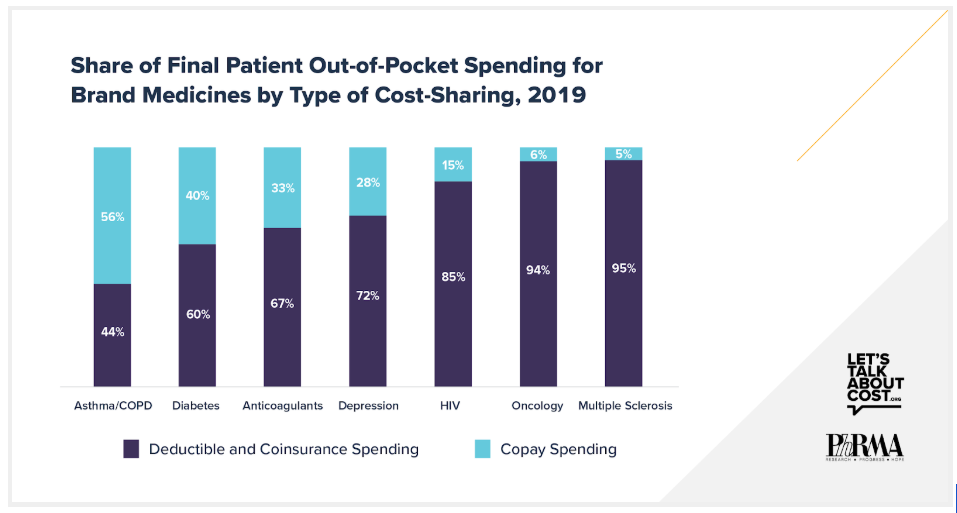

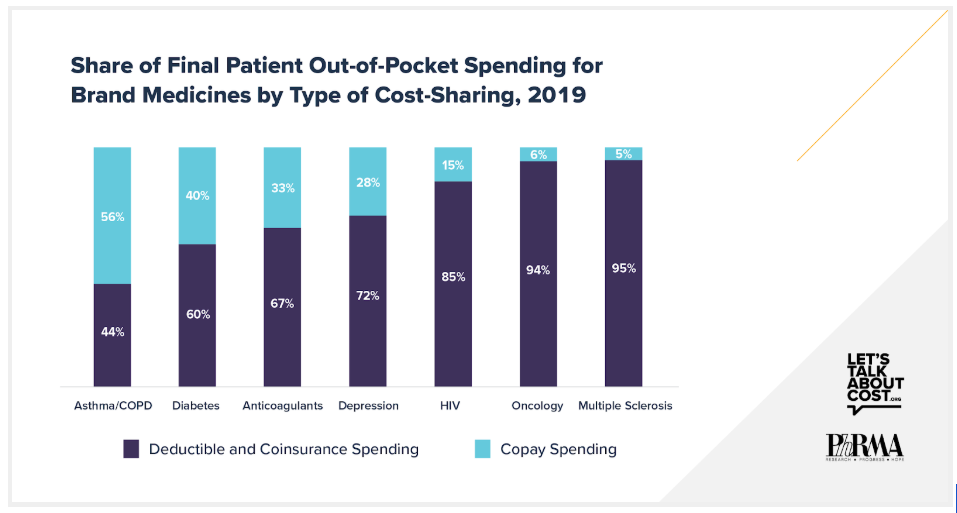

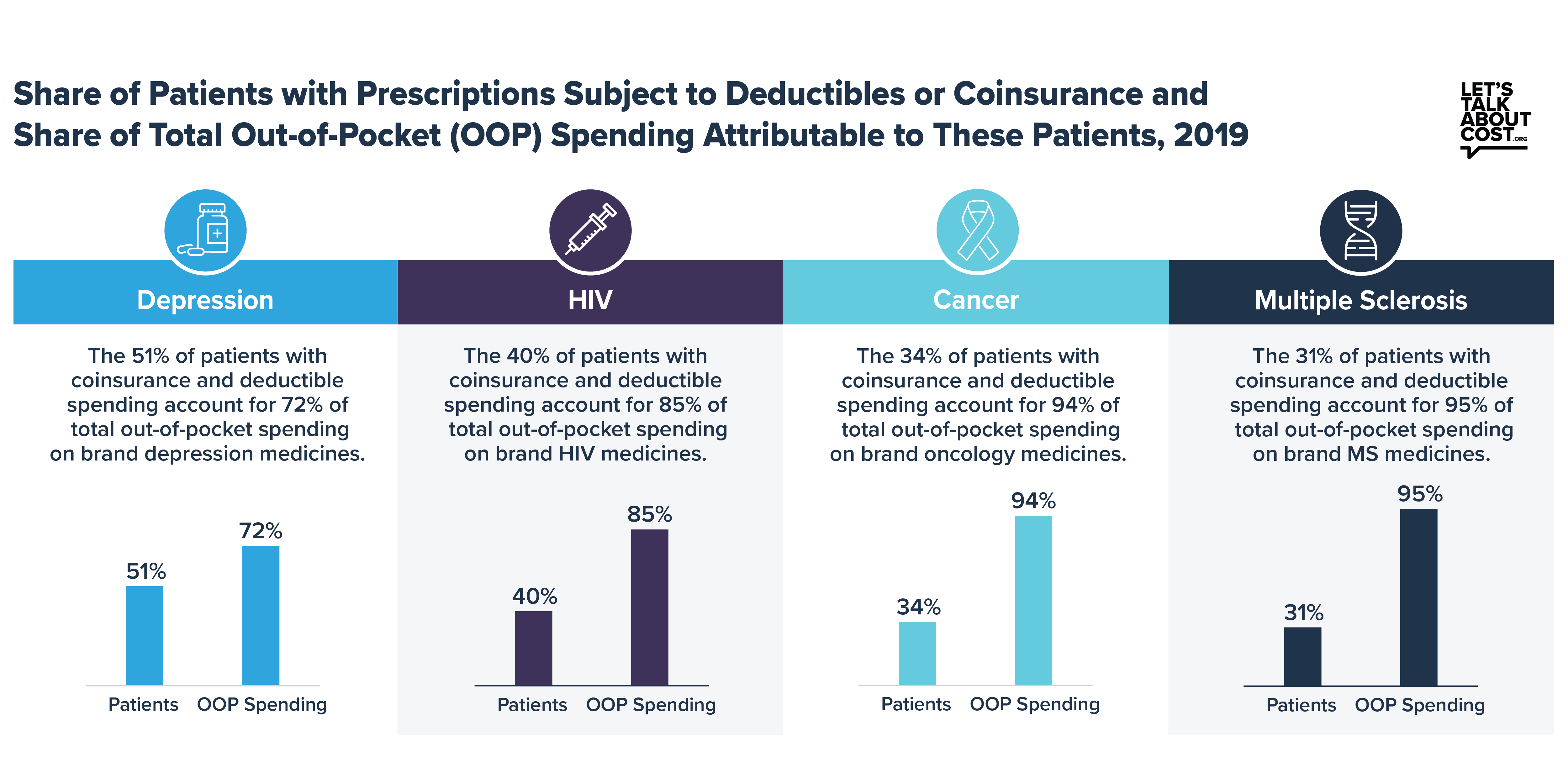

A decade ago, most patients paid only copays for brand medicines. But in recent years, use of deductibles and coinsurance in commercial health plans has skyrocketed. According to a recent IQVIA analysis, commercially-insured patients now pay most of their out-of-pocket spending for brand medicines in the form of deductibles and coinsurance. For five of seven therapeutic areas examined by IQVIA, deductible and coinsurance spending accounted for more than two-thirds of patients’ total out-of-pocket spending. For two therapeutic areas, oncology and multiple sclerosis, deductibles and coinsurance accounted for more than 90%.

