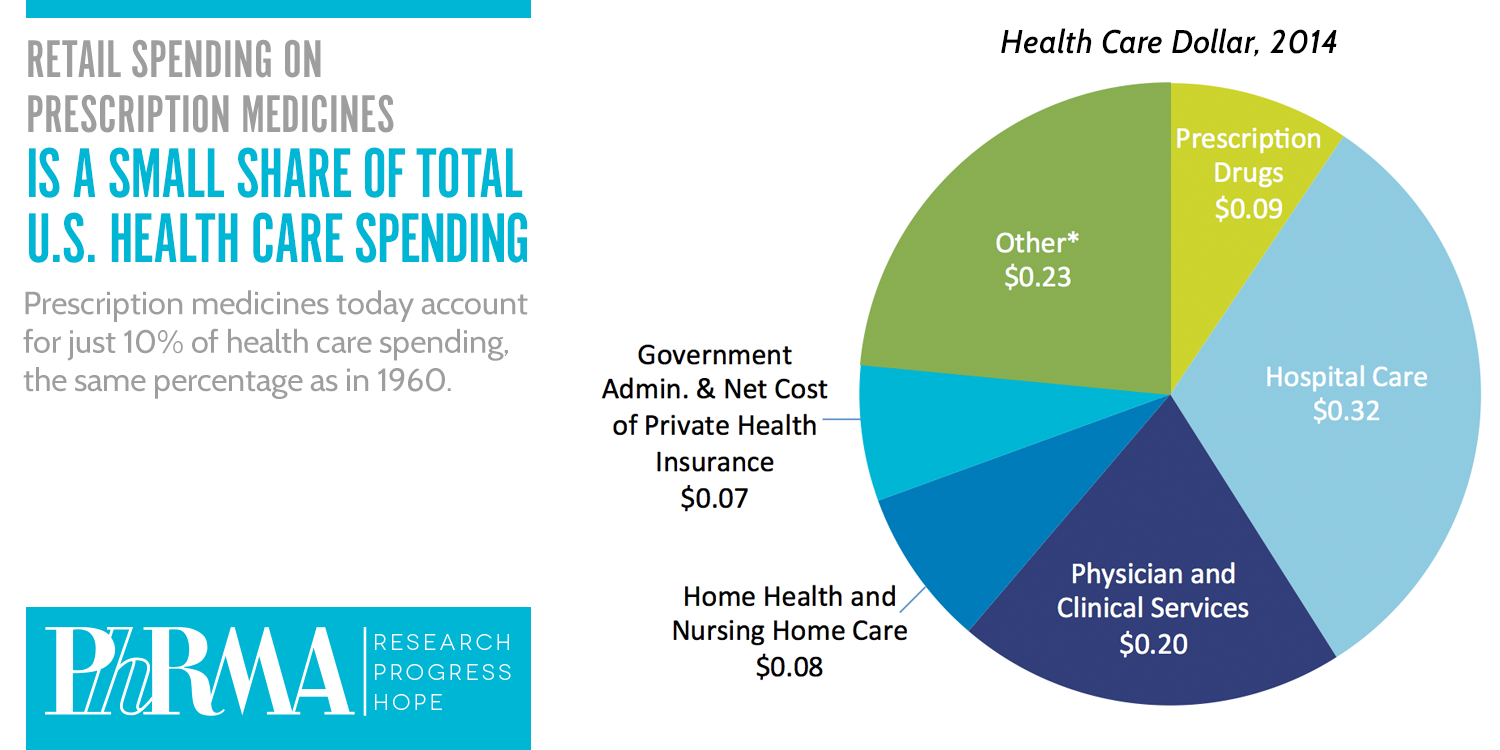

In case you missed it, a Wall Street Journal article this morning explored pricing trends in the biopharmaceutical industry. In the piece, the authors correctly stated that spending on retail prescription medicines accounts for just 10 percent of U.S. health care spending and noted the “impact on total health care spending has been limited” because once patents end, brand medicines then face competition from lower-cost generics. But the following three points are also important to consider when discussing spending on prescription medicines.

- The average wholesale price (AWP) or “list price” of a medicine is not a true representation of actual market prices. The AWP or “list price” is not an accurate representation of actual market prices because it does not include discounts or rebates and is rarely what is actually paid. In fact, recent published estimates of rebates paid by manufacturers put the total at $40 billion per year.

- Competition among brand-name medicines helps to control costs even before the introduction of lower-cost generics. Companies developing medicines race to be first to the market. It is a race because – in most cases – medicines from competitors are already in development. As we saw with recent activity in the hepatitis C market, this race can close quickly. In fact, on average, there is competition from another brand name medicine in less than two years. Once these patents end, brand medicines then face additional competition from lower-cost generics.

- Insurers and pharmacy benefit managers aggressively negotiate the prices of medicines. Medicines are purchased in a uniquely competitive market, where concentrated purchasers use more aggressive cost containment tools than for other parts of the U.S. health care system. In fact, Express Scripts has publicly stated it will save the U.S. $4 billion annually as a result of its aggressive negotiations for hepatitis C medicines.