Impact of deductibles in health plans

The changing structure of health coverage could lead to long term problems for patients and the health system.

Impact of deductibles in health plans.

The changing structure of health coverage could lead to long term problems for patients and the health system.

Impact of deductibles in health plans.

We’ve seen reports on the use of high deductibles that include prescription drugs in health insurance exchange plans and the burden they put on patients. A recent IMS Health report, Emergence and Impact of Pharmacy Deductibles: Implications for Patients in Commercial Health Plans, reveals that commercial health plans are also increasingly applying deductibles to prescription drug benefits. The report indicates this trend is expected to continue as the 2018 effective date for the excise tax on higher-cost health plans, also known as the “Cadillac Tax,” approaches. The report also suggests this trend could have a negative impact on health, since IMS found that patients with pharmacy deductibles have lower adherence to drug therapies and higher prescription abandonment rates than patients without pharmacy deductibles. These new findings show how the changing structure of commercial health insurance coverage could lead to long term problems for patients and the health system at large.

Combined Deductible

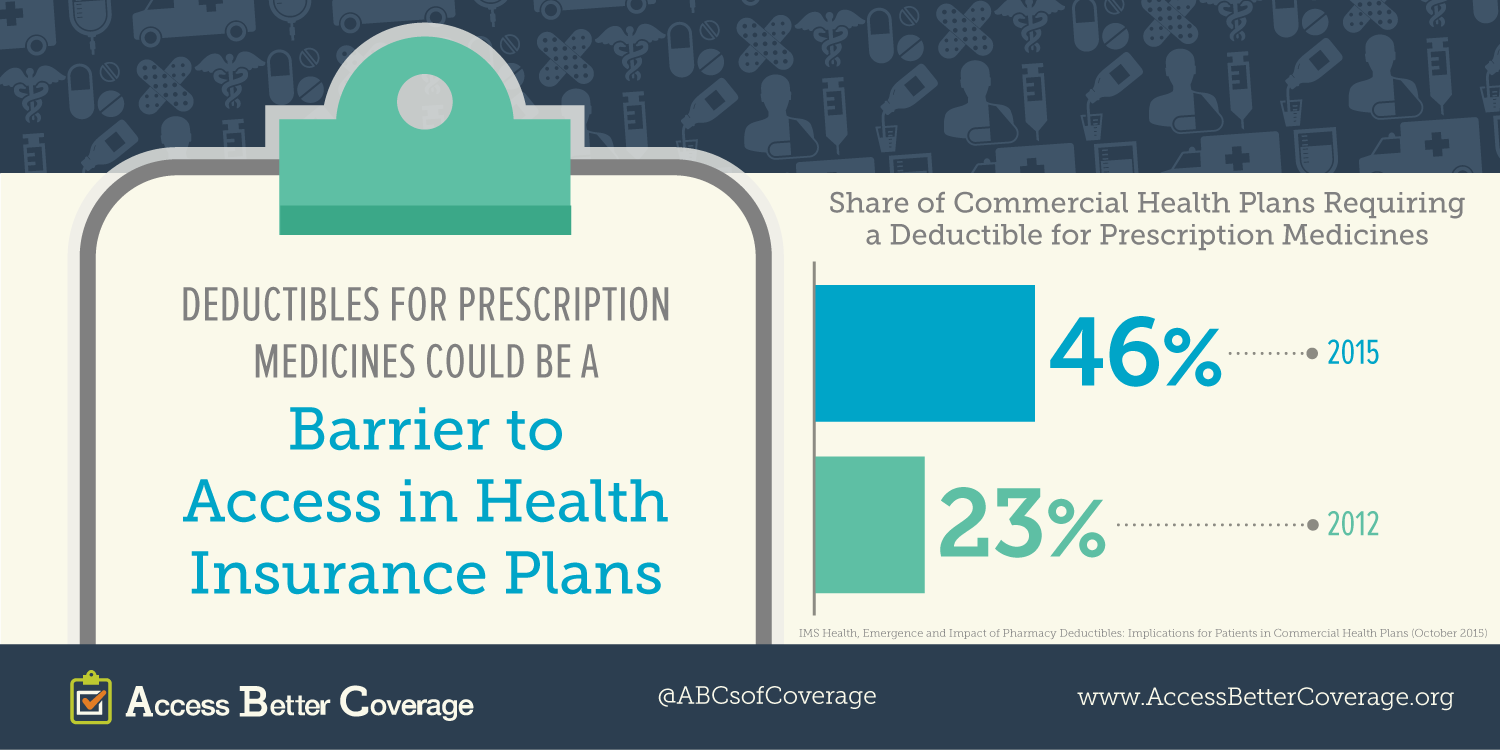

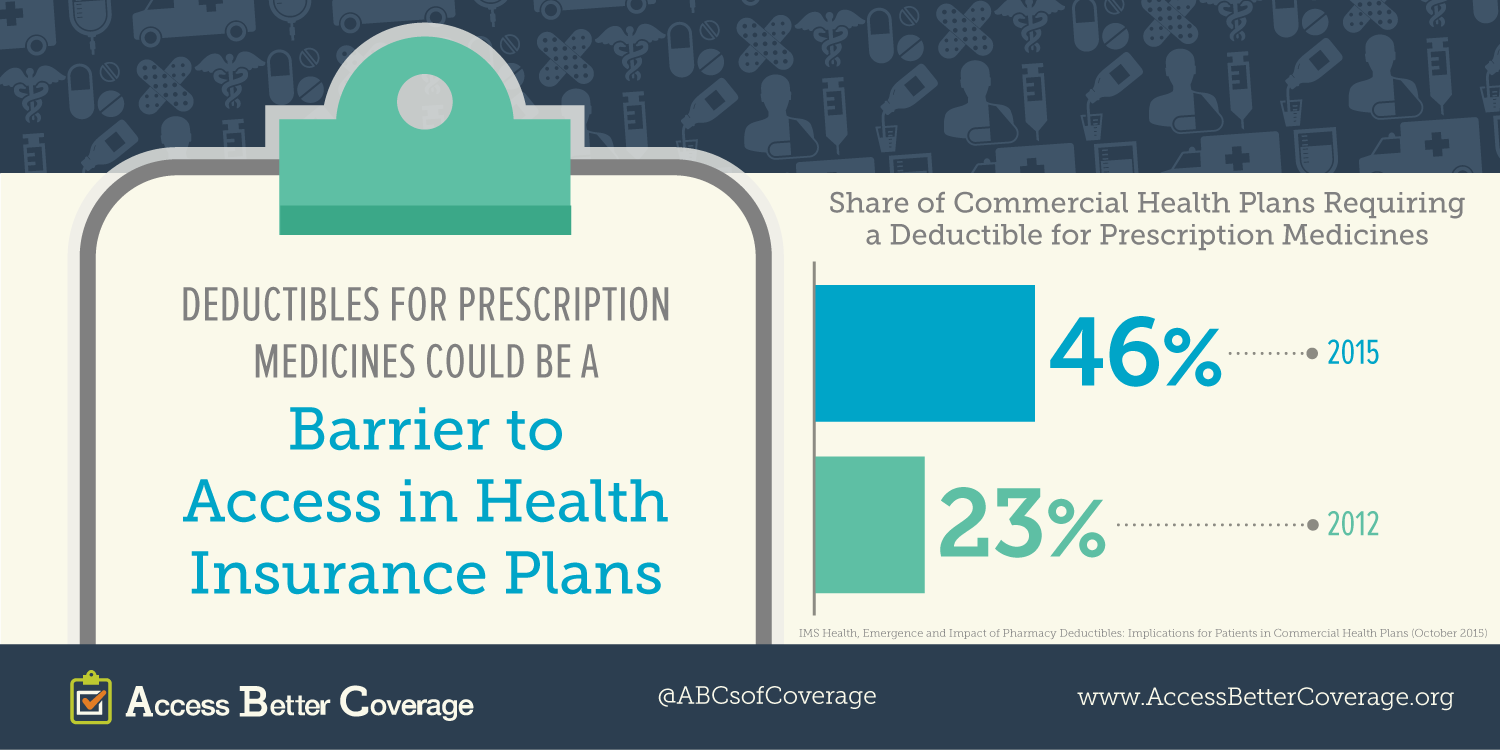

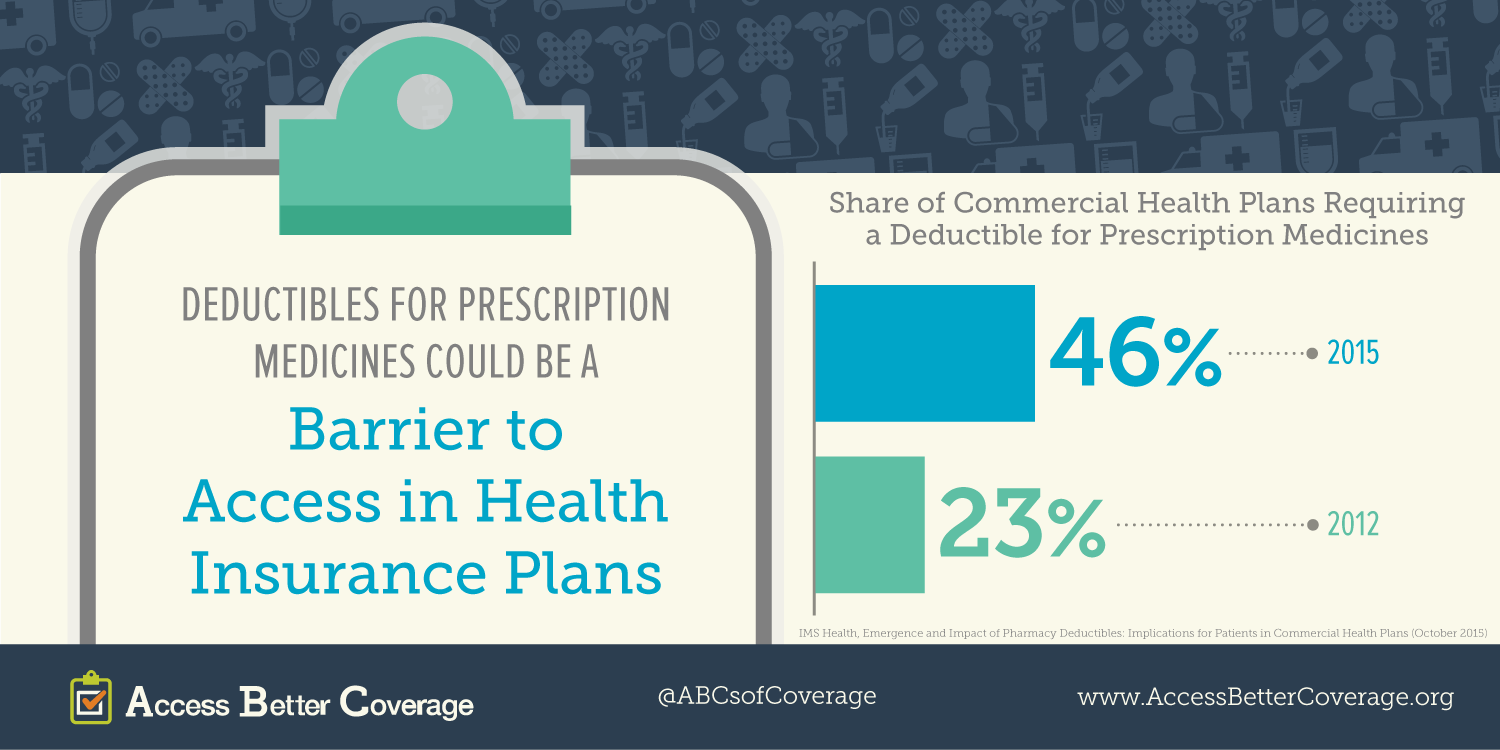

