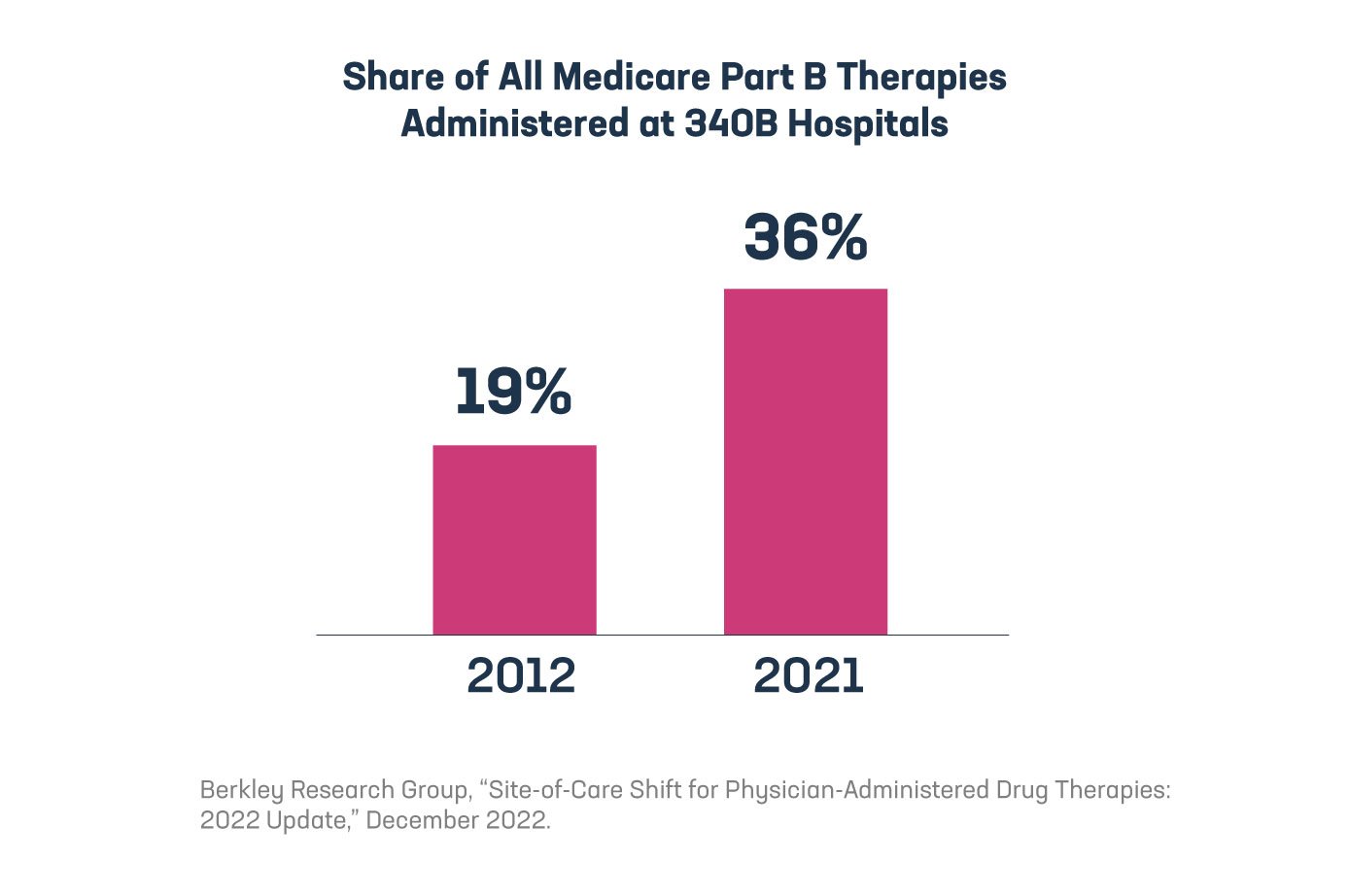

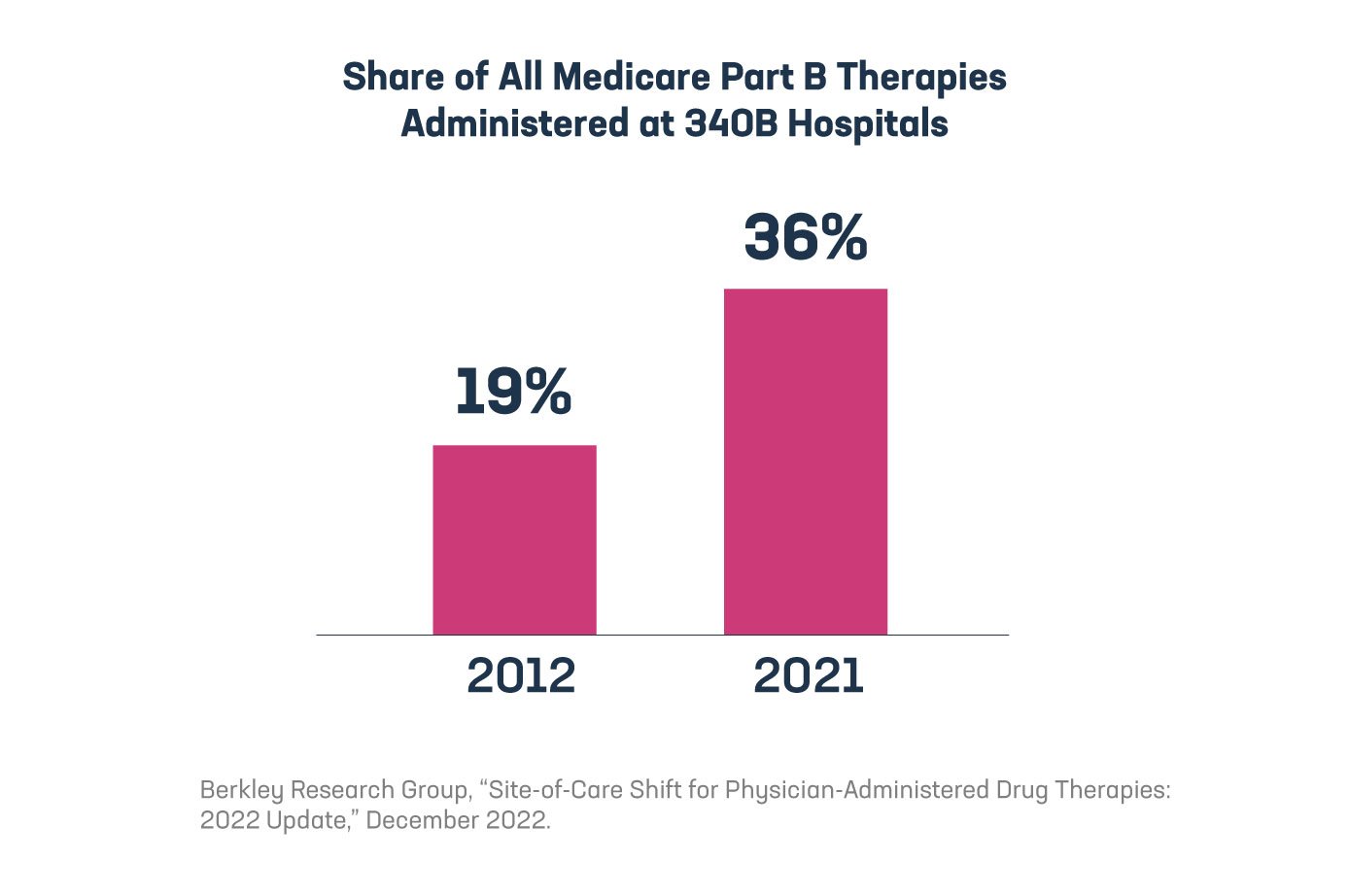

Yet another study highlights the unintended consequences of the 340B program, which is increasing costs for patients and the health care system as a whole. In this case, the Berkeley Research Group (BRG) found that nearly 36% of all Medicare Part B therapy sales occurred at 340B hospitals in 2021, up nearly 17 percentage points since 2012, meaning care is moving from physician offices and non-340B hospitals to 340B hospitals. Given that 340B hospitals mark up the price of medicines significantly more than physician offices, this shift in site of care is driving up costs for the entire system.

BRG identified the top 10 medicines by Part B sales in three different disease areas to take a closer look at this trend.

- For breast cancer medicines in this study, the share of Part B sales occurring at 340B hospitals nearly doubled since 2012, reaching 45% of sales in 2021.

- Similarly, nearly 20% of Part B multiple myeloma medicine sales occurred at 340B hospitals in 2012, and that share has since jumped to over 46% as of 2021.

- In 2012, 14% of the rheumatoid arthritis drug sales in Part B were at 340B hospitals, which increased to over 20% in 2021.

Consumers and payers end up paying for an estimated 27% of the profits 340B covered entities generate – through higher insurance premiums and higher prices for cash-paying and uninsured patients. These higher premiums and higher prices are tied, at least in part, to hospitals significantly marking up the price of medicines compared to physician offices. Hospitals’ practice of significantly marking up medicine prices creates strong incentives for 340B hospitals to acquire physician offices and turn them into 340B-eligible hospital outpatient departments. The net effect of these acquisitions can leave patients with fewer community-based provider options and push patients into higher cost hospital-based settings.

Another alarming trend impacting patient costs has been found in the commercial market. A recent study found that among all commercially insured patients receiving outpatient care, meaning those who received medicines and those who did not, average per-patient spending on outpatient medicines was more than two and a half times higher at 340B disproportionate share hospitals (DSH) hospitals than at non-340B DSH hospitals. According to the study, a key driver of this increased spending is that 340B DSH hospitals prescribe patients more expensive medicines. This analysis also found that the average cost per prescription for a patient receiving care at 340B DSH hospitals was more than 150% greater than the average cost per prescription at non-340B hospitals.

When taking a holistic look at our health care system and areas that are impacting patient costs, the 340B program cannot be overlooked. There is clear evidence that 340B-driven consolidation and prescribing practices of 340B hospitals are contributing to higher patient costs and negatively impacting the entire health care system.

Learn more at PhRMA.org/340B and read the full analysis from BRG here.