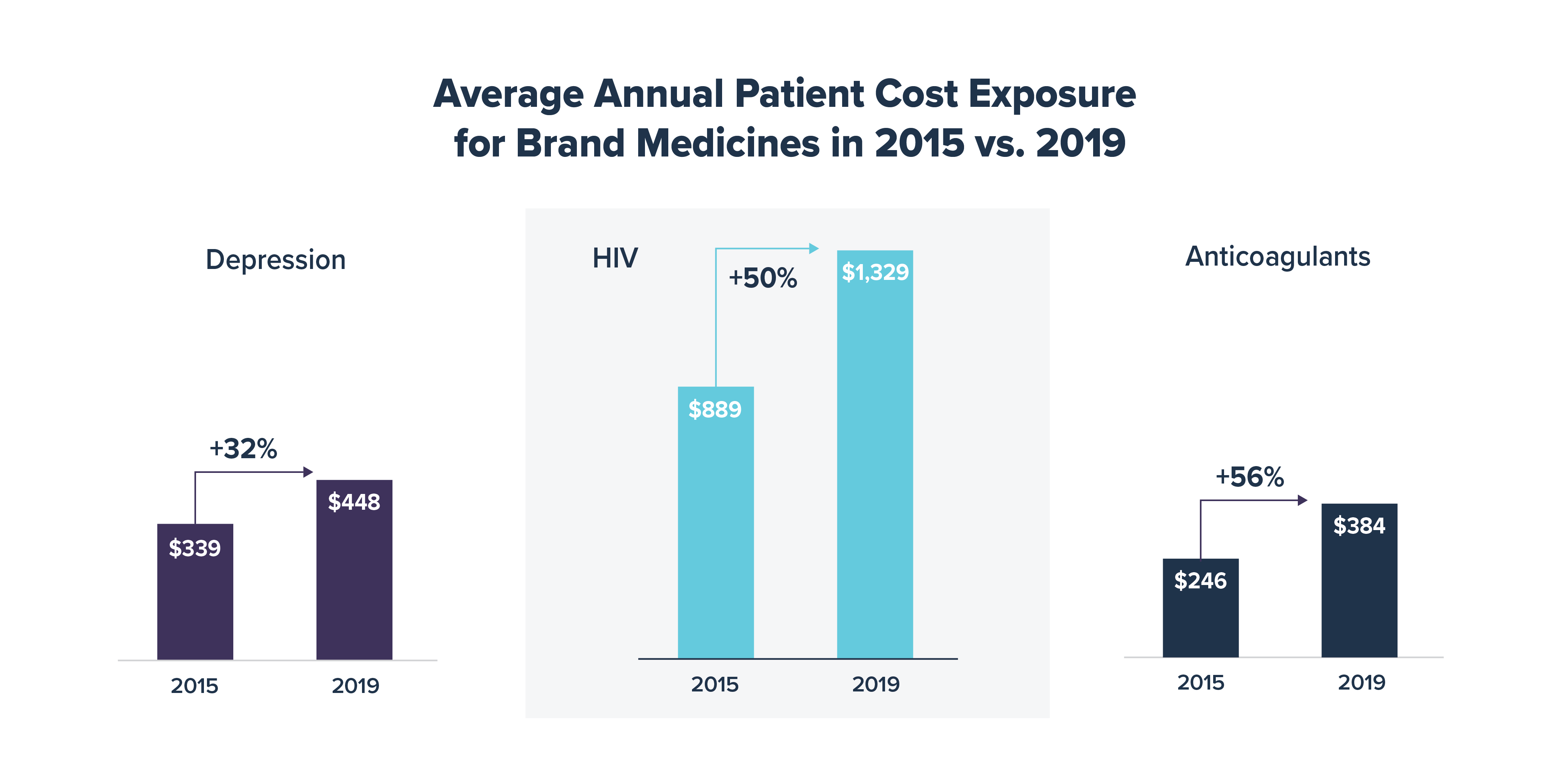

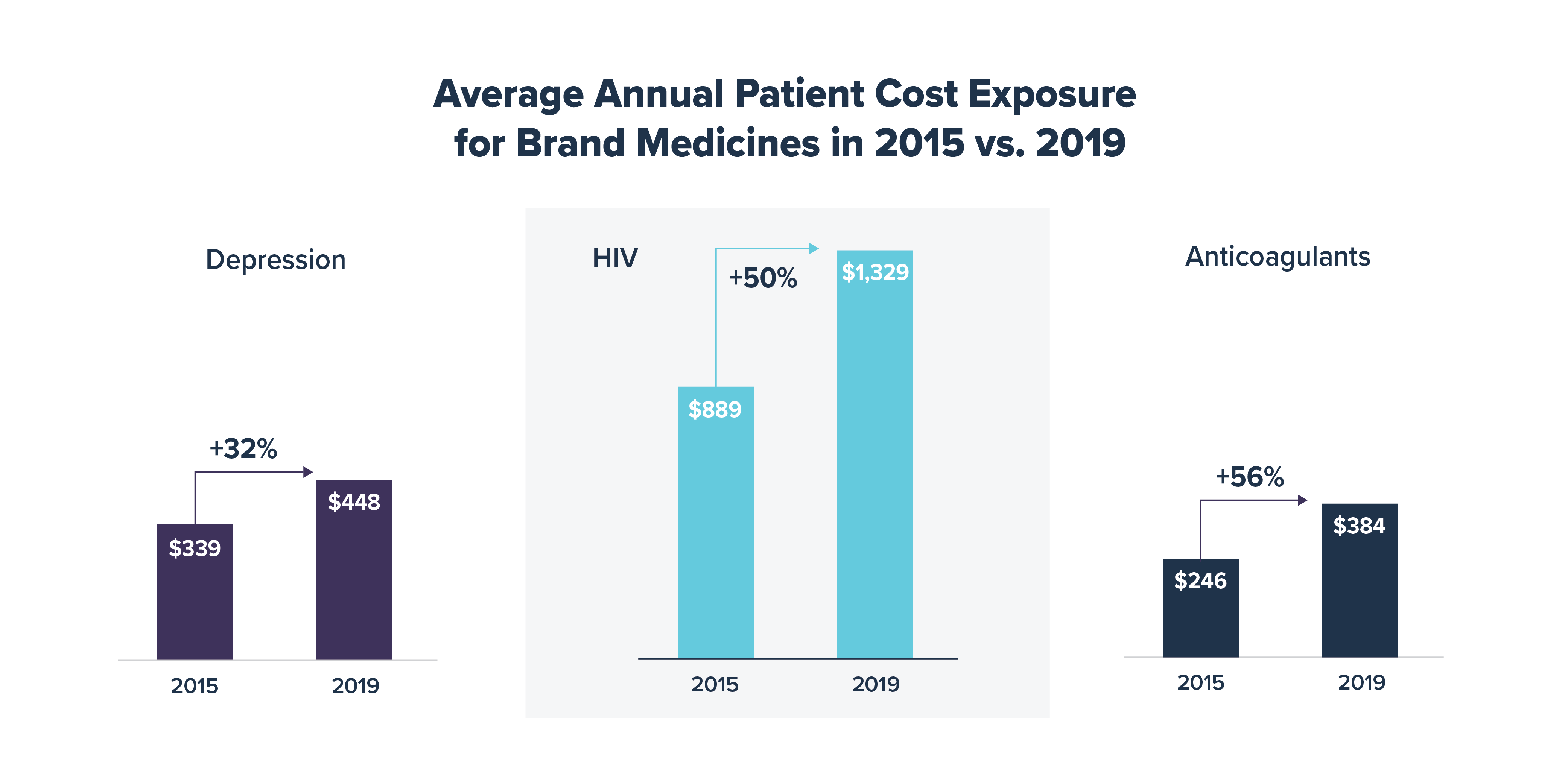

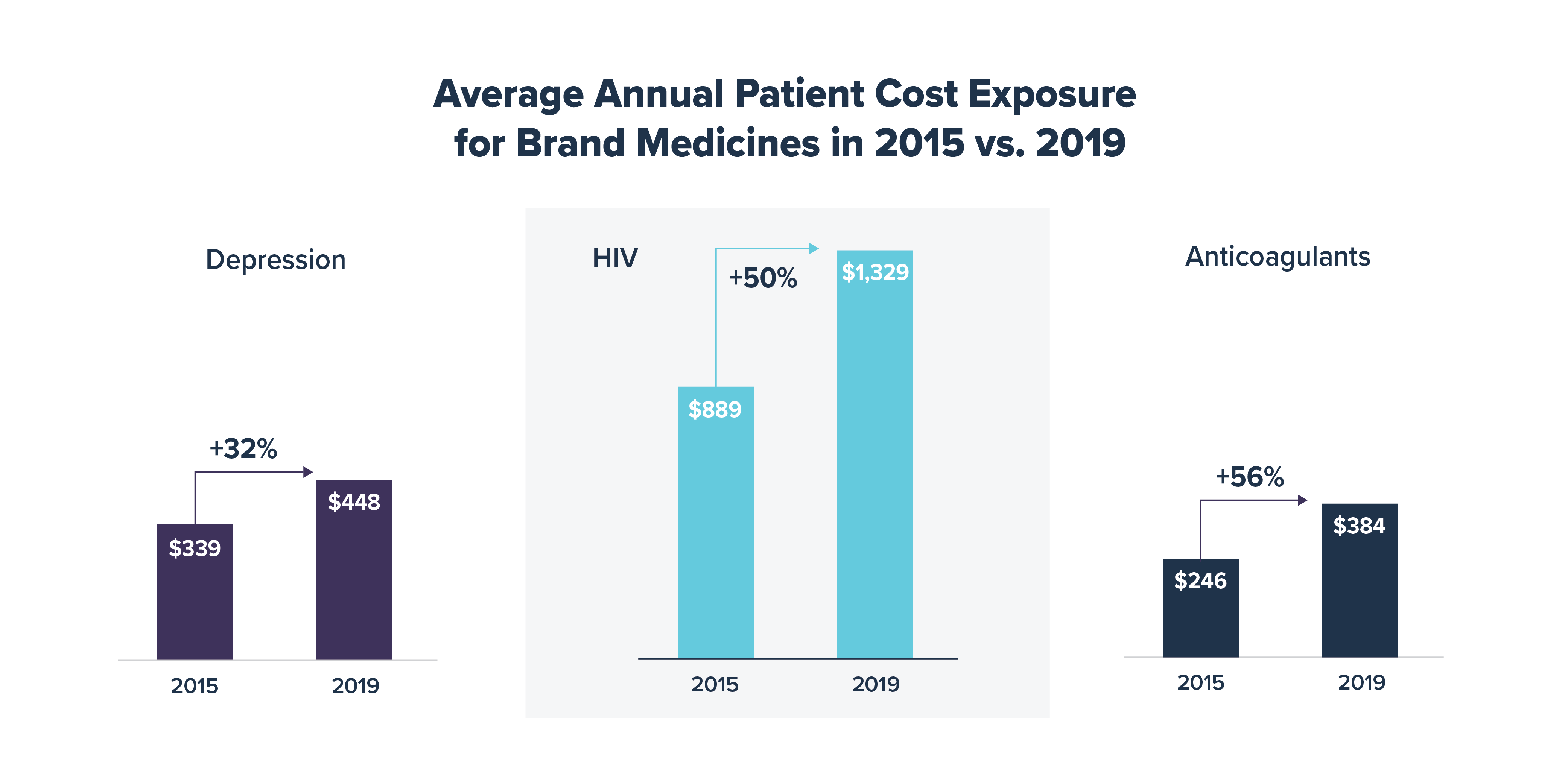

According to a recent IQVIA analysis, commercial health plans have increased patients’ average out-of-pocket costs for brand medicines by over 50% in some therapeutic areas since 2015. Notably, of the seven therapeutic areas that IQVIA analyzed, including anticoagulants, asthma/COPD, depression, diabetes, HIV, multiple sclerosis and oncology treatments, average patient cost exposure between 2015 and 2019 saw a 32% increase for depression, a 50% increase for HIV and a 56% increase for anticoagulants. Cost exposure represents the level of cost sharing patients would have paid out of pocket if financial assistance, like manufacturer cost-sharing assistance, had not been available.