According to IMS, the share of commercial health plans requiring a deductible for prescription medicines doubled from 23 percent in 2012 to 46 percent in 2015. Most of the growth in plans subjecting prescription drugs to deductibles was due to increased enrollment in plans with integrated—also called combined—deductibles. A combined deductible is one where both medical AND pharmacy benefits are subject to the deductible.

When patients enroll in a plan where drugs are subject to a deductible, their prescription drugs are not covered until the deductible is met, at which point they likely still have to pay a copay or coinsurance. Not surprisingly, these out-of-pocket costs can be a burden on patients. The study found that patients with a prescription drug deductible have higher abandonment and lower adherence rates than patients in plans that do not subject drugs to a deductible. This raises concerns because studies have shown that medication adherence leads to lower health care use and costs.[1]

Cadillac Tax

With the impending Cadillac Tax, which imposes a 40 percent excise tax on employer-sponsored health plans that exceed a certain premium threshold, going into effect in 2018, even more plans may require a deductible for prescription medicines as employers scale back benefits to avoid triggering the tax. The Cadillac Tax puts Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) at risk as well. FSAs and HSAs allow people to put aside money, tax free, to pay for health care expenses such as doctor copays and contact lenses. However, the Internal Revenue Service (IRS) has indicated that worker pre-tax contributions to FSAs and HSAs may count towards the Cadillac tax threshold. It is therefore likely that employers will eliminate FSAs to avoid the tax.[2] It is also possible that employers could eliminate HSAs given that a fifth of existing HSAs would trigger the tax as currently written.[3] FSA and HSA accounts were designed to provide a way for employees to save for their out-of-pocket health spending.

Taken together, the implementation of the Cadillac Tax potentially forcing the elimination of these accounts and the increase in the number of consumers enrolling in health plans with combined deductibles is a double whammy.” Health plan enrollees would be forced to face higher deductibles with no savings vehicle to mitigate the high out-of-pocket costs. Subjecting medicines to a deductible increases hurdles patients may face when trying to access needed health care.

[1] M. Christopher Roebuck, Joshua N. Liberman, Marin Gemmill-Toyama and Troyen A. Brennan

Medication Adherence Leads To Lower Health Care Use And Costs Despite Increased Drug Spending Health Affairs, 30, no.1 (2011):91-99

[2] http://www.politico.com/story/2015/08/flexible-spending-accounts-may-vanish-as-a-result-of-obamacare-cadillac-tax-213167

[3] http://www.benefitspro.com/2014/10/29/20-of-plans-could-trigger-cadillac-tax