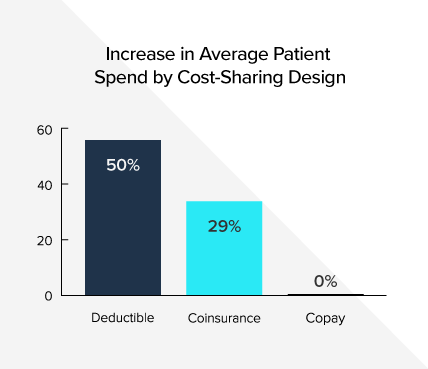

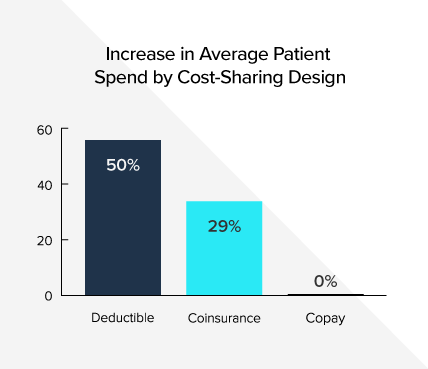

Spending on medicines is growing at the slowest rate in years, but according to a new IQVIA Institute for Human Data Science article, at the pharmacy, commercially insured patients with a deductible have seen their out-of-pocket costs for brand medicines increase 50 percent since 2014. The data also show 55 percent of patients’ out-of-pocket spending on brand medicines in 2017 was for prescriptions filled in the deductible or with coinsurance rather than with a fixed copay. This share has increased 20 percent since 2013 as insurers are increasingly shifting more and more of the costs of medicines to patients.

Change in Average Patient Out-of-Pocket Spend by Cost-Sharing Design, Commercial Market, Brand Drugs, 2014-2017

Share of Commercially Insured Patient Out-of-Pocket Spend for Brand Medicines by Cost-Sharing Design

Even though rebates paid by biopharmaceutical companies often substantially reduce what insurers and pharmacy benefit managers (PBMs) pay for medicines, insurers typically use list prices—rather than discounted prices—to determine how much to charge patients with deductibles and coinsurance. Unlike care received at an in-network hospital or physician’s office, negotiated discounts for medicines are usually not shared with patients with deductibles or coinsurance. Sharing rebates with patients at the pharmacy could save certain commercially insured patients with high deductibles and coinsurance $145 to more than $800 annually, according to a recent analysis from Milliman. Patients with chronic conditions are disproportionately impacted by high out-of-pocket costs.

To help many commercially insured patients afford these out-of-pocket costs, biopharmaceutical companies offer copay coupons for some medicines. Unfortunately, insurers and PBMs are increasingly using copay accumulator programs to block these coupons from being applied to deductibles and out-of-pocket maximums. These programs can result in patients facing thousands of dollars in unexpected costs and many patients may leave the pharmacy empty-handed.

To learn more, visit www.LetsTalkAboutCost.org.