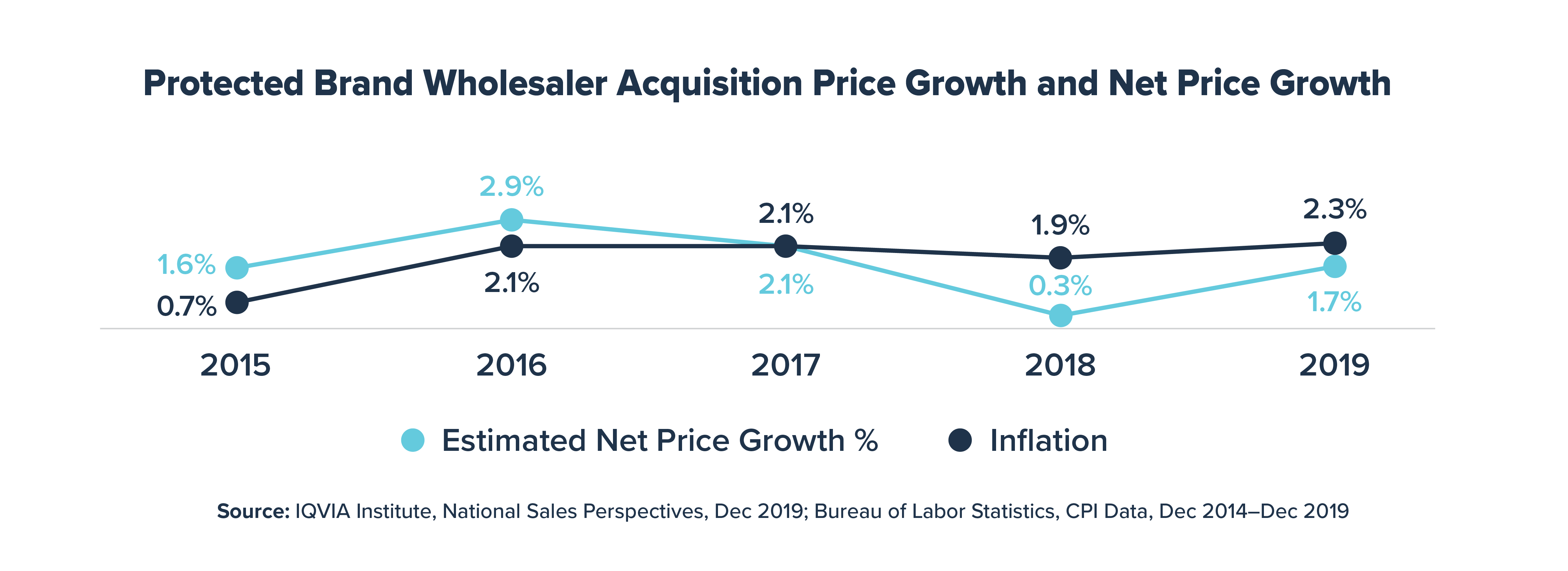

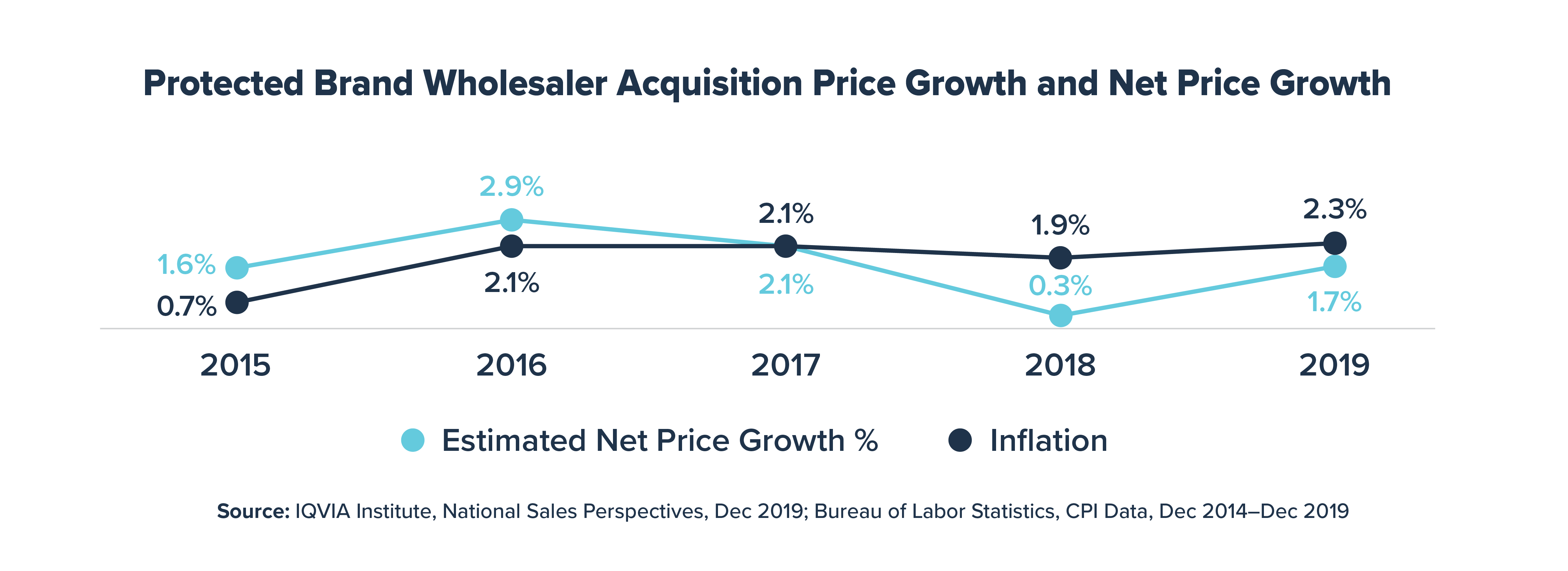

Over this same period, while health plans were exposing chronically ill patients to increasingly higher cost sharing for brand medicines, average net prices for brand medicines grew by less than 3% annually, which was in line with or below the inflation rate.