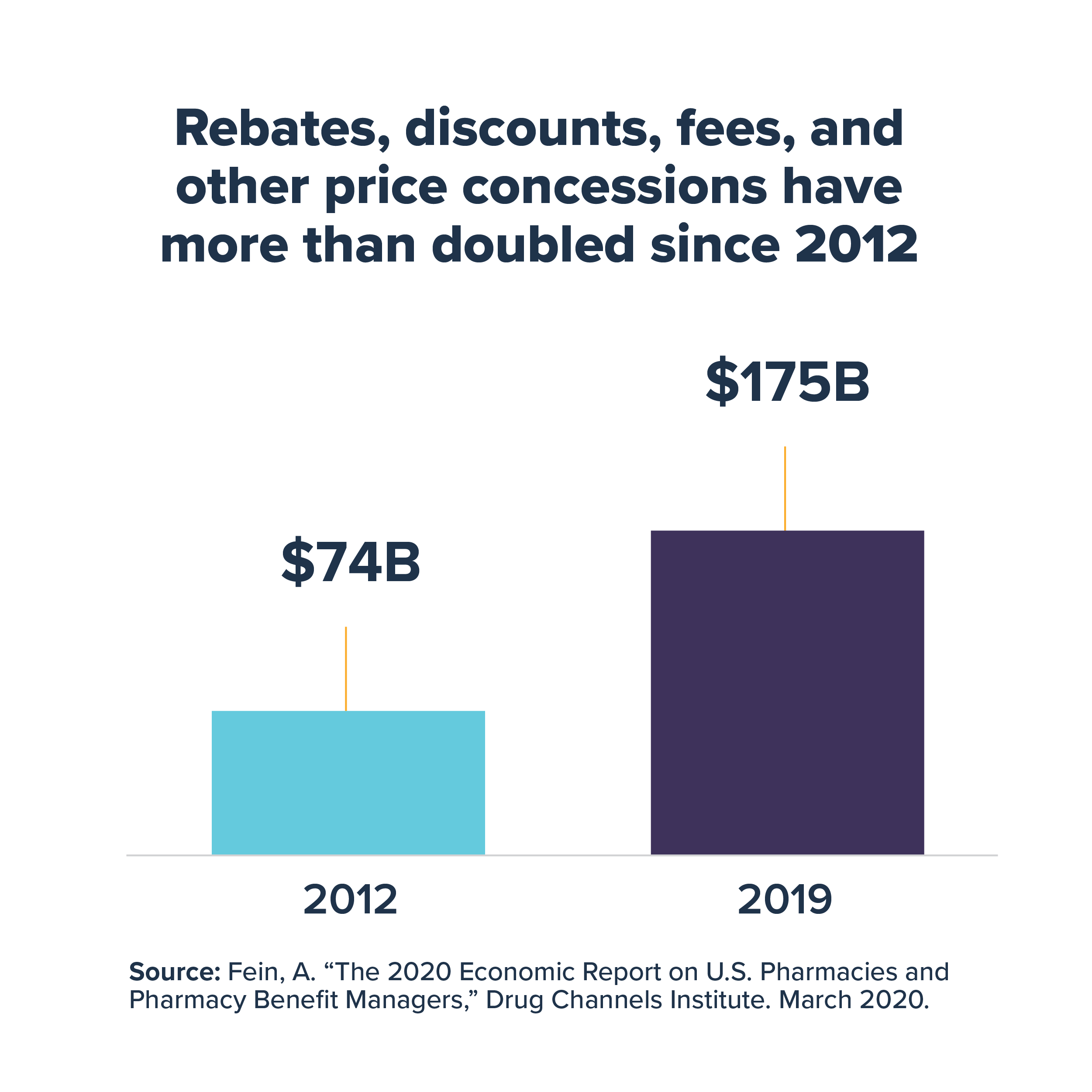

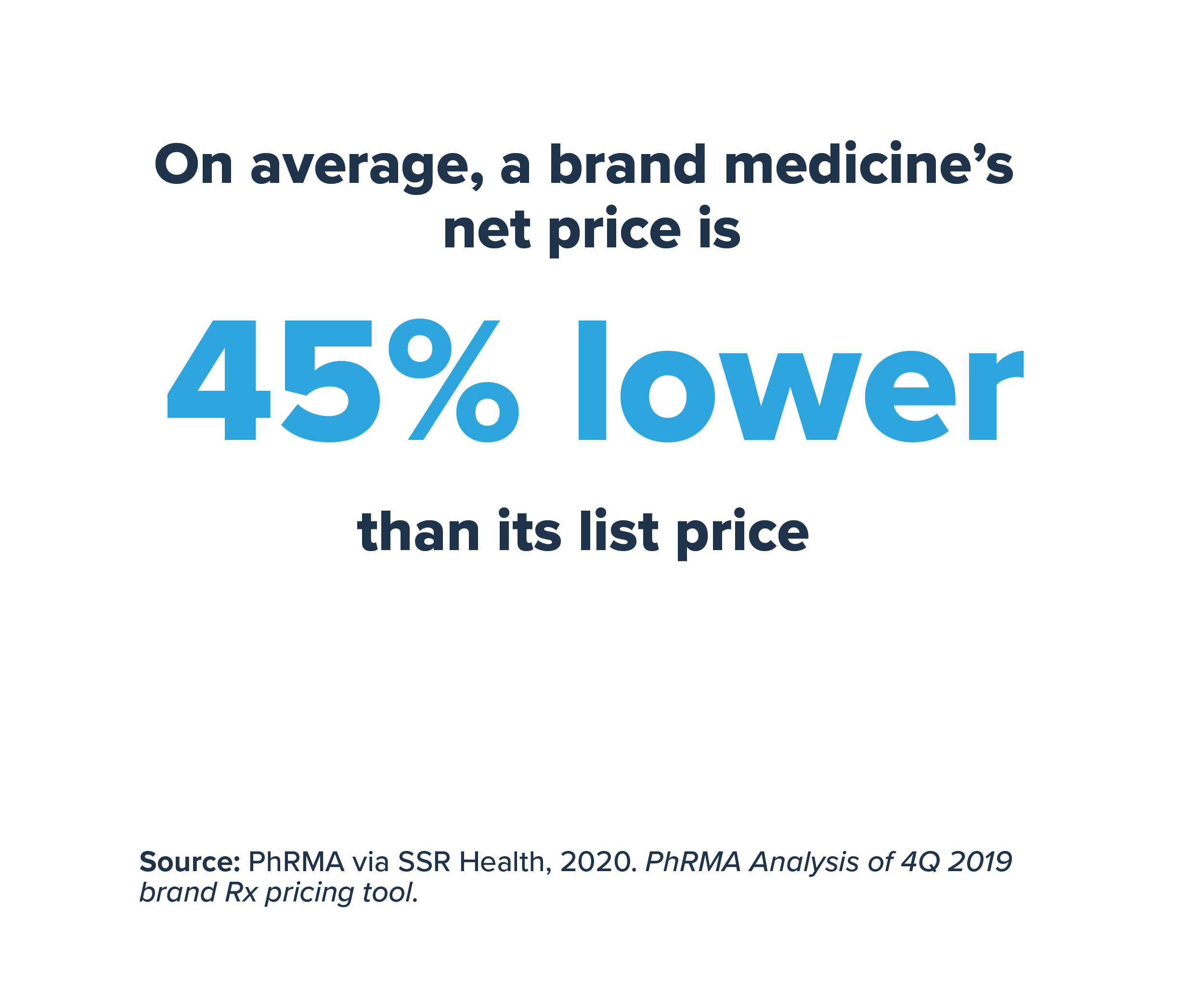

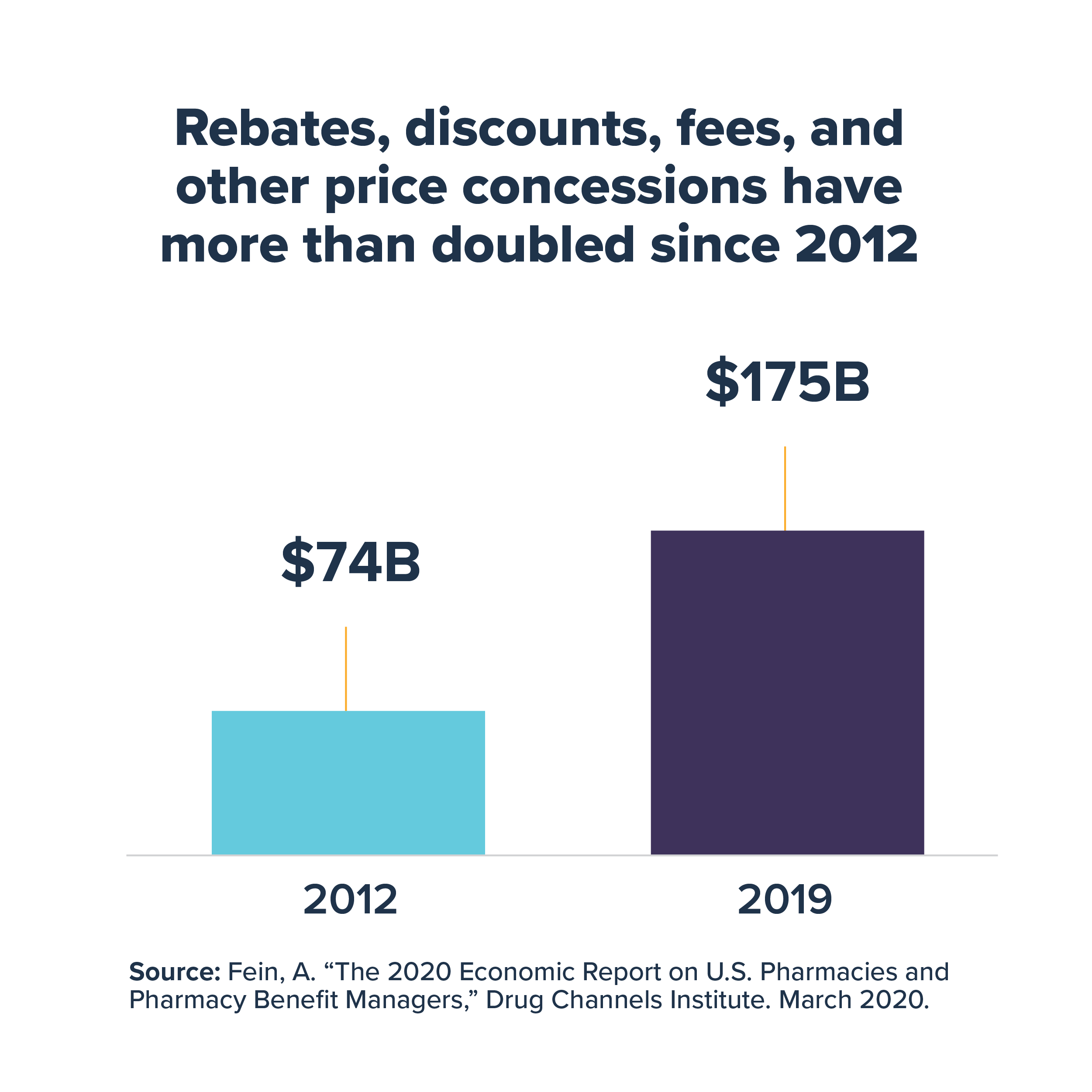

Although health plans and pharmacy benefit managers (PBMs) often negotiate large rebates from biopharmaceutical companies that significantly reduce the prices of brand medicines, patients with deductibles and coinsurance typically do not directly benefit from these savings and must pay cost sharing based on the full undiscounted prices. In 2019, these rebates and discounts paid to health plans, PBMs, the government and others totaled $175 billion and reduced the price of brand medicine by 45%, on average, compared to list price. Because health plans typically do not factor in these significant savings when calculating the deductible and coinsurance amounts patients must pay, out-of-pocket costs for these patients can be significantly higher than they otherwise would be if based on the discounted cost of the medicine.

