufacturer cost-sharing assistance help them at the pharmacy counter. The change allows commercial market health plans to refuse to count cost-sharing assistance toward patient out-of-pocket caps. Additionally, the Administration is considering further changes related to Medicaid that would make it more difficult for manufacturers to offer assistance. Both of these changes are the wrong approach for Americans.

We should be helping patients afford their medicines, not making it harder.

View the full analysis and learn more at LetsTalkAboutCost.org.