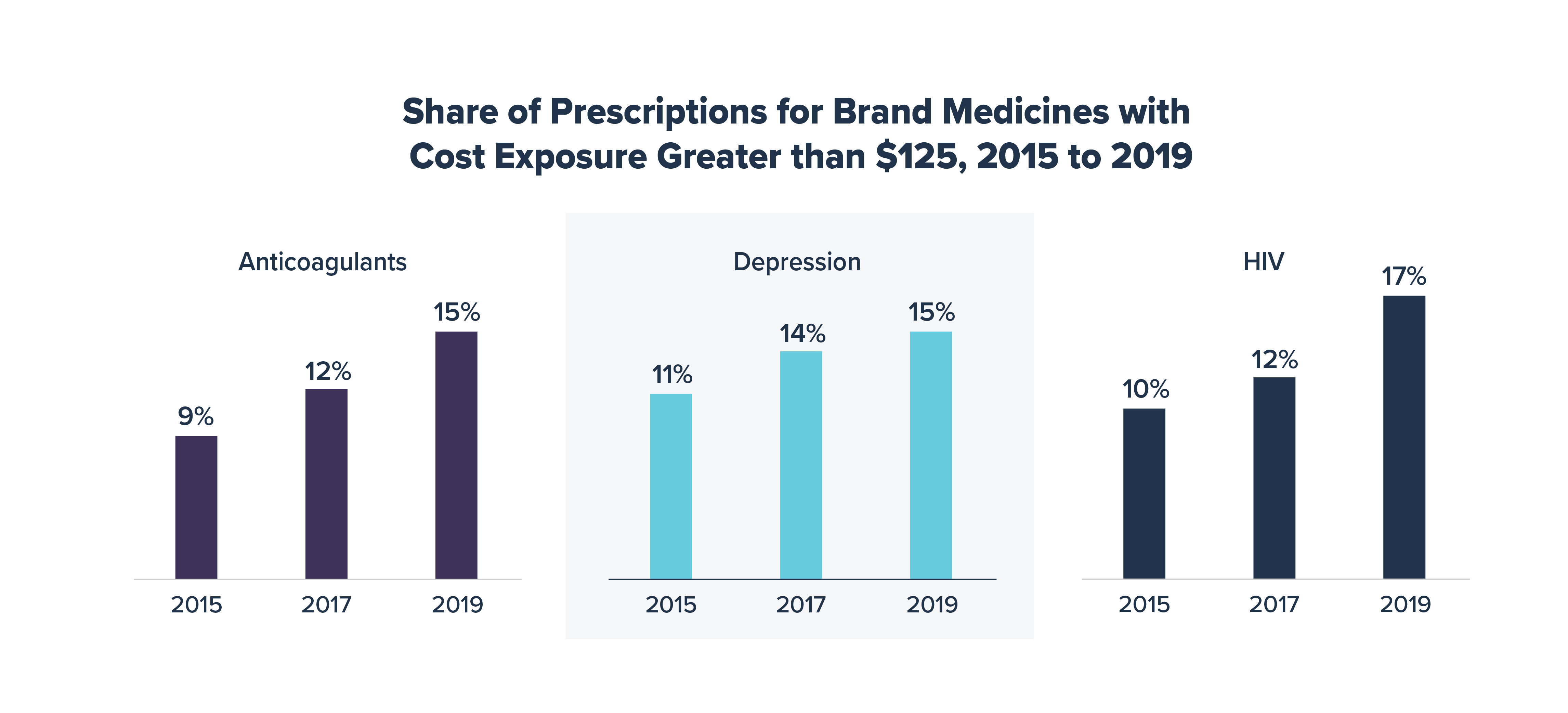

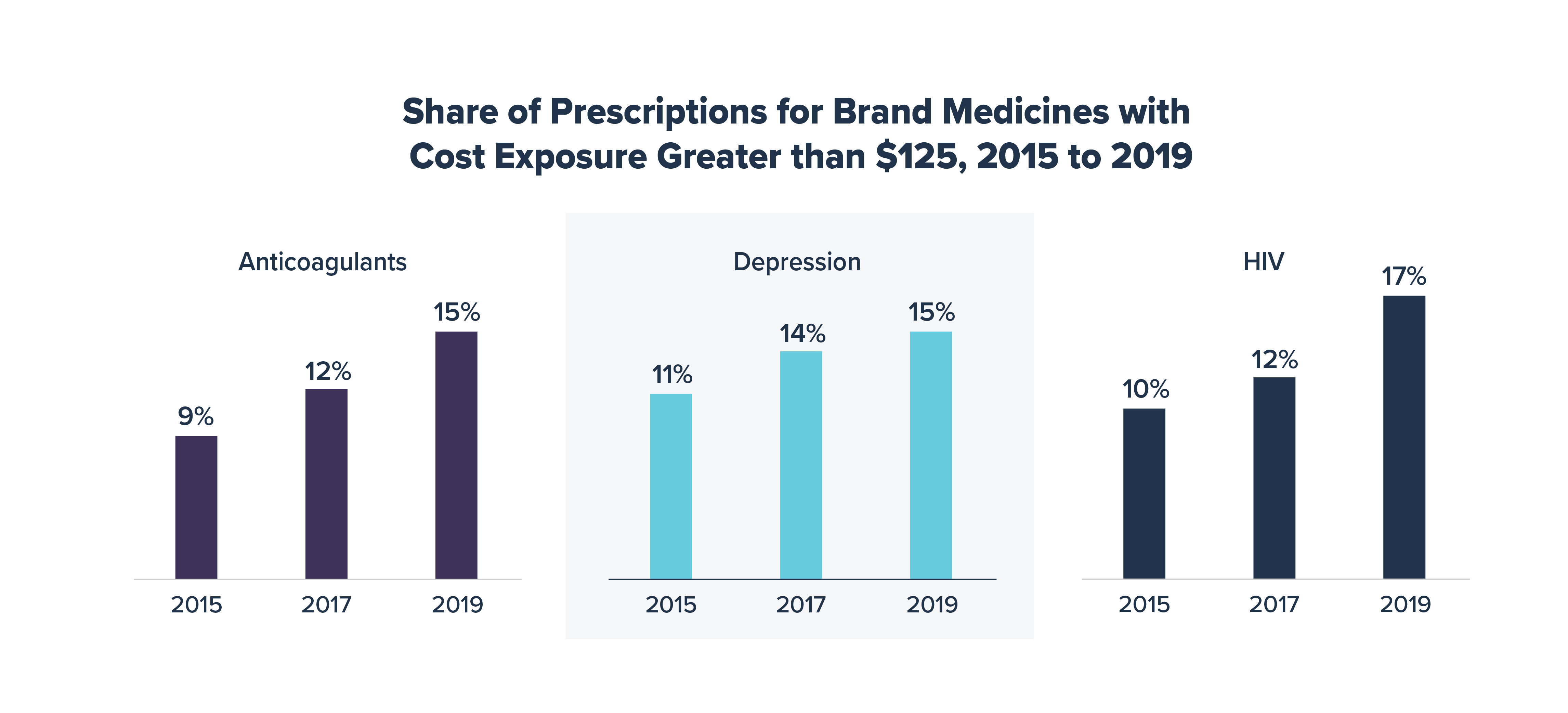

IQVIA’s analysis also shows that in 2019, health plans required cost sharing of $125 or greater for nearly one in six prescriptions for brand medicines to treat HIV and depression as well as anticoagulants, up from 1 in 10 prescriptions in 2015. Over time, increased exposure to high out-of-pocket costs for these medicines likely resulted in more patients walking away from the pharmacy counter empty handed.