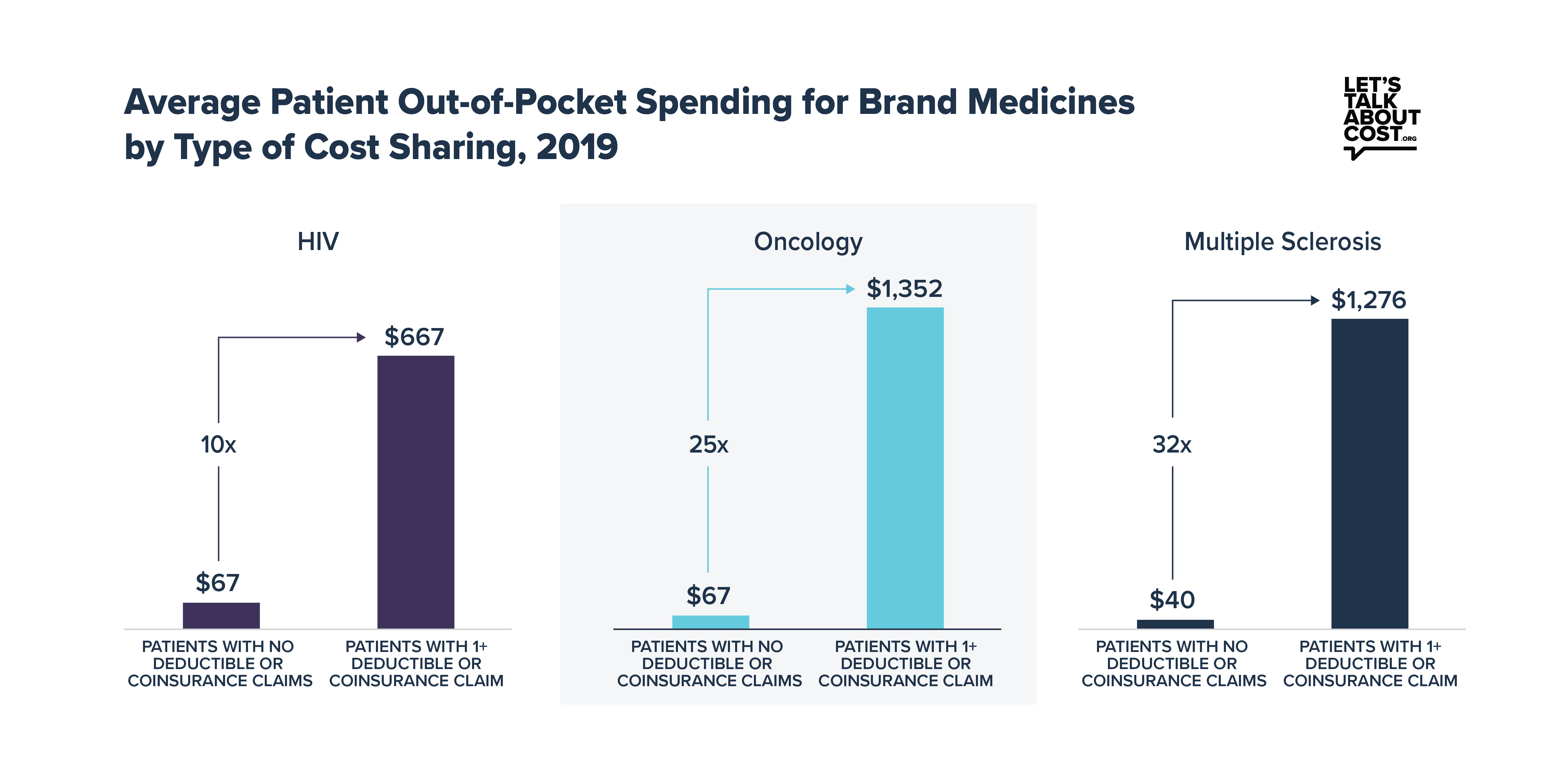

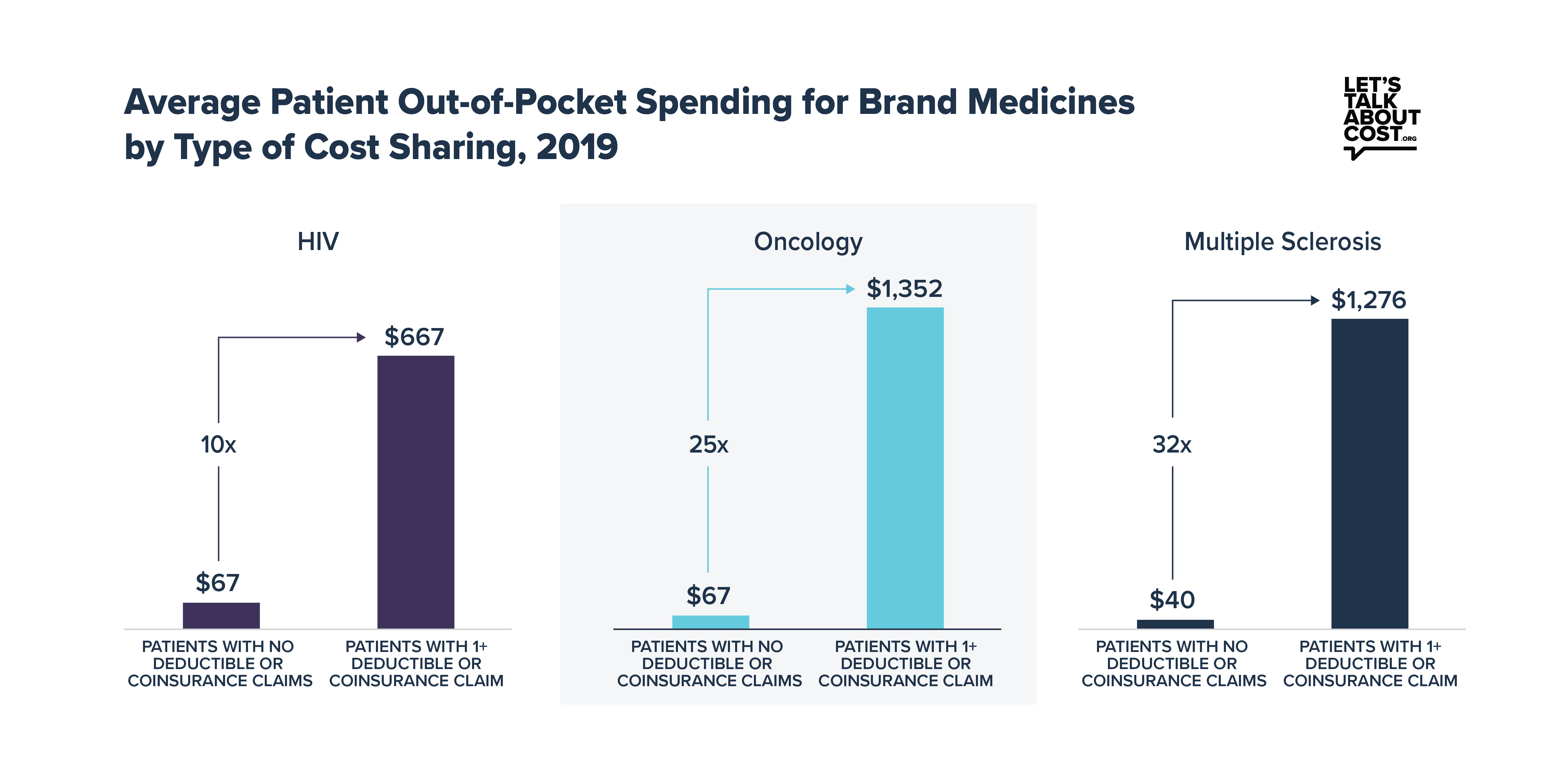

Deductibles and coinsurance clearly drive high out-of-pocket costs for patients taking brand medicines. Across the seven therapeutic areas in the IQVIA analysis, patients with deductibles or coinsurance paid as much as 25 or 30 times more out of pocket annually for brand medicines than patients with copays only. The increasing use of deductibles and coinsurance by health plans disproportionately burdens patients with chronic conditions who are prescribed brand medicines, who are often some of the most vulnerable in the health system.