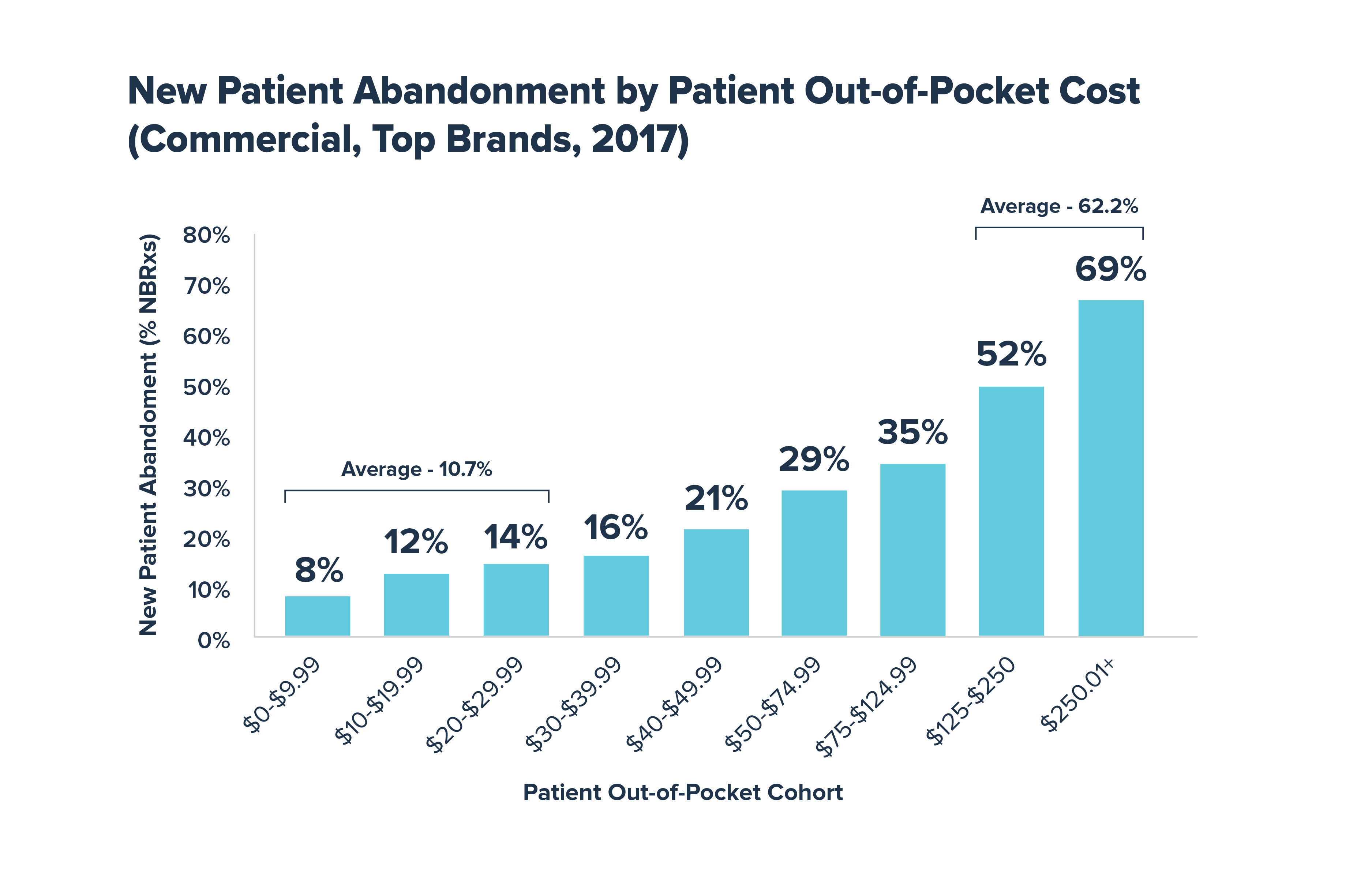

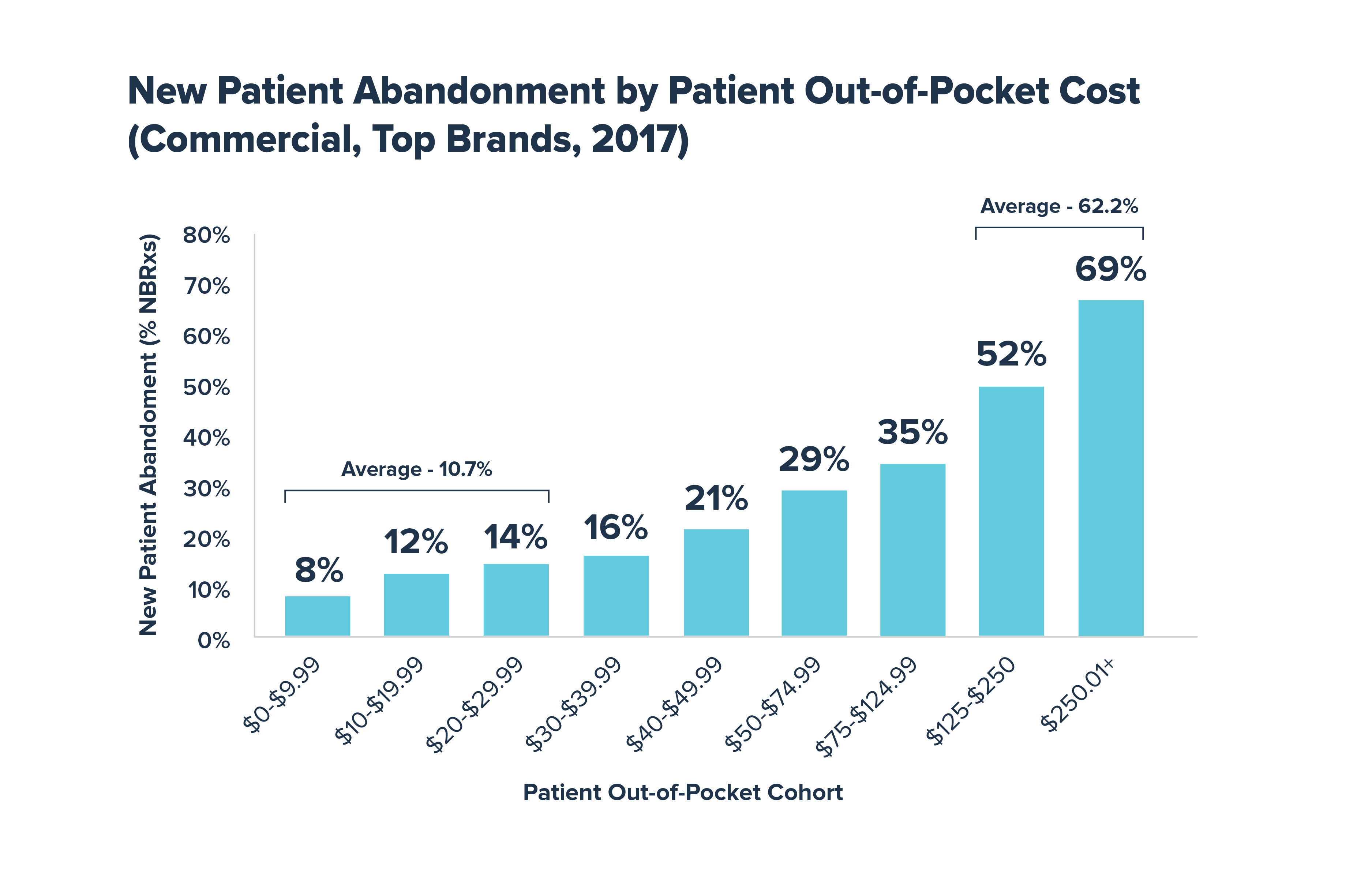

It is well documented that high out-of-pocket costs can lead to medication abandonment and non-adherence, which can result in poor health outcomes. Prior research from IQVIA shows that more than 62% of new prescriptions that cost patients $125 or more out of pocket are abandoned at the pharmacy counter. In contrast, fewer than 11% of new prescriptions are abandoned when out-of-pocket costs are less than $30.

Although health plans and pharmacy benefit managers often negotiate large rebates on brand medicines that significantly reduce what the health plan pays, patients with deductibles and coinsurance do not always benefit from these savings and typically must pay cost sharing based on the full undiscounted prices. Instead of punishing patients with chronic diseases and subjecting them to high out-of-pocket costs, plans should share these rebates and discounts directly with patients at the pharmacy counter.

Learn more at LetsTalkAboutCost.org.