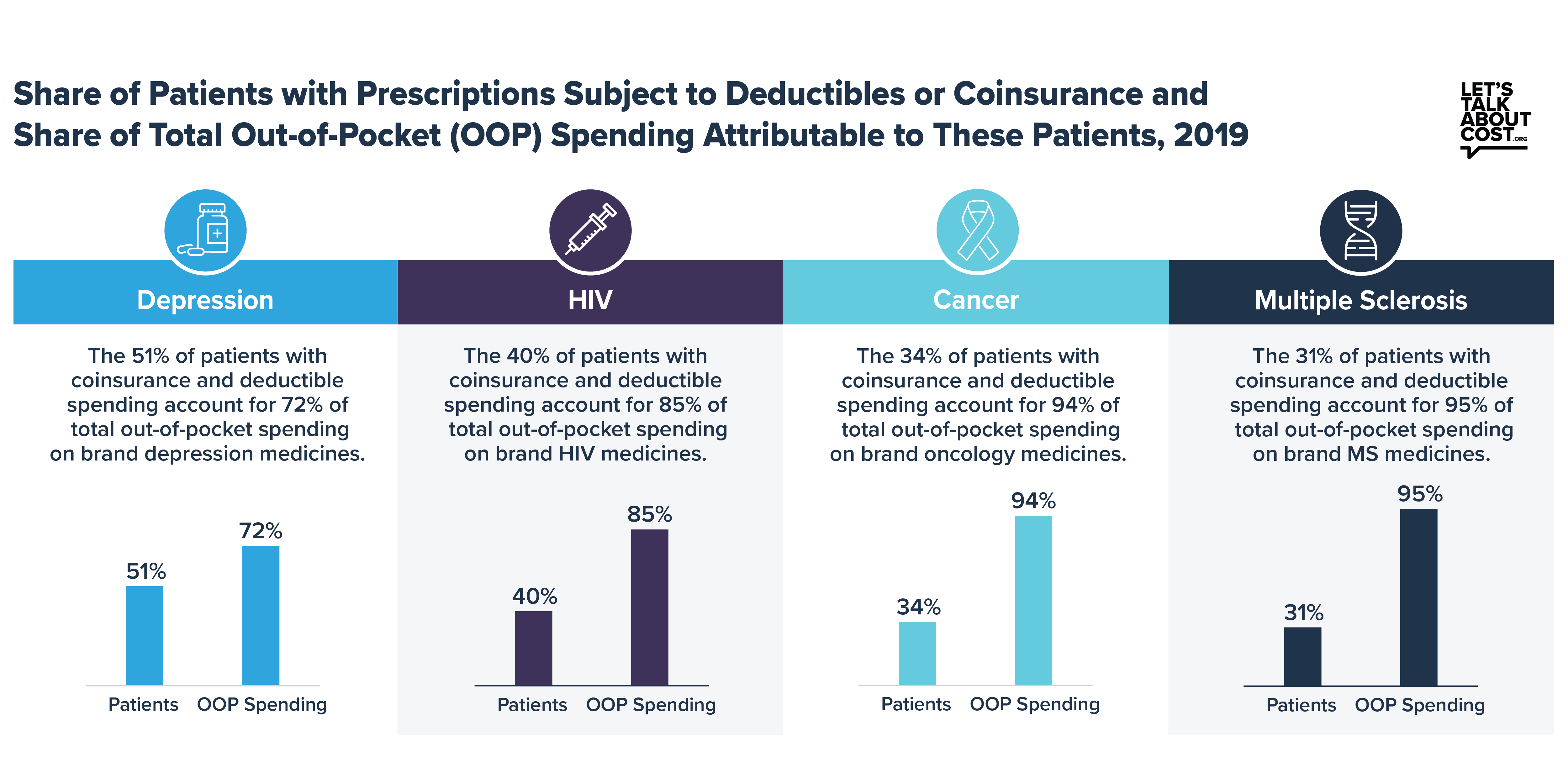

The IQVIA analysis also shows that out-of-pocket spending for brand medicines is heavily concentrated among the subset of patients who fill prescriptions in the deductible or are required to pay coinsurance. For example, fewer than one-third of patients taking brand medicines to treat multiple sclerosis were subject to deductibles or coinsurance, but that same subset of patients accounted for 95% of total out-of-pocket spending on brand multiple sclerosis medicines. It is clear they are being disproportionately burdened by health plans’ current system.

Health plans’ increasing use of coinsurance and deductibles has unfairly shifted the cost of care onto patients with chronic conditions best managed with brand medicines. One solution would be to share more of the savings health plans and PBMs receive with patients at the pharmacy counter, ending the practice of making patients with deductibles and coinsurance pay cost sharing based on full undiscounted prices. Sharing negotiated discounts and rebates could save certain commercially insured patients with high deductibles and coinsurance between $145 and $880 annually while affecting premiums by about 1% or less. Right now, health plans are forcing the most vulnerable patients to shoulder the largest cost burden, which is the opposite of how insurance is supposed to work. We should be helping patients afford their medicines, not making it harder.

View the full analysis and learn more at LetsTalkAboutCost